As Monday's RTM vote on the budget is nearly upon us, PLEASE take a few minutes to write one more email expressing your view on the budget. We need to ensure that RTM members - both Democratic and Republican - carry through on their promise to keeping our taxes low and our Town affordable. (Read their campaign promises below - in their OWN words)

CLICK HERE TO SEND a "1-Click" Email to the RTM

CLICK HERE TO SEND a "1-Click" Email to the RTM

|

URGENT "CALL TO ACTION" re: Budget

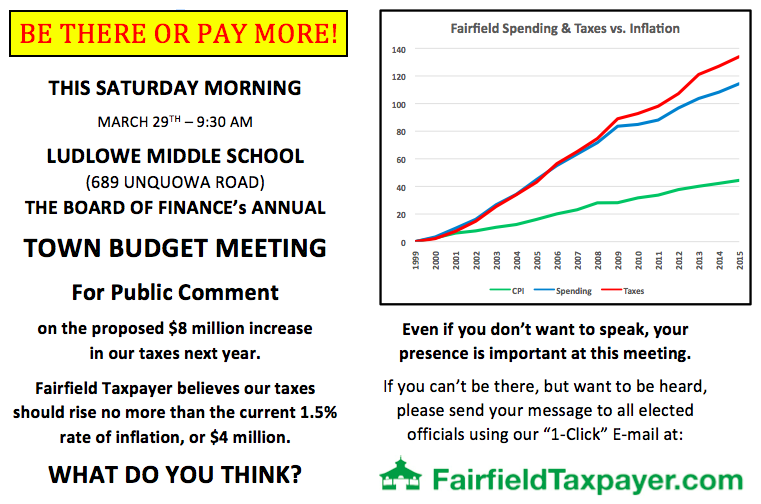

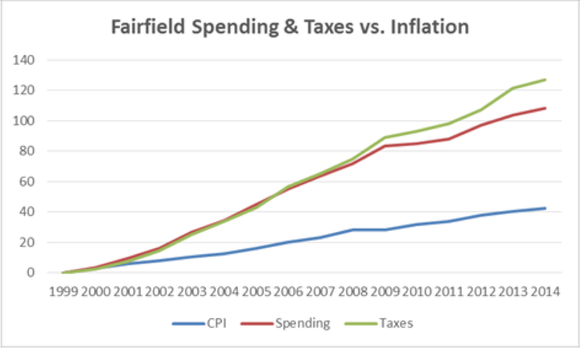

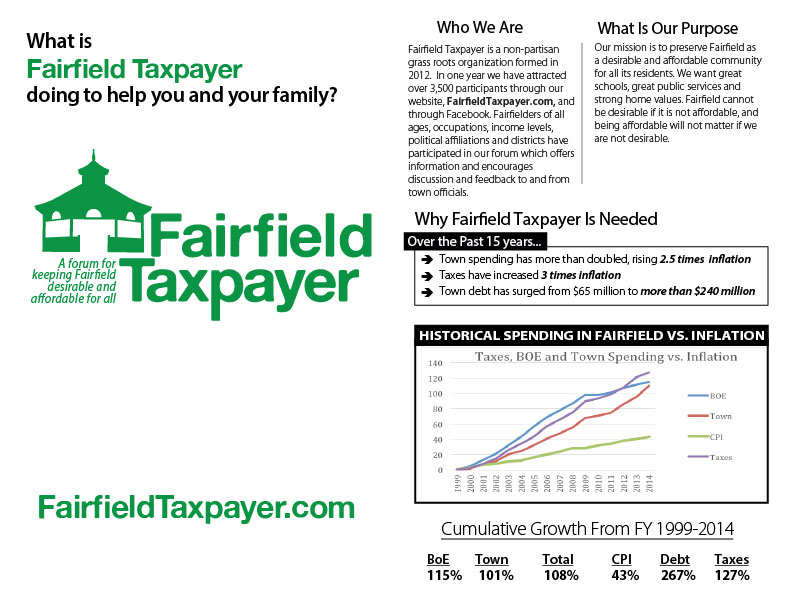

The Budget Season is nearly over, and it is very important that the Representative Town Meeting (RTM) hear our opinions before they vote. Monday night's RTM vote completes this year's budget process. Now is the last chance to write "1-Click" Emails...also, make every effort to attend the meeting to speak. What: RTM Meeting (public comment and vote) When: Monday, May 5th, 8pm Where: Fairfield Warde HS, 755 Melville Ave If the RTM does not trim the proposed $7.5M increase in spending, Fairfield's tax rate is slated to rise 2.4%, 60% higher than inflation. The difference between 2.4% and 1.5% may seem small, but at a time when many are still struggling with lower incomes, it is one that on its own would compound over 10 years into taxes that are up 27% instead of 16% in line with inflation. THAT is why, after 17 years when spending and taxes have increased at 2.5x-3.0x the rate of inflation, Fairfield Taxpayer is so focused on seeing Fairfield's taxes increase no more than the rate of inflation. Enough is enough! We know that many of you went to the polls in November and voted for candidates who you believed were committed to getting our spending and taxes under control. You may even have been motivated by those red signs that said Fairfield should "stop" raising taxes. A brief summary of some of the campaign promises you heard from various candidates appear in the boxes at the bottom. Can you guess which box contains quotes from which party?(See beneath the second one for answer.) Having elected so many RTM representatives from both parties who are dedicated to controlling Fairfield's spending and taxes, why should we citizens have to do more? Because without pressure to hold our elected officials accountable for their campaign promises, it is possible that vocal special-interest groups will cause some representatives to forget why they were elected and approve higher increases in spending and taxes than we can afford. Send a "1-Click" Email to the entire RTM so they know for sure that the people who elected them expect them to do what they said they would do. The points below should help put in context the need to control spending and taxes:

Maintain quality of life while keeping our town affordable. Keep taxes low without impacting the quality of life in Fairfield. Keep property taxes at nominal or no increase so that Fairfield stays affordable. Long-term fiscal responsibility, efficiencies in town operations including Board of Education. An eye on spending to ensure that we are an affordable town for all. Reduce taxes. Fiscal responsibility and better long-term planning. Quality of life is also reflected in affordability and I am committed to listen to constituents regarding what they are willing to pay for. Preserve the high quality and breadth of offerings while controlling expenses that lead to unaffordable tax increases. Make sure that Fairfield remains affordable for our seniors and that budgets are as lean as possible. Maintain our excellent public schools and town services, control expenses, and keep Fairfield affordable for our seniors. Keep Fairfield affordable and helping small business owners, keep taxes low. Help local small business owners, and keep Fairfield affordable. Maintain quality of life while keeping our town affordable. Keep Fairfield affordable. Keep Fairfield affordable but be sure to keep the service level we have come to expect. Make sure Fairfield is fiscally strong and affordable for everybody for the future. The town needs to continue this excellence while being fiscally responsible. Hold tax growth to inflation; Fairfield cannot continue taxing a larger percentage of their resident's paychecks each year. Operate at a level of growth that is equal to or less than inflation. Affordability. Slow the rate of spending growth Town wide. Place a "CAP" on budget increases at 1.8%. Keep Fairfield affordable for all. Support our tax growth at the rate of inflation. Strive for affordability. Hold the line on taxes. Contain the growth of expenses to a level that is less than the rate of inflation. Work with a sense of urgency to find ways to slow the growth of spending and taxes to keep Fairfield affordable. There should be no budget increases this year. Hold the line on spending and tax increases. No budget increases throughout the town boards. Hold the line on tax increase. Keep Fairfield an affordable and desirable community. Tax relief through efficiencies leading to reduced spending (our town is becoming unaffordable and tax dollars are not being spent wisely at all times). Taxes are still too high. We need to solve Fairfield's high tax problem. Make and keep the town affordable for all citizens. I want Fairfield to be affordable. Slow the growth of spending and no new taxes. Limit our tax growth to the rate of inflation. We have to keep slowing the rate of tax increase. Reduce taxes and curtail unnecessary spending. We need to be more fiscally responsible. Keep taxes down by setting CPI or some other index as the benchmark for tax increases. (Top: Democratic campaign promises. Bottom: Republican campaign promises) |

Public frustrated as RTM stays mum on potential budget cuts

The public at the Representative Town Meeting this week expected to hear where the legislative body's members may be considering cuts to the proposed municipal budget for 2014-15. Instead, those attending ended up listening mostly to themselves Monday night as the RTM failed to detail any anticipated cuts in the budget, which now stands at $286,015,872. Although not a requirement, in recent years, the agenda for the RTM's session prior to the budget vote asks that any members who plan to propose cuts at the budget meeting next Monday make their intentions known. But for the last several years, that has not happened. Read More Fairfield Citizen 4/30/14

The public at the Representative Town Meeting this week expected to hear where the legislative body's members may be considering cuts to the proposed municipal budget for 2014-15. Instead, those attending ended up listening mostly to themselves Monday night as the RTM failed to detail any anticipated cuts in the budget, which now stands at $286,015,872. Although not a requirement, in recent years, the agenda for the RTM's session prior to the budget vote asks that any members who plan to propose cuts at the budget meeting next Monday make their intentions known. But for the last several years, that has not happened. Read More Fairfield Citizen 4/30/14

Can We Really Increase our Home Values by Raising our Taxes?

A recent claim to Fairfield’s elected officials in support of the proposed BOE budget was as follows:

“It’s fact. Numerous research studies show that each additional dollar of local property taxes spent on education results in an increase in the grand list of approximately $34.27. That means property values go up when local education spending increases.”

DOES THIS SEEM TOO GOOD TO BE TRUE: “HOME VALUES GO UP WHEN TAXES ARE RAISED”? We thought so, and so we looked carefully at these “research studies.” Read More

A recent claim to Fairfield’s elected officials in support of the proposed BOE budget was as follows:

“It’s fact. Numerous research studies show that each additional dollar of local property taxes spent on education results in an increase in the grand list of approximately $34.27. That means property values go up when local education spending increases.”

DOES THIS SEEM TOO GOOD TO BE TRUE: “HOME VALUES GO UP WHEN TAXES ARE RAISED”? We thought so, and so we looked carefully at these “research studies.” Read More

Analysis of High School Athletic Team Costs Per Student

In response to a question from a member of the Board of Finance, on March 21st the School Administration provided a breakdown of the cost of each athletic team at both high schools. These breakdowns are provided in the Appendix. The total of the two schools’ costs is $534,415.

Last year, in the “packet” dated 5/17/13 distributed in advance of the BOE meeting on May 21st, the School Administration also provided a breakdown, with the costs at both high schools aggregated. This breakdown is also provided in the Appendix. The total of the two schools’ costs was $1,466,614.

Clearly, the cost breakdowns distributed most recently are not complete.

Some observations based on the breakdown provided a year ago are... Read More

In response to a question from a member of the Board of Finance, on March 21st the School Administration provided a breakdown of the cost of each athletic team at both high schools. These breakdowns are provided in the Appendix. The total of the two schools’ costs is $534,415.

Last year, in the “packet” dated 5/17/13 distributed in advance of the BOE meeting on May 21st, the School Administration also provided a breakdown, with the costs at both high schools aggregated. This breakdown is also provided in the Appendix. The total of the two schools’ costs was $1,466,614.

Clearly, the cost breakdowns distributed most recently are not complete.

Some observations based on the breakdown provided a year ago are... Read More

The town needs to cut property tax rates

Implementing the proposed spending budget and property-tax increase would be counter-productive and continue, rather than address, the fiscal problems faced by the town. I am a strong supporter of the public schools, a registered democrat, and a believer in effective government. Unfortunately, sometimes, effectiveness requires doing less than we want in recognition of budgetary, political and economic realities. Now is one of those times. Read More Fairfield Minuteman 4/4/14

Implementing the proposed spending budget and property-tax increase would be counter-productive and continue, rather than address, the fiscal problems faced by the town. I am a strong supporter of the public schools, a registered democrat, and a believer in effective government. Unfortunately, sometimes, effectiveness requires doing less than we want in recognition of budgetary, political and economic realities. Now is one of those times. Read More Fairfield Minuteman 4/4/14

Board Of Selectmen Make Few Changes In $286.7 Million Fairfield Budget

The town budget process moved forward Tuesday afternoon after the Fairfield Board of Selectmen agreed to approve an additional $256,000 in funding for school security to the fiscal year 2015 budget, without adding too much to the overall total spending plan. At the end of the board meeting Tuesday afternoon, the selectmen passed a budget with an increase of just over $42,000 in spending, keeping the overall budget increase at 2.67 percent. Read More Fairfield Daily Voice (4/2/14)

The town budget process moved forward Tuesday afternoon after the Fairfield Board of Selectmen agreed to approve an additional $256,000 in funding for school security to the fiscal year 2015 budget, without adding too much to the overall total spending plan. At the end of the board meeting Tuesday afternoon, the selectmen passed a budget with an increase of just over $42,000 in spending, keeping the overall budget increase at 2.67 percent. Read More Fairfield Daily Voice (4/2/14)

Public forum on '15 budget: Residents argue lower taxes vs. school needs

More than 200 residents turned out for Saturday's forum on the proposed $286.7 million town budget for 2014-15, and public comment was split between those who want a lower tax increase in the next fiscal year and those who want more money spent on education. Read More Fairfield Citizen 3/29/14

More than 200 residents turned out for Saturday's forum on the proposed $286.7 million town budget for 2014-15, and public comment was split between those who want a lower tax increase in the next fiscal year and those who want more money spent on education. Read More Fairfield Citizen 3/29/14

Fairfield Taxpayer's General Response to Anthony Calabrese (and others)

Read More

Read More

High School Courses and Classes with Small Numbers of Students

The topic of “small class sizes” in Fairfield’s high schools appears to have gained wider interest, including some new data from the School Administration in response to a question from a member of the Board of Finance.

Fairfield Taxpayer previously published a table on this subject that showed that 37% of the Courses offered in our two high schools had an average number of students per class below 16 (i.e., 1-15). These data came directly from the school administration’s ~100-page lists for each high school of every course and class offered, and are based on the average number of students per class for each course reported in those lists. Read More and See Data

The topic of “small class sizes” in Fairfield’s high schools appears to have gained wider interest, including some new data from the School Administration in response to a question from a member of the Board of Finance.

Fairfield Taxpayer previously published a table on this subject that showed that 37% of the Courses offered in our two high schools had an average number of students per class below 16 (i.e., 1-15). These data came directly from the school administration’s ~100-page lists for each high school of every course and class offered, and are based on the average number of students per class for each course reported in those lists. Read More and See Data

Ridgefield Police Move to Defined Contribution Plans and High Deductible Health Plans

Some say this "Can't be done in Fairfield". Read More

Some say this "Can't be done in Fairfield". Read More

Fairfield Taxpayer Responds to Recent Letter in the Minuteman

According to a recent letter in the Fairfield Minuteman and the Fairfield Citizen News, “We need to spend more money on education.” Why? Because affordability is not a concern for a wealthy town like Fairfield, and because lower spending will hurt both our children and our property values. The author offers the following arguments:

Read More

According to a recent letter in the Fairfield Minuteman and the Fairfield Citizen News, “We need to spend more money on education.” Why? Because affordability is not a concern for a wealthy town like Fairfield, and because lower spending will hurt both our children and our property values. The author offers the following arguments:

Read More

Aquarion to rebate customers $10M over three years

In July 2013, while citizens of Fairfield and other towns were fighting Aquarion's proposed 23% rate hike over three years, research revealed that it should receive a tax credit on certain capital purchases the company made. We found several current examples of other water companies that passed along those savings to ratepayers in the form of lower rates. This issue was raised in the public hearings over the summer. The Connecticut PURA (Public Utilities Regulatory Authority) just announced today the reopening of the docket in order to review a proposed agreement whereby Aquarion will return $10M to ratepayers over the next three years, implying a 5.6% reduction in rates. Hopefully this will be approved and implemented soon. Read More (3/17/14)

Related Articles: Fairfield Daily Voice, Fairfield Patch

In July 2013, while citizens of Fairfield and other towns were fighting Aquarion's proposed 23% rate hike over three years, research revealed that it should receive a tax credit on certain capital purchases the company made. We found several current examples of other water companies that passed along those savings to ratepayers in the form of lower rates. This issue was raised in the public hearings over the summer. The Connecticut PURA (Public Utilities Regulatory Authority) just announced today the reopening of the docket in order to review a proposed agreement whereby Aquarion will return $10M to ratepayers over the next three years, implying a 5.6% reduction in rates. Hopefully this will be approved and implemented soon. Read More (3/17/14)

Related Articles: Fairfield Daily Voice, Fairfield Patch

Speak out against tax increases (In some ways, it's as simple as comparing mill rates)

A grand list is the sum of all taxable property in a town. The town mill rate is the tax each resident pays on each thousand dollars of his or her property in the town. (Mille is thousand in Latin.)

The grand list in Greenwich is $31 billion and they have nine thousand students. So for each student, Greenwich has $3.4 million in property. Westport’s grand list is $10 billion with about six thousand students; so $1.7 million per student. Darien, and New Canaan are similar with about $2 million of taxable property per student. Fairfield is a truly wonderful, wonderful town. But its grand list is $11 billion dollars with ten thousand students, so we have only $1 million of taxable property per student: NOT almost $2 million like Darien, New Canaan, and Westport; and CERTAINLY NOT over $3 million like Greenwich. Read More (Fairfield Minuteman 3/13/14)

A grand list is the sum of all taxable property in a town. The town mill rate is the tax each resident pays on each thousand dollars of his or her property in the town. (Mille is thousand in Latin.)

The grand list in Greenwich is $31 billion and they have nine thousand students. So for each student, Greenwich has $3.4 million in property. Westport’s grand list is $10 billion with about six thousand students; so $1.7 million per student. Darien, and New Canaan are similar with about $2 million of taxable property per student. Fairfield is a truly wonderful, wonderful town. But its grand list is $11 billion dollars with ten thousand students, so we have only $1 million of taxable property per student: NOT almost $2 million like Darien, New Canaan, and Westport; and CERTAINLY NOT over $3 million like Greenwich. Read More (Fairfield Minuteman 3/13/14)

“You Can Fool Some of the People . . .”

Fairfield Taxpayer is responding here to a number of issues raised by Superintendent of Schools David Title and BOE Chairman Philip Dwyer in their recent presentation to the Board of Selectmen and the Board of Finance. The presentation was made in support of their request for a $5.8 million (3.9%) increase in the FY15 BOE budget (to $157 million from $151.2 million). Read More

Fairfield Taxpayer is responding here to a number of issues raised by Superintendent of Schools David Title and BOE Chairman Philip Dwyer in their recent presentation to the Board of Selectmen and the Board of Finance. The presentation was made in support of their request for a $5.8 million (3.9%) increase in the FY15 BOE budget (to $157 million from $151.2 million). Read More

Affordable housing should suit community needs not developers

I have lived on Fairchild Avenue for three decades. It’s a dead end street, known mostly because of Mancuso’s Restaurant on the corner of Fairchild and Kings Highway. I raised two sons in that neighborhood. My eldest son worked at Mancuso’s when it was called Three Brothers Pizza. I will probably die in that neighborhood. In fact, I live a few hundred feet from the 54-unit affordable housing project that will open at the end of Fairchild Avenue this spring.

Now another developer wants to add a 66-bedrooms affordable housing complex across the street. In order to build the new complex, the developer needs a waiver. The developer wants 66 bedrooms on less than half an acre—a number four times greater than the 54-unit. Read More (Fairfield Minuteman 3/13/14)

I have lived on Fairchild Avenue for three decades. It’s a dead end street, known mostly because of Mancuso’s Restaurant on the corner of Fairchild and Kings Highway. I raised two sons in that neighborhood. My eldest son worked at Mancuso’s when it was called Three Brothers Pizza. I will probably die in that neighborhood. In fact, I live a few hundred feet from the 54-unit affordable housing project that will open at the end of Fairchild Avenue this spring.

Now another developer wants to add a 66-bedrooms affordable housing complex across the street. In order to build the new complex, the developer needs a waiver. The developer wants 66 bedrooms on less than half an acre—a number four times greater than the 54-unit. Read More (Fairfield Minuteman 3/13/14)

Does higher education spending lead to better performance?

Read More

Read More

March 11th TPZ Hearing (see directly below) is POSTPONED to April 8th.

Please be advised that due to the fact that the Fairfield Citizen failed to publish Fairfield's legal notice of tomorrow’s hearing in Friday’s paper, the hearing on the above application will have to be postponed. It has been rescheduled for April 8th.

Please be advised that due to the fact that the Fairfield Citizen failed to publish Fairfield's legal notice of tomorrow’s hearing in Friday’s paper, the hearing on the above application will have to be postponed. It has been rescheduled for April 8th.

Important FT Call to Action: High Density Housing in Fairfield

We have been learning about the very important and complex subject of zoning regulations, high-density housing, and affordable housing for a while through the efforts of a group of dedicated RTM members and other concerned citizens.

On Tuesday, April 8th, the Town Plan and Zoning Commission (TPZ) will consider public comments on an application to build a 33-unit affordable-housing complex at 145 Fairchild/110 Berwick avenues. This is a very important hearing - with implications for every Fairfield neighborhood. Of perhaps greater importance, the TPZ will also hear an update on the Town's Affordable Housing Plan..... Read More

We have been learning about the very important and complex subject of zoning regulations, high-density housing, and affordable housing for a while through the efforts of a group of dedicated RTM members and other concerned citizens.

On Tuesday, April 8th, the Town Plan and Zoning Commission (TPZ) will consider public comments on an application to build a 33-unit affordable-housing complex at 145 Fairchild/110 Berwick avenues. This is a very important hearing - with implications for every Fairfield neighborhood. Of perhaps greater importance, the TPZ will also hear an update on the Town's Affordable Housing Plan..... Read More

How long can Fairfield afford Taxes rising 3x Inflation?

Fairfield Taxpayer made a presentation to the Greater Fairfield Realtor's Association on March 5th. It covered some background on our group and focused on our efforts to keep Fairfield affordable and why it's necessary. Click Here for the full slide deck.

Use Common Sense to Manage Town's Budget (Like we all do at Home)

This is my third budget season as a member of the RTM, and the pattern is familiar. Departments construct their budget requests by starting with what was spent the previous year and then add costs that are “uncontrollable” – like contractual increases in salaries, actuarial increases in pension/healthcare benefits, mandated increases from state and federal government, and necessary increases to our reserves. Unfortunately, all of these add-ons are very real expenses and have to be covered. What’s missing is a recognition that, if increases like those listed are inevitable, we have to cut somewhere else to make the budget affordable. Since we didn’t do that in the past, what we have today is taxes that have increased over the last 15 years at 3x the rate of inflation.

Just recently, the BOE submitted their 2014-15 budget asking for an increase of 3.9%, which is over 2.5x the current 1.5% rate of inflation. This request will have to go through the approval process and hopefully there will be the needed cuts. Some say that the BOE should spend more on world languages, or music, or gifted-student programs and the town should stop the draconian slashing of our education budget that has gone on for years. But history shows that the BOE budget has gone up every year (except 2010 when it was flat) and currently represents over 54% of the town’s total spending. In fact, over the last fifteen years the number of students went up 37% while the spending per student went up 57%. And these numbers don’t include the annual cost of servicing our debt (that now represents almost 10% of the overall budget) which is heavily devoted to building, expanding, and remodeling our schools.

Advocates for BOE budget increases say that Fairfield spends much less per student than towns like Greenwich, Darien, New Canaan, Westport, and Wilton. The problem with this argument is that Fairfield simply doesn’t have the same spending power as those other towns. The state uses a gauge called the Public Investment Community score (PIC) which measures the “relative wealth and need” of all Connecticut towns. It’s based on five criteria — per capita income, per capita grand list, the mill rate, per capita aid to children receiving Temporary Family Assistance, and the unemployment rate. A review of these PIC scores shows that the towns most comparable to Fairfield are ones like Madison, Avon, Guilford, and Farmington and we spend more per pupil than any of them and our test results are no better.

Everybody wants an excellent school system and, yes, the children are our future. But whether you are among the 70% of households that do not have children in our schools or the 30% that do, you should understand that we can’t spend the same per student as some of the wealthiest towns in the entire country. To do that we would have to impose substantially higher taxes, and, when our property taxes rise too high, not only will our home values suffer but we will drive out more and more residents who are already making daily sacrifices to live here. Many local realtors will confirm that this is exactly what is happening now. Simply put, raising our taxes faster than the rate of inflation is not sustainable.

We need a new approach to how we budget. It should be a top-down approach that first determines how much we can afford to spend. A good start would be to simply restrict budget growth for the town, including the BOE, to no more than the rate of inflation. The First Selectman and the BOE should adopt this goal at the outset of the budget cycle and then determine what programs can be provided more efficiently and which programs need to be cut or streamlined in order to offset the “unavoidable” increases and still live within our means.

We live in a wonderful town. To keep it that way we need to apply the same common sense budget restraints that every family does in managing their personal finances. It’s not too late. Let’s do it before we so over-price the cost of living in Fairfield that our property values go into the kind of long-term decline that has befallen other once thriving towns.

David Mackenzie, RTM, District 3, Fairfield

Read in Fairfield Minuteman

This is my third budget season as a member of the RTM, and the pattern is familiar. Departments construct their budget requests by starting with what was spent the previous year and then add costs that are “uncontrollable” – like contractual increases in salaries, actuarial increases in pension/healthcare benefits, mandated increases from state and federal government, and necessary increases to our reserves. Unfortunately, all of these add-ons are very real expenses and have to be covered. What’s missing is a recognition that, if increases like those listed are inevitable, we have to cut somewhere else to make the budget affordable. Since we didn’t do that in the past, what we have today is taxes that have increased over the last 15 years at 3x the rate of inflation.

Just recently, the BOE submitted their 2014-15 budget asking for an increase of 3.9%, which is over 2.5x the current 1.5% rate of inflation. This request will have to go through the approval process and hopefully there will be the needed cuts. Some say that the BOE should spend more on world languages, or music, or gifted-student programs and the town should stop the draconian slashing of our education budget that has gone on for years. But history shows that the BOE budget has gone up every year (except 2010 when it was flat) and currently represents over 54% of the town’s total spending. In fact, over the last fifteen years the number of students went up 37% while the spending per student went up 57%. And these numbers don’t include the annual cost of servicing our debt (that now represents almost 10% of the overall budget) which is heavily devoted to building, expanding, and remodeling our schools.

Advocates for BOE budget increases say that Fairfield spends much less per student than towns like Greenwich, Darien, New Canaan, Westport, and Wilton. The problem with this argument is that Fairfield simply doesn’t have the same spending power as those other towns. The state uses a gauge called the Public Investment Community score (PIC) which measures the “relative wealth and need” of all Connecticut towns. It’s based on five criteria — per capita income, per capita grand list, the mill rate, per capita aid to children receiving Temporary Family Assistance, and the unemployment rate. A review of these PIC scores shows that the towns most comparable to Fairfield are ones like Madison, Avon, Guilford, and Farmington and we spend more per pupil than any of them and our test results are no better.

Everybody wants an excellent school system and, yes, the children are our future. But whether you are among the 70% of households that do not have children in our schools or the 30% that do, you should understand that we can’t spend the same per student as some of the wealthiest towns in the entire country. To do that we would have to impose substantially higher taxes, and, when our property taxes rise too high, not only will our home values suffer but we will drive out more and more residents who are already making daily sacrifices to live here. Many local realtors will confirm that this is exactly what is happening now. Simply put, raising our taxes faster than the rate of inflation is not sustainable.

We need a new approach to how we budget. It should be a top-down approach that first determines how much we can afford to spend. A good start would be to simply restrict budget growth for the town, including the BOE, to no more than the rate of inflation. The First Selectman and the BOE should adopt this goal at the outset of the budget cycle and then determine what programs can be provided more efficiently and which programs need to be cut or streamlined in order to offset the “unavoidable” increases and still live within our means.

We live in a wonderful town. To keep it that way we need to apply the same common sense budget restraints that every family does in managing their personal finances. It’s not too late. Let’s do it before we so over-price the cost of living in Fairfield that our property values go into the kind of long-term decline that has befallen other once thriving towns.

David Mackenzie, RTM, District 3, Fairfield

Read in Fairfield Minuteman

First Selectman releases F2015 Budget

On Friday, First Selectman Mike Tetreau released his proposed F2015 budget for Fairfield - including both the town budget and his budget for Board of Education spending. This now marks the beginning of this year budget season, whereby the full Boards of Selectman, Finance and RTM each take their turn with hearings, make changes and pass their version of the budget, with the RTM having final say.

The overall budget calls for a 2.99% increase in overall spending from this year, 2x the rate of inflation. Excluded from the proposed budget is the cost of enhanced security for our schools. The scope and cost of this new service will be added once determined. While the budget as proposed marks an easing of growth from the rate of 2.5x inflation that marked the past 15 years, it is still well beyond what is sustainable from a long term standpoint. Because of changes in the Grand List as well as non-tax revenues to the town, Mr Tetreau's budget will increase our property taxes 2.67%. We will have more comments regarding the budget after we complete our analysis of the several hundred pages of data which was released. Click here for a download of the complete budget and cover letter.

On Friday, First Selectman Mike Tetreau released his proposed F2015 budget for Fairfield - including both the town budget and his budget for Board of Education spending. This now marks the beginning of this year budget season, whereby the full Boards of Selectman, Finance and RTM each take their turn with hearings, make changes and pass their version of the budget, with the RTM having final say.

The overall budget calls for a 2.99% increase in overall spending from this year, 2x the rate of inflation. Excluded from the proposed budget is the cost of enhanced security for our schools. The scope and cost of this new service will be added once determined. While the budget as proposed marks an easing of growth from the rate of 2.5x inflation that marked the past 15 years, it is still well beyond what is sustainable from a long term standpoint. Because of changes in the Grand List as well as non-tax revenues to the town, Mr Tetreau's budget will increase our property taxes 2.67%. We will have more comments regarding the budget after we complete our analysis of the several hundred pages of data which was released. Click here for a download of the complete budget and cover letter.

The Facts: Fairfield's Historic Budget Data Click here to See

FAIRFIELD TAXPAYER RESPONDS TO JOHN MITOLA’S MESSAGE REGARDING "A TEACHABLE MOMENT"

Read More

Read More

A TEACHABLE MOMENT FOR OUR BOARD OF ED

THE PROPOSED BOE BUDGET OFFERS IMPORTANT LESSONS

FOR TAXPAYERS AND THE PUBLIC OFFICIALS WHO REPRESENT US.

It’s budget time again in Fairfield. The opening round is the BOE budget recently proposed by Superintendent Title, who has requested a $5.7 million increase to $157 million, representing a 3.8% increase over the current year’s budget. The biggest increase in six years.

As usual, Dr. Title offers sound reasons for his request (e.g., an unavoidable increase in the costs of special education students, contractual increases in staff salaries and benefits, and essential maintenance for school facilities) that are backed up by 181 pages of numbers and charts plus a 54-page slide presentation. In a series of long meetings, he will now lead the BOE through a detailed, line-by-line review. If history is any guide, BOE members will ask many questions, they will seek even greater efficiencies than Dr. Title has already documented, and they will vote in favor of some token cuts. They will be strongly discouraged from making any program cuts because “we don’t want to hurt the children,” because “the children are our future,” and because “people move to Fairfield for the schools and thus any cuts will hurt property values.” Read More

THE PROPOSED BOE BUDGET OFFERS IMPORTANT LESSONS

FOR TAXPAYERS AND THE PUBLIC OFFICIALS WHO REPRESENT US.

It’s budget time again in Fairfield. The opening round is the BOE budget recently proposed by Superintendent Title, who has requested a $5.7 million increase to $157 million, representing a 3.8% increase over the current year’s budget. The biggest increase in six years.

As usual, Dr. Title offers sound reasons for his request (e.g., an unavoidable increase in the costs of special education students, contractual increases in staff salaries and benefits, and essential maintenance for school facilities) that are backed up by 181 pages of numbers and charts plus a 54-page slide presentation. In a series of long meetings, he will now lead the BOE through a detailed, line-by-line review. If history is any guide, BOE members will ask many questions, they will seek even greater efficiencies than Dr. Title has already documented, and they will vote in favor of some token cuts. They will be strongly discouraged from making any program cuts because “we don’t want to hurt the children,” because “the children are our future,” and because “people move to Fairfield for the schools and thus any cuts will hurt property values.” Read More

Our Most Recent Posts:

FAIRFIELD TAXPAYER’S TOWN LABOR CONTRACT SUMMARIES

Any town’s budget is determined by the quantity and quality of the services it provides, and by the cost of providing those services. Most of the cost of providing public services is labor, which is determined primarily by wages, benefits (for both active and retired workers) and work rules.

In order to help Fairfield's residents and public officials evaluate the cost of labor in the town budget, Fairfield Taxpayer has created a summary of the terms of the seven union contracts (plus the agreement that applies to Department Heads) that determine what our public employees are paid. In progress is a similar summary of contract terms for school employees. We also plan to provide information on how Fairfield's labor costs compare to those of other towns, and on how public employee wages and benefits compare to comparable jobs in the private sector.

We have made every effort to ensure that the information in these summaries is both comprehensive and accurate, but it is quite possible that there are errors, and/or that we have not included everything that would be helpful. If they are not yet perfect, we hope they soon will be with the help of those who review and use them.

Click Here to view summary

For the country as a whole, the U.S. Bureau of Labor Statistics reported on September 11, 2013 that private industry employers spent an average of $29.11 per hour worked for employee compensation in June 2013 ($20.47 in wages and $8.65 in benefits), while total compensation costs for state and local government workers averaged $42.09 per hour ($27.15 in wages and $14.94 in benefits). As the BLS report cautions, the data for private and public workers is not directly comparable because of differences in the mix of workers, including the fact that professional and administrative support occupations (including teachers) account for two-thirds of the state and local government workforce, compared with one-half of private industry.

http://www.bls.gov/news.release/pdf/ecec.pdf

Any town’s budget is determined by the quantity and quality of the services it provides, and by the cost of providing those services. Most of the cost of providing public services is labor, which is determined primarily by wages, benefits (for both active and retired workers) and work rules.

In order to help Fairfield's residents and public officials evaluate the cost of labor in the town budget, Fairfield Taxpayer has created a summary of the terms of the seven union contracts (plus the agreement that applies to Department Heads) that determine what our public employees are paid. In progress is a similar summary of contract terms for school employees. We also plan to provide information on how Fairfield's labor costs compare to those of other towns, and on how public employee wages and benefits compare to comparable jobs in the private sector.

We have made every effort to ensure that the information in these summaries is both comprehensive and accurate, but it is quite possible that there are errors, and/or that we have not included everything that would be helpful. If they are not yet perfect, we hope they soon will be with the help of those who review and use them.

Click Here to view summary

For the country as a whole, the U.S. Bureau of Labor Statistics reported on September 11, 2013 that private industry employers spent an average of $29.11 per hour worked for employee compensation in June 2013 ($20.47 in wages and $8.65 in benefits), while total compensation costs for state and local government workers averaged $42.09 per hour ($27.15 in wages and $14.94 in benefits). As the BLS report cautions, the data for private and public workers is not directly comparable because of differences in the mix of workers, including the fact that professional and administrative support occupations (including teachers) account for two-thirds of the state and local government workforce, compared with one-half of private industry.

http://www.bls.gov/news.release/pdf/ecec.pdf