FSA Senior Finances Workshop

Please mark your calendars:

Click here for more information

- State of CT issues - Bigelow Center, Wednesday February 26 (10:00 AM).

- Senior-friendly housing - Woods Library, Thursday February 27 (6:30 PM).

Click here for more information

Senior & Disabled Tax Relief

Reasons to Reconsider the Proposed Changes to SDTR Program

January 2019

Fairfield Taxpayer has done extensive work on Senior & Disabled Tax Relief (SDTR) as a concept, as implemented by the Town of Fairfield and as proposed recently by the RTM. What follows is a link to each of the four papers (one of which is still in draft form because the proposed RTM ordinance was shelved before it could be published), as well as a one-page summary of all the issues, fully copied below. As always, we welcome your comments at [email protected].

Fairfield Taxpayer has done extensive work on Senior & Disabled Tax Relief (SDTR) as a concept, as implemented by the Town of Fairfield and as proposed recently by the RTM. What follows is a link to each of the four papers (one of which is still in draft form because the proposed RTM ordinance was shelved before it could be published), as well as a one-page summary of all the issues, fully copied below. As always, we welcome your comments at [email protected].

|

#1.

|

| ||||||

|

#2.

|

| ||||||

|

#3.

|

| ||||||

|

#4.

|

| ||||||

TEN REASONS TO RECONSIDER THE PROPOSED CHANGES TO THE SDTR ORDINANCE

1. Does it work? We don’t know how well the SDTR Program works, and we don’t know whether the proposed changes will make it work better. The number of participants is not a valid measure of effectiveness, so increasing the number of participants is not per se a valid public policy objective.

2. How do we know? No provision has been made to establish rational metrics to measure the performance of the SDTR Program or to obtain the data we would need to do so. The claim that obtaining the data we need would take five years is not valid because we could obtain some useful data within a year.

3. Better Options? If the program’s stated purpose (“to assist elderly homeowners with a portion of the costs of property taxation”) means our objective is to keep seniors in their homes longer than they would otherwise stay, there may be more cost-effective ways to do that than increasing SDTR spending.

4. Rich versus poor? The benefits of the proposed increases in “percentages of taxes due” and “dollar caps” for various income brackets are skewed toward the rich at the expense of the poor. Given the Program’s objective, any incremental spending should go to the lower-income seniors who need it most.

5. Credits for millionaires? Raising the income limit to $90,000 and eliminating the $650,000 QTAV limit means we would be providing credits to seniors with considerable financial means instead of those in greater need. Rather than give insignificant credits to higher-income seniors (including some millionaires), any increase in spending should go instead primarily to lower-income seniors who really need help, some of whom must now spend half of their income to pay the taxes on a median-value home.

6. Can we afford it? Replacing the QTAV with an Assessment Limit and raising the income limit means that the number of participants could more than double, which means Program costs could more than double without the proposed reduction in the cap on overall program costs (from 2.5% to 1.6% of taxes levied on real property), but even with this lower cap, total SDTR credits are likely to rise 23% or $0.8 million next year (from $3.4 million to $4.2 million) at a time when such a big increase may not be affordable, but once enacted, the increase cannot be avoided.

7. No proration rules? The likely greater increase in the number of participants than the 23% increase in funding means that credits to current participants would have to be cut unless provisions are made to protect them, which would mean that new participants would get much lower credits. No such “proration language” has yet been proposed, and thus this very material provision has never been reviewed by the SDTR Committee, by the RTM’s L&A Committee, by the RTM, by any other Town board, or by the public.

8. Discriminatory? Protecting current participants from cuts by creating a two-tier system that gives new participants much lower credits would not be fair, would probably deny adequate credits to some seniors, would deny needed increases to some current participants, would be very complicated to understand and administer, would create recurring problems every new year, and may not be legal.

9. No easy way back? Once the proposed changes are adopted, it will be very difficult to go back and make changes that would deny or cut credits to some participants.

10. Not legal? Under state law (§12-129n), the RTM cannot adopt or amend a municipal property tax relief program that has not been recommended by the Board of Finance.

2. How do we know? No provision has been made to establish rational metrics to measure the performance of the SDTR Program or to obtain the data we would need to do so. The claim that obtaining the data we need would take five years is not valid because we could obtain some useful data within a year.

3. Better Options? If the program’s stated purpose (“to assist elderly homeowners with a portion of the costs of property taxation”) means our objective is to keep seniors in their homes longer than they would otherwise stay, there may be more cost-effective ways to do that than increasing SDTR spending.

4. Rich versus poor? The benefits of the proposed increases in “percentages of taxes due” and “dollar caps” for various income brackets are skewed toward the rich at the expense of the poor. Given the Program’s objective, any incremental spending should go to the lower-income seniors who need it most.

5. Credits for millionaires? Raising the income limit to $90,000 and eliminating the $650,000 QTAV limit means we would be providing credits to seniors with considerable financial means instead of those in greater need. Rather than give insignificant credits to higher-income seniors (including some millionaires), any increase in spending should go instead primarily to lower-income seniors who really need help, some of whom must now spend half of their income to pay the taxes on a median-value home.

6. Can we afford it? Replacing the QTAV with an Assessment Limit and raising the income limit means that the number of participants could more than double, which means Program costs could more than double without the proposed reduction in the cap on overall program costs (from 2.5% to 1.6% of taxes levied on real property), but even with this lower cap, total SDTR credits are likely to rise 23% or $0.8 million next year (from $3.4 million to $4.2 million) at a time when such a big increase may not be affordable, but once enacted, the increase cannot be avoided.

7. No proration rules? The likely greater increase in the number of participants than the 23% increase in funding means that credits to current participants would have to be cut unless provisions are made to protect them, which would mean that new participants would get much lower credits. No such “proration language” has yet been proposed, and thus this very material provision has never been reviewed by the SDTR Committee, by the RTM’s L&A Committee, by the RTM, by any other Town board, or by the public.

8. Discriminatory? Protecting current participants from cuts by creating a two-tier system that gives new participants much lower credits would not be fair, would probably deny adequate credits to some seniors, would deny needed increases to some current participants, would be very complicated to understand and administer, would create recurring problems every new year, and may not be legal.

9. No easy way back? Once the proposed changes are adopted, it will be very difficult to go back and make changes that would deny or cut credits to some participants.

10. Not legal? Under state law (§12-129n), the RTM cannot adopt or amend a municipal property tax relief program that has not been recommended by the Board of Finance.

FSA Senior Finances Workshop

Where: Bigelow Center for Senior Activities, Multipurpose Room, 100 Mona Terrace

When: Friday, January 19th 10am - Noon

When: Friday, January 19th 10am - Noon

FSA Senior Housing Workshop

Where: Bigelow Center for Senior Activities, Multipurpose Room, 100 Mona Terrace

When: Friday, October 13th 10am - Noon

When: Friday, October 13th 10am - Noon

Your browser does not support viewing this document. Click here to download the document.

FSA Commentary on Elimination of State Income Tax on Social Security Benefits

As part of its campaign seeking repeal of the State income tax on Social Security benefits, Fairfield Senior Advocates, a nonpartisan citizen action group, appeared at the Committee on Aging hearing in Hartford. “Raised Bill 6987 in the General Assembly gives Connecticut seniors what they desperately need, income tax relief,” said Gordon Mackenzie of Fairfield, leader of the FSA Social Security initiative, who appeared at the hearing.

“During the November 2016 election campaign many legislative candidates made repeal of the State income tax on Social Security part of their electoral platforms. We expect them to fulfill that promise, and this bill is a step in that direction,” said FSA coordinating director Urb Leimkuhler of Fairfield.

More than 70 legislators from both parties are sponsoring 20+ bills in the House and Senate that would eliminate the income tax on Social Security. Mackenzie indicated that “introducing a bill is a good start, but we won’t be satisfied until it is released from Committee, voted on and enacted into law, repealing the tax”. Read more: Fairfield Minuteman 2/8/17

Read the FSA press release regarding the CGA hearing below

As part of its campaign seeking repeal of the State income tax on Social Security benefits, Fairfield Senior Advocates, a nonpartisan citizen action group, appeared at the Committee on Aging hearing in Hartford. “Raised Bill 6987 in the General Assembly gives Connecticut seniors what they desperately need, income tax relief,” said Gordon Mackenzie of Fairfield, leader of the FSA Social Security initiative, who appeared at the hearing.

“During the November 2016 election campaign many legislative candidates made repeal of the State income tax on Social Security part of their electoral platforms. We expect them to fulfill that promise, and this bill is a step in that direction,” said FSA coordinating director Urb Leimkuhler of Fairfield.

More than 70 legislators from both parties are sponsoring 20+ bills in the House and Senate that would eliminate the income tax on Social Security. Mackenzie indicated that “introducing a bill is a good start, but we won’t be satisfied until it is released from Committee, voted on and enacted into law, repealing the tax”. Read more: Fairfield Minuteman 2/8/17

Read the FSA press release regarding the CGA hearing below

| fairfieldsenioradvocates_press_release_cga_hearing_2-7-17.pdf | |

| File Size: | 102 kb |

| File Type: | |

Fairfield Senior Advocates (FSA) Update

Your browser does not support viewing this document. Click here to download the document.

Fairfield Assisted Living Facility Approved on Mill Hill Terrace

An assisted-living facility on Mill Hill Terrace, though hotly opposed by neighbors, was approved recently by the Town Plan and Zoning Commission.

The commission gave unanimous approval to a special permit for Maplewood of Fairfield, a three-story, 98-unit facility for seniors on 27 acres adjacent to Mill Hill School. The developer will set aside 13 acres of the property as open space in perpetuity, with public access. Read more: Fairfield Citizen 6/23/16

An assisted-living facility on Mill Hill Terrace, though hotly opposed by neighbors, was approved recently by the Town Plan and Zoning Commission.

The commission gave unanimous approval to a special permit for Maplewood of Fairfield, a three-story, 98-unit facility for seniors on 27 acres adjacent to Mill Hill School. The developer will set aside 13 acres of the property as open space in perpetuity, with public access. Read more: Fairfield Citizen 6/23/16

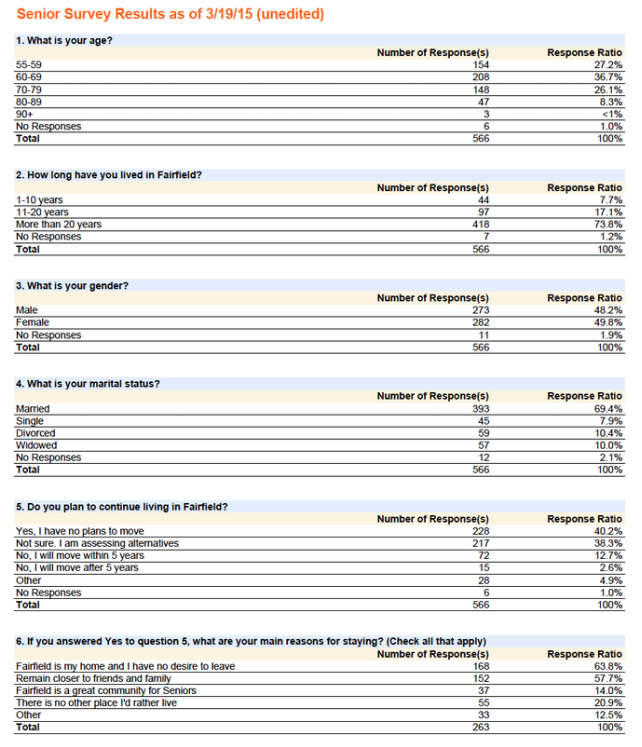

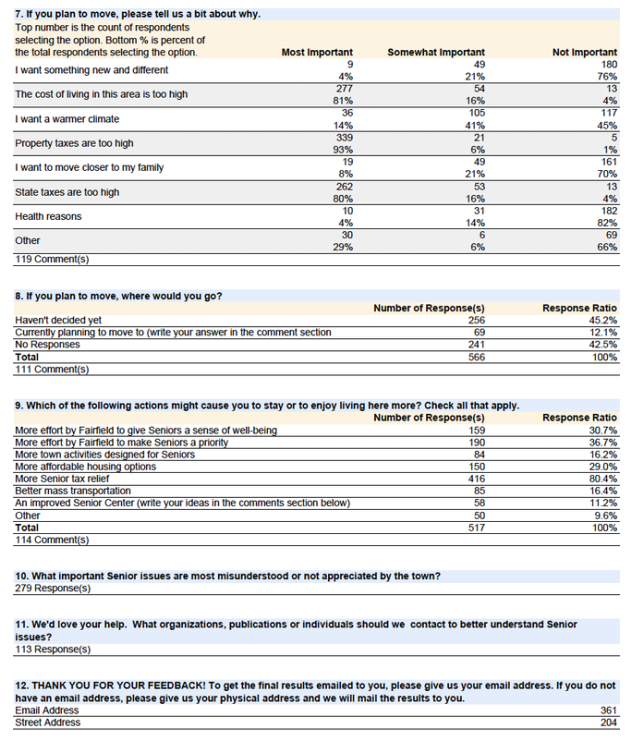

Senior Survey Results as of 3/19/15

See the consolidated survey results as of 3/19/15 below. To date we have 566 responses which is a good start, but we have a long way to go in order to get a good representative sample of Fairfield's Seniors. Fairfield has approximately 12,000 residents over the age of 60 and we need your help to broaden our reach. We encourage you to take the survey and send the link to others so that we may get a solid representative sample of this important demographic.

See the consolidated survey results as of 3/19/15 below. To date we have 566 responses which is a good start, but we have a long way to go in order to get a good representative sample of Fairfield's Seniors. Fairfield has approximately 12,000 residents over the age of 60 and we need your help to broaden our reach. We encourage you to take the survey and send the link to others so that we may get a solid representative sample of this important demographic.

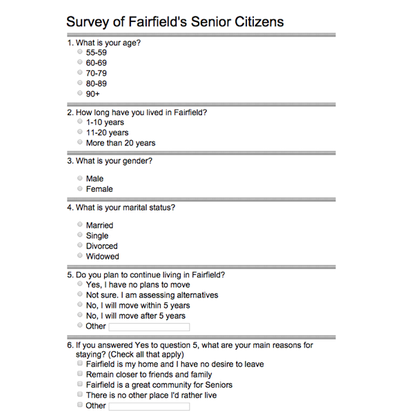

Survey of Fairfield's Senior Citizens

FT's Senior Survey is designed to help us understand the issues affecting Fairfield's seniors that relate to our mission of keeping Fairfield desirable and affordable for all residents. We look forward to compiling the survey results and sharing them in the coming months.

(Click here or anywhere on the survey below to view and take the full survey)

FT's Senior Survey is designed to help us understand the issues affecting Fairfield's seniors that relate to our mission of keeping Fairfield desirable and affordable for all residents. We look forward to compiling the survey results and sharing them in the coming months.

(Click here or anywhere on the survey below to view and take the full survey)

Fairfield Senior Center

The town offers extensive programs and activities at the Senior Center to service the needs of Fairfield's seniors. Membership is up an impressive 68% vs. last year due to the excellent efforts of Director Terry Giegenback. To view the official site click here. The Community Resource Directory lists and explains the services available. Click here to view the directory (please be patient - this is a large file and may take a few minutes to download).

The town offers extensive programs and activities at the Senior Center to service the needs of Fairfield's seniors. Membership is up an impressive 68% vs. last year due to the excellent efforts of Director Terry Giegenback. To view the official site click here. The Community Resource Directory lists and explains the services available. Click here to view the directory (please be patient - this is a large file and may take a few minutes to download).

Fairfield Senior Partners

Fairfield Senior Partners is an organization that has spent a lot of time understanding the concerns of Fairfield's senior citizens and advocating for policies and programs to meet those needs. We suggest you visit their website to learn more about this resource. Below is information taken from the Fairfield Senior Partners site:

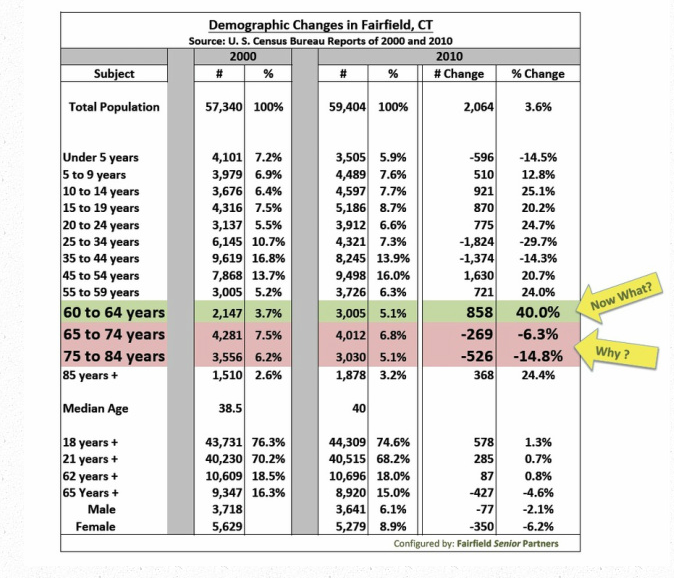

One does not need to look too hard at our population of older adults to know that enthusiasm and energy is not wasted on the young around here. The U.S. Census Bureau provides hundreds of facts about our population in the 2010 Demographic Profile. For the purposes of our advocacy efforts, below are some selected numbers from that report.

Fairfield Senior Partners is an organization that has spent a lot of time understanding the concerns of Fairfield's senior citizens and advocating for policies and programs to meet those needs. We suggest you visit their website to learn more about this resource. Below is information taken from the Fairfield Senior Partners site:

One does not need to look too hard at our population of older adults to know that enthusiasm and energy is not wasted on the young around here. The U.S. Census Bureau provides hundreds of facts about our population in the 2010 Demographic Profile. For the purposes of our advocacy efforts, below are some selected numbers from that report.

To find out more about Fairfield Senior Partners click here.