Vote NO in NOvember If You Care About HOW Things Are Done In Fairfield

The Town Charter codifies the basic rules by which we agree to govern our Town. These rules should

be reviewed on a regular basis to ensure they allow us to govern ourselves as well as possible.

Because nothing is more important than how we govern ourselves, any review should be conducted

by knowledgeable and impartial citizens who are able to analyze all of the costs, benefits, tradeoffs

and risks associated with any possible governance changes, and to explain clearly the basis for any

changes they recommend.

Unfortunately, the recent Charter review process was flawed in many ways:

• Months before any formal announcement that the Town would be reviewing its Charter, outside

counsel was retained for that purpose and briefed by the First Selectperson (FS) and Town

Attorney without consulting other members of the Board of Selectmen (BOS), which is the Town

body responsible for the Charter review process.

• Then, the First Selectperson nominated a full slate of seven members for the Charter Revision

Commission (CRC), a majority of whom appear to have been chosen because they were in favor of

major changes in the structure of our government (e.g., replacing the three-person BOS with a

Mayor, replacing the RTM with a Town Council, and hiring a Town Manager to run our Town), all

seven of whom were subsequently approved by the BOS, not unanimously, but on a party-line

vote (two R’s in favor, one D opposed).

• And, without informing the BOS that a much longer timeframe was possible, the schedule for

Charter revision was drastically shortened to about one year from the almost three years allowed

by State statute, a critical decision with important negative consequences:

➢ critical issues were deliberated by the CRC during the summer months when many

citizens were away and unable to participate;

➢ the Representative Town Meeting (RTM) was denied its important role under State

statute of forming an independent, bi-partisan committee to advise voters on any

proposed Charter revisions; and

➢ the CRC was not able to do its job, stating in its final report that it did not have “sufficient

time to carefully study whether there are disadvantages in the current structure, decide

on what changes would improve the town, and then gain the support for the changes

from the Town political leadership and citizens.”

• The CRC did not merely run out of time, it was never able or willing to analyze fully and explain

clearly the full implications of potential governance changes that either were or should have been

considered within the context of Fairfield’s unique history and civic culture.

➢ Instead of thoughtful analysis, the CRC merely deferred to “expert opinion” about how

other towns are governed and asserted that Fairfield would somehow be “more efficient,”

“more streamlined” and “more accountable” if, like them, it concentrated power in fewer

hands with fewer checks and balances.

➢ Instead of thoughtful analysis, the CRC spent its time trying to reach agreement among its

members, flipflopping on some of its major decisions for reasons that were never

explained in public, making some recommendations that we are being asked to approve

without any rationale whatsoever (e.g., reducing the maximum size of the RTM and

stripping its authority to manage its own size), and never debating critical issues like

whether the proposed new, expanded Chief Administrative Officer position should report

only to the First Selectperson or to the BOS.

• When the CRC was eventually forced by a huge public outcry to abandon any major structural

changes, its remaining recommendations were hurriedly lumped together in one “omnibus” ballot

question that denied the public our right to vote separately on certain significant changes, and

which failed to explain clearly several significant changes.

• Last but not least, all these process failures have imposed on Fairfield a substantial “opportunity

cost” by denying us the potential benefits of what could and should have been a far more open,

impartial, thoughtful, rigorous and unhurried review of possible changes in our Charter.

If you agree that we should all care deeply about HOW things are done in our Town, and that Fairfield

deserves a second chance to do the job right by appointing a new CRC, please “Vote NO in NOvember”

on ballot question #2.

Bud Morten

October 18, 2022

be reviewed on a regular basis to ensure they allow us to govern ourselves as well as possible.

Because nothing is more important than how we govern ourselves, any review should be conducted

by knowledgeable and impartial citizens who are able to analyze all of the costs, benefits, tradeoffs

and risks associated with any possible governance changes, and to explain clearly the basis for any

changes they recommend.

Unfortunately, the recent Charter review process was flawed in many ways:

• Months before any formal announcement that the Town would be reviewing its Charter, outside

counsel was retained for that purpose and briefed by the First Selectperson (FS) and Town

Attorney without consulting other members of the Board of Selectmen (BOS), which is the Town

body responsible for the Charter review process.

• Then, the First Selectperson nominated a full slate of seven members for the Charter Revision

Commission (CRC), a majority of whom appear to have been chosen because they were in favor of

major changes in the structure of our government (e.g., replacing the three-person BOS with a

Mayor, replacing the RTM with a Town Council, and hiring a Town Manager to run our Town), all

seven of whom were subsequently approved by the BOS, not unanimously, but on a party-line

vote (two R’s in favor, one D opposed).

• And, without informing the BOS that a much longer timeframe was possible, the schedule for

Charter revision was drastically shortened to about one year from the almost three years allowed

by State statute, a critical decision with important negative consequences:

➢ critical issues were deliberated by the CRC during the summer months when many

citizens were away and unable to participate;

➢ the Representative Town Meeting (RTM) was denied its important role under State

statute of forming an independent, bi-partisan committee to advise voters on any

proposed Charter revisions; and

➢ the CRC was not able to do its job, stating in its final report that it did not have “sufficient

time to carefully study whether there are disadvantages in the current structure, decide

on what changes would improve the town, and then gain the support for the changes

from the Town political leadership and citizens.”

• The CRC did not merely run out of time, it was never able or willing to analyze fully and explain

clearly the full implications of potential governance changes that either were or should have been

considered within the context of Fairfield’s unique history and civic culture.

➢ Instead of thoughtful analysis, the CRC merely deferred to “expert opinion” about how

other towns are governed and asserted that Fairfield would somehow be “more efficient,”

“more streamlined” and “more accountable” if, like them, it concentrated power in fewer

hands with fewer checks and balances.

➢ Instead of thoughtful analysis, the CRC spent its time trying to reach agreement among its

members, flipflopping on some of its major decisions for reasons that were never

explained in public, making some recommendations that we are being asked to approve

without any rationale whatsoever (e.g., reducing the maximum size of the RTM and

stripping its authority to manage its own size), and never debating critical issues like

whether the proposed new, expanded Chief Administrative Officer position should report

only to the First Selectperson or to the BOS.

• When the CRC was eventually forced by a huge public outcry to abandon any major structural

changes, its remaining recommendations were hurriedly lumped together in one “omnibus” ballot

question that denied the public our right to vote separately on certain significant changes, and

which failed to explain clearly several significant changes.

• Last but not least, all these process failures have imposed on Fairfield a substantial “opportunity

cost” by denying us the potential benefits of what could and should have been a far more open,

impartial, thoughtful, rigorous and unhurried review of possible changes in our Charter.

If you agree that we should all care deeply about HOW things are done in our Town, and that Fairfield

deserves a second chance to do the job right by appointing a new CRC, please “Vote NO in NOvember”

on ballot question #2.

Bud Morten

October 18, 2022

| vote_no_in_november.pdf | |

| File Size: | 201 kb |

| File Type: | |

BECAUSE YOU SAY SO . . . REALLY?

This letter was sent by one of FT’s close associates, Bud Morten, to a number of elected officials recently. We thought it was worthy of sharing.

In case you haven’t been paying close attention, here is my personal summary of what Fairfield’s Charter Revision Commission (CRC) seems to be saying to the public after nine months of work.

_________________________

Listen up people!

We are the Charter Revision Commission, chosen by the First Selectwoman and approved by the Board of Selectpersons (BOS).

Here’s what you need to know:

We worked really hard.

We held lots of meetings.

We talked with governance experts.

We talked with current and past local and regional public officials.

We talked with our Completely Impartial legal counselor.

We talked with the Town Attorney.

We talked with one another.

We read lots of emails.

We listened to lots of public comments.

We were Completely Open and Transparent . . . uh, even though you may not understand how we were sometimes able to completely change our minds from one meeting to the next with no further public discussion, and even though one of our seven commissioners completely vanished without explanation.

Here’s what we decided:

1. You only need 30, not 40, representatives on the Representative Town Meeting (RTM). We are so sure of this that we refused at our final meeting to even discuss the possibility of leaving it at 40. Thirty is actually way more than you need. If we could, we would cut it further or, better yet, replace both the RTM and the BOS with a Town Council and a Mayor and/or Manager. Also, you really shouldn’t get to elect all your RTM reps — some reps should get a seat simply because they represent a different political “party” than the others in your districts — but we had to drop that idea after certain acrimonious people unfairly distorted and politicized it at our last public hearing.

2. In the future, a Town Administrator (TA) should run the Town’s operations and s/he should be appointed by and report to the First Selectperson (FS).

3. The BOS and the Board of Finance (BOF) should be required to hold some joint budget hearings.

4. There are also a bunch of less important changes about things like Constables and the Tree Warden.

That’s it.

We six experts have unanimously agreed on all this, so you don’t need any analysis or explanation of the expected benefits, costs, risks and tradeoffs associated with any of our major changes.

After the BOS approves our decisions, you should vote in favor of them in November.

Trust us. Everything will be better, modernized, streamlined, more efficient, more transparent, more accountable, more accessible. Nothing will go wrong. There will be no unintended consequences. We know best. Because we say so.

_________________________

The most important flaw in the CRC’s proceedings has been their presumption that if the six of them agree and if they think they can get public approval, there is no need for any analysis of all the expected benefits, costs, risks and tradeoffs associated with their recommendations.

However, the purpose of the CRC was not to get these six people to agree on what should be changed; the purpose was to have them analyze whether any changes in our governance system would be beneficial and if so, to explain clearly to us the rationale for any recommendations.

Here are some examples of important issues the CRC failed to analyze and explain to the public.

Size of RTM: Why will a smaller RTM be better for Fairfield; why and how will it be “more accountable” rather than less accountable, and “better able” to address the Town’s many issues? What exactly are the problems being solved and how significant are they? Are any of these problems more likely attributable to a lack of adequate staff and legal support for the RTM? How should we evaluate the performance of the RTM? What bad things have happened or will happen to Fairfield because its RTM is too big, even though some highly successful towns like Greenwich and Darien have much larger RTMs? What benefits do we obtain from a larger RTM that will be lost? For example, would a smaller RTM adversely affect the Civic Culture of our community? How should we weigh the relative importance of all these and other benefits, costs and risks? Subject to learning more, I personally believe the RTM should remain at 40 members.

Town Administrator: The objective of this change is to provide more professional operating management for our Town and allow the FS to focus more on strategic matters. The question is whether the TA should be appointed by and report to the FS, which is how things work today with the Town’s Chief Administrative Officer and Chief Fiscal Officer. The FS is our Town’s CEO, and both private- and public-sector CEOs (e.g., Governors and Presidents) are almost always allowed to appoint their own executive teams and cabinets. And, over time, different FS will bring different skill sets, experience, personalities and strategic priorities to the job, so they should presumably have the flexibility to choose a TA that will best complement and support their agenda rather than, in the worst case, obstruct it. On the other hand, maybe the TA should be appointed by and report to the BOS? Indeed, in other towns, the Town Manager usually reports to a Town Council rather than to the Mayor or FS. And our Superintendent of Schools is appointed by and reports to the BOE, which seems to work pretty well. Reporting to the FS definitely makes the TA role more political and would limit the candidate pool to those willing to accept what could be only a four-year term. Frequent TA turnover would also mean that we never get the full benefit of long-term professional management based on long-term institutional knowledge and relationships. I personally can’t decide yet which is best and want to learn more.

Budget Process: Why should we mandate that the BOS and the BOF must hold some joint budget hearings? Why not simply encourage them to continue to adopt by mutual agreement whatever budget hearing process they feel is most constructive? Subject to learning more, I personally believe the Charter should not dictate what the BOS and BOF must do with regard to their budget hearings.

In conclusion, the CRC’s recommendations will soon be voted on by the BOS, and I urge you to tell them what you think, whether you agree with me or not: [email protected]. This is your 383-year-old town.

Bud Morten

June 21, 2022

In case you haven’t been paying close attention, here is my personal summary of what Fairfield’s Charter Revision Commission (CRC) seems to be saying to the public after nine months of work.

_________________________

Listen up people!

We are the Charter Revision Commission, chosen by the First Selectwoman and approved by the Board of Selectpersons (BOS).

Here’s what you need to know:

We worked really hard.

We held lots of meetings.

We talked with governance experts.

We talked with current and past local and regional public officials.

We talked with our Completely Impartial legal counselor.

We talked with the Town Attorney.

We talked with one another.

We read lots of emails.

We listened to lots of public comments.

We were Completely Open and Transparent . . . uh, even though you may not understand how we were sometimes able to completely change our minds from one meeting to the next with no further public discussion, and even though one of our seven commissioners completely vanished without explanation.

Here’s what we decided:

1. You only need 30, not 40, representatives on the Representative Town Meeting (RTM). We are so sure of this that we refused at our final meeting to even discuss the possibility of leaving it at 40. Thirty is actually way more than you need. If we could, we would cut it further or, better yet, replace both the RTM and the BOS with a Town Council and a Mayor and/or Manager. Also, you really shouldn’t get to elect all your RTM reps — some reps should get a seat simply because they represent a different political “party” than the others in your districts — but we had to drop that idea after certain acrimonious people unfairly distorted and politicized it at our last public hearing.

2. In the future, a Town Administrator (TA) should run the Town’s operations and s/he should be appointed by and report to the First Selectperson (FS).

3. The BOS and the Board of Finance (BOF) should be required to hold some joint budget hearings.

4. There are also a bunch of less important changes about things like Constables and the Tree Warden.

That’s it.

We six experts have unanimously agreed on all this, so you don’t need any analysis or explanation of the expected benefits, costs, risks and tradeoffs associated with any of our major changes.

After the BOS approves our decisions, you should vote in favor of them in November.

Trust us. Everything will be better, modernized, streamlined, more efficient, more transparent, more accountable, more accessible. Nothing will go wrong. There will be no unintended consequences. We know best. Because we say so.

_________________________

The most important flaw in the CRC’s proceedings has been their presumption that if the six of them agree and if they think they can get public approval, there is no need for any analysis of all the expected benefits, costs, risks and tradeoffs associated with their recommendations.

However, the purpose of the CRC was not to get these six people to agree on what should be changed; the purpose was to have them analyze whether any changes in our governance system would be beneficial and if so, to explain clearly to us the rationale for any recommendations.

Here are some examples of important issues the CRC failed to analyze and explain to the public.

Size of RTM: Why will a smaller RTM be better for Fairfield; why and how will it be “more accountable” rather than less accountable, and “better able” to address the Town’s many issues? What exactly are the problems being solved and how significant are they? Are any of these problems more likely attributable to a lack of adequate staff and legal support for the RTM? How should we evaluate the performance of the RTM? What bad things have happened or will happen to Fairfield because its RTM is too big, even though some highly successful towns like Greenwich and Darien have much larger RTMs? What benefits do we obtain from a larger RTM that will be lost? For example, would a smaller RTM adversely affect the Civic Culture of our community? How should we weigh the relative importance of all these and other benefits, costs and risks? Subject to learning more, I personally believe the RTM should remain at 40 members.

Town Administrator: The objective of this change is to provide more professional operating management for our Town and allow the FS to focus more on strategic matters. The question is whether the TA should be appointed by and report to the FS, which is how things work today with the Town’s Chief Administrative Officer and Chief Fiscal Officer. The FS is our Town’s CEO, and both private- and public-sector CEOs (e.g., Governors and Presidents) are almost always allowed to appoint their own executive teams and cabinets. And, over time, different FS will bring different skill sets, experience, personalities and strategic priorities to the job, so they should presumably have the flexibility to choose a TA that will best complement and support their agenda rather than, in the worst case, obstruct it. On the other hand, maybe the TA should be appointed by and report to the BOS? Indeed, in other towns, the Town Manager usually reports to a Town Council rather than to the Mayor or FS. And our Superintendent of Schools is appointed by and reports to the BOE, which seems to work pretty well. Reporting to the FS definitely makes the TA role more political and would limit the candidate pool to those willing to accept what could be only a four-year term. Frequent TA turnover would also mean that we never get the full benefit of long-term professional management based on long-term institutional knowledge and relationships. I personally can’t decide yet which is best and want to learn more.

Budget Process: Why should we mandate that the BOS and the BOF must hold some joint budget hearings? Why not simply encourage them to continue to adopt by mutual agreement whatever budget hearing process they feel is most constructive? Subject to learning more, I personally believe the Charter should not dictate what the BOS and BOF must do with regard to their budget hearings.

In conclusion, the CRC’s recommendations will soon be voted on by the BOS, and I urge you to tell them what you think, whether you agree with me or not: [email protected]. This is your 383-year-old town.

Bud Morten

June 21, 2022

| because_you_say_so...really_6.21.22.pdf | |

| File Size: | 120 kb |

| File Type: | |

Fairfield Finance Board Restores School Budget, Cuts Town Request

The finance board approved a $345.1 million budget request for 2022-23 in a split vote along party lines. The budget proposal includes a controversial move to fully restore the Board of Education’s budget request.

Next year’s budget now includes nearly $202.5 million for the schools, which is about $10.4 million, or 5.42 percent, more than the current budget.

It also includes about $142.6 for the town, which is about $2.4 million more than the current year. Both figures include the shared expenses between the schools and the town. CT Insider 4.4.22

Next year’s budget now includes nearly $202.5 million for the schools, which is about $10.4 million, or 5.42 percent, more than the current budget.

It also includes about $142.6 for the town, which is about $2.4 million more than the current year. Both figures include the shared expenses between the schools and the town. CT Insider 4.4.22

Budget Update from BOF Chairwoman Lori Charlton

Last night, with my wholehearted support, Fairfield's Board of Finance (BOF) voted 5-4 to approve an amended Town budget, which will now go the RTM for review and a vote. I am thankful to my colleagues and proud of the result.

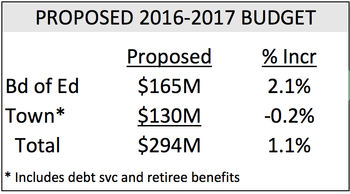

Here's the bottom line of budget dollars and changes from last year:

Here's the bottom line of budget dollars and changes from last year:

- Education spending: $202.5 million, + 5.4%

- Town spending: $116.9 mm, +4.3%

- Shared Education/Town: $25.7mm, -(8.9%)

- Non-tax revenue: $28.9, +6.4%

- Increase in grand list: 2.1%

- Mill rate: 27.32, +1.29% Patch 4.1.22

Tempers Flare, $2.5M In School Funding Restored At BOF Budget Meeting

Tempers flared Thursday at a nearly-six-hour meeting of the Fairfield Board of Finance, during which members voted by a narrow margin to restore $2.5 million in education funding that was cut earlier in the town's annual budget process.

Republican members called the restoration "astronomical" and "wasteful," while Democrats argued it wasn't the right time to deny the school board the full amount it requested.

The money was restored before the Board of Finance approved the 2023 town budget, increasing expenses by $2.3 million compared to the spending plan greenlit last month by the Board of Selectmen. The altered budget, which will next go to the Representative Town Meeting, totals $345.1 million, after school spending was increased by 1.25 percent and town spending was cut by 0.15 percent. Patch 4.1.22

Republican members called the restoration "astronomical" and "wasteful," while Democrats argued it wasn't the right time to deny the school board the full amount it requested.

The money was restored before the Board of Finance approved the 2023 town budget, increasing expenses by $2.3 million compared to the spending plan greenlit last month by the Board of Selectmen. The altered budget, which will next go to the Representative Town Meeting, totals $345.1 million, after school spending was increased by 1.25 percent and town spending was cut by 0.15 percent. Patch 4.1.22

Bud Morten’s Comments to the Board of Finance 3/26/22

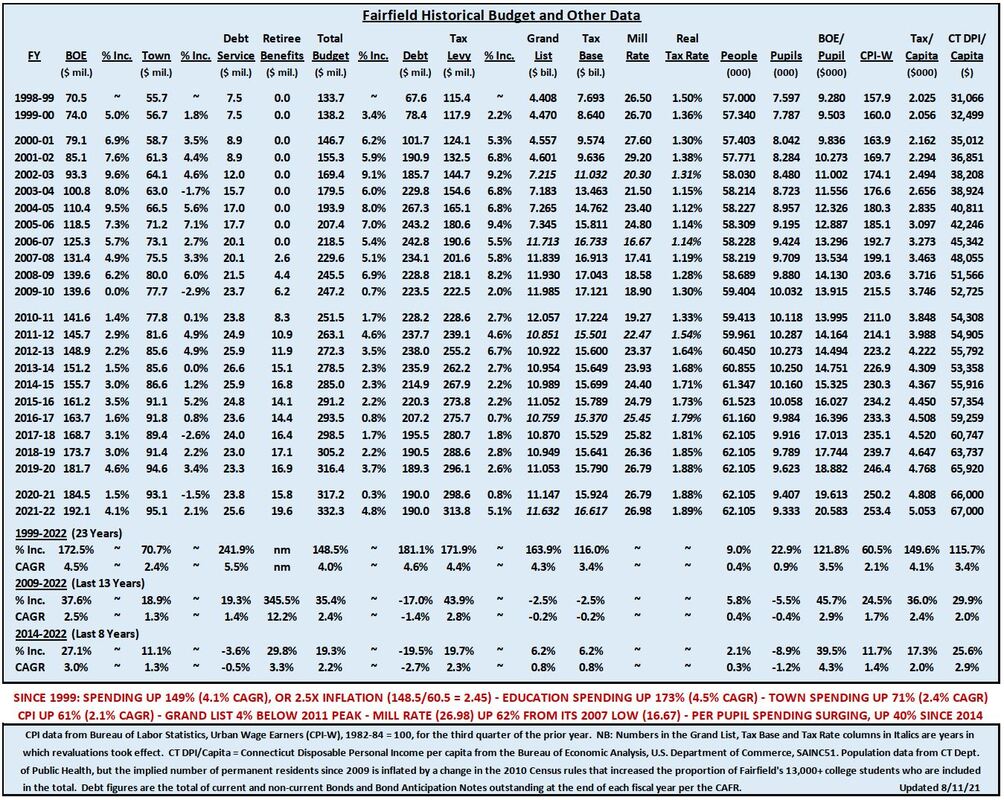

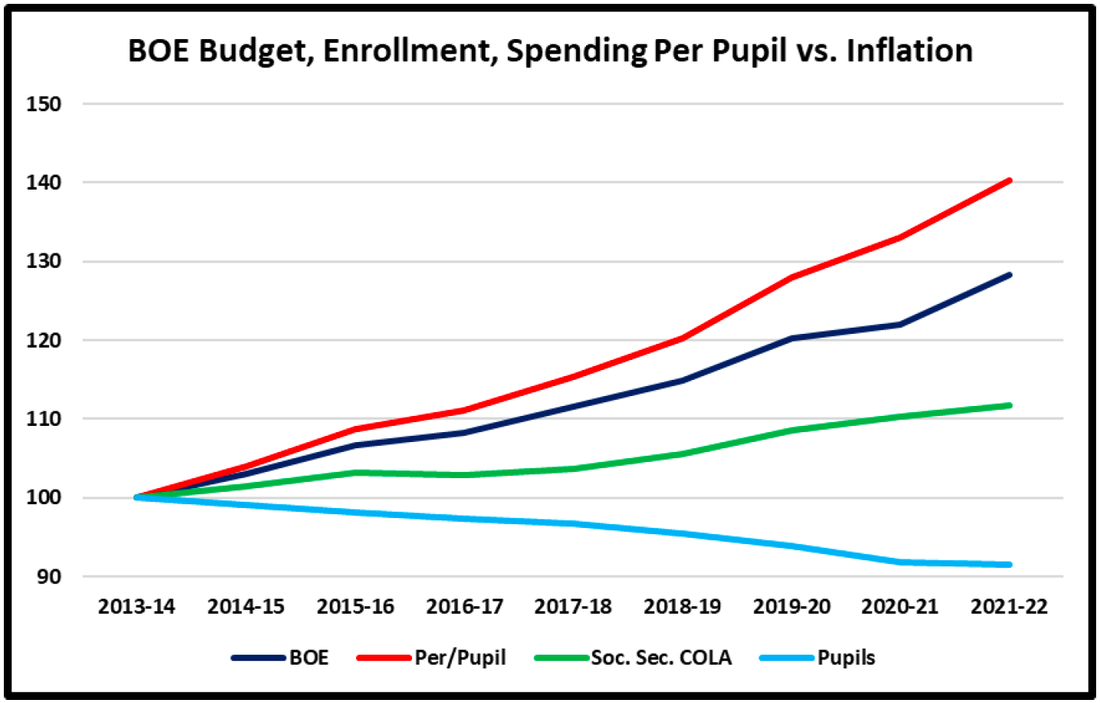

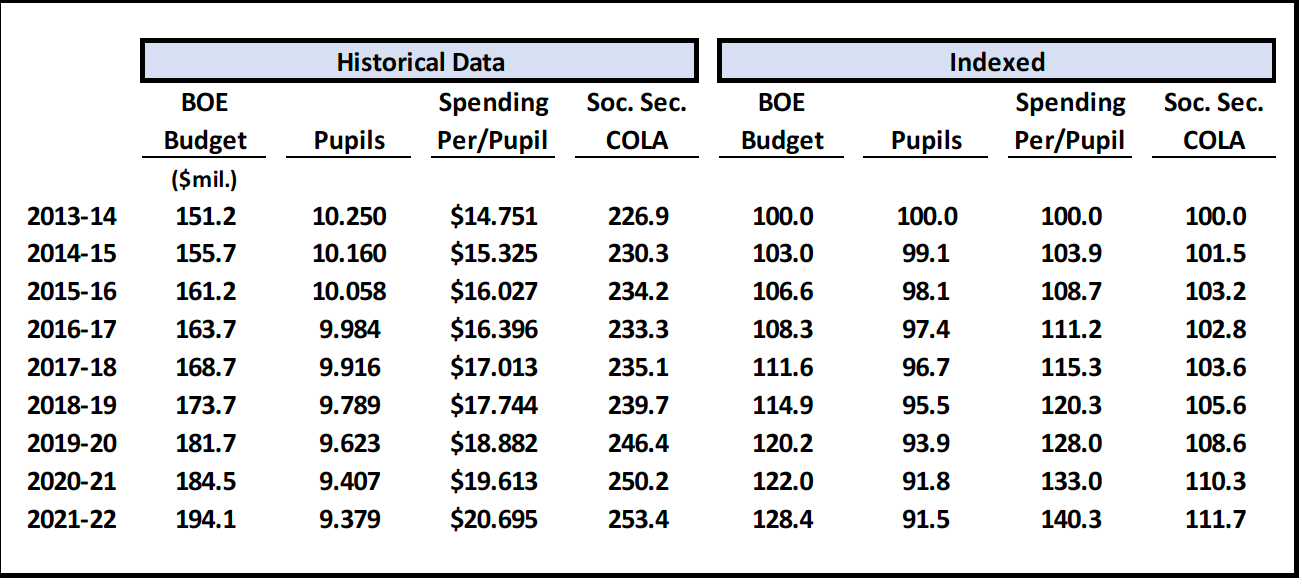

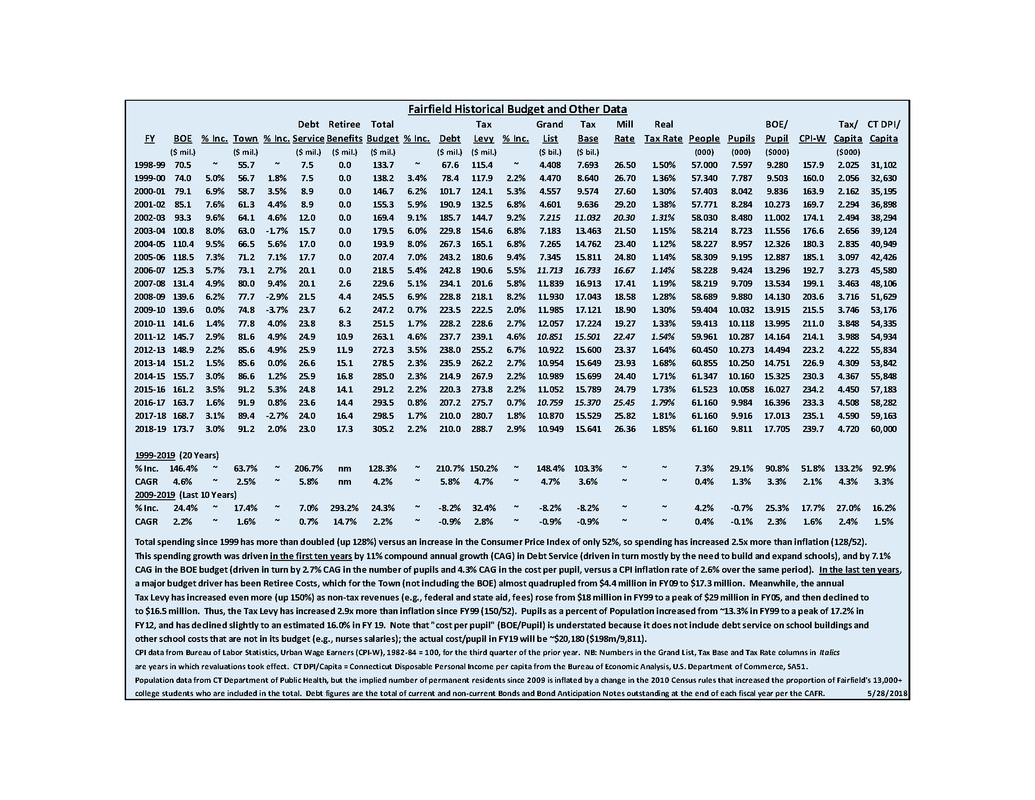

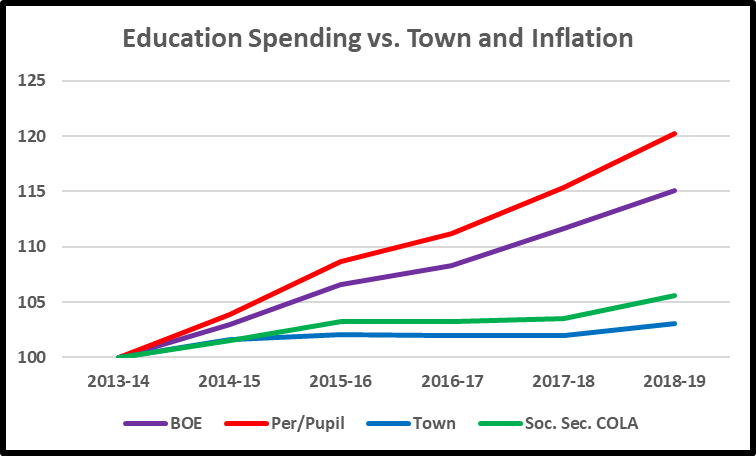

The cost of our public schools – now two-thirds of total spending – is rapidly eclipsing all other public services, which I believe is likely to have serious negative long-term consequences.

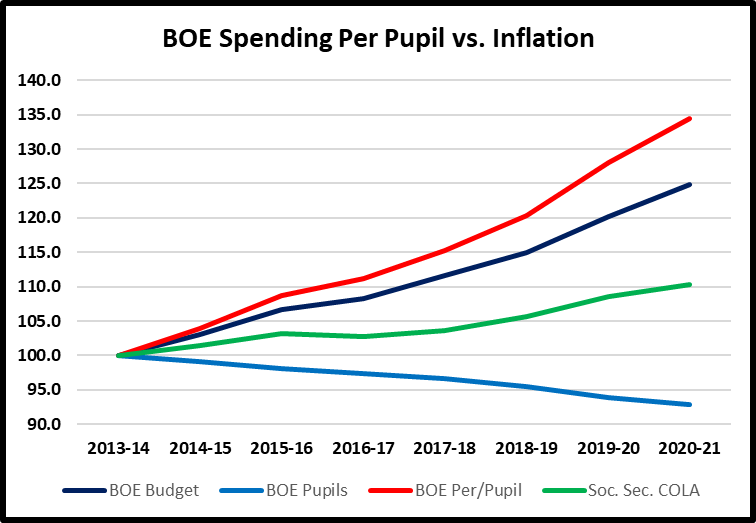

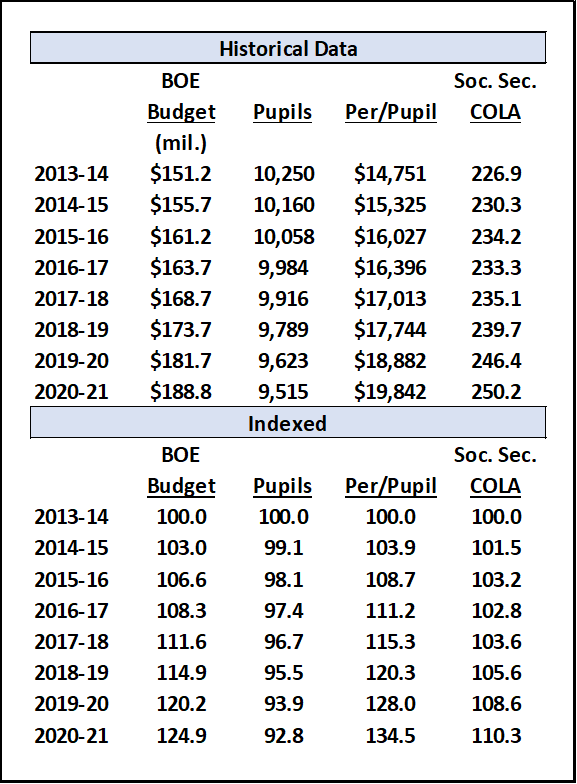

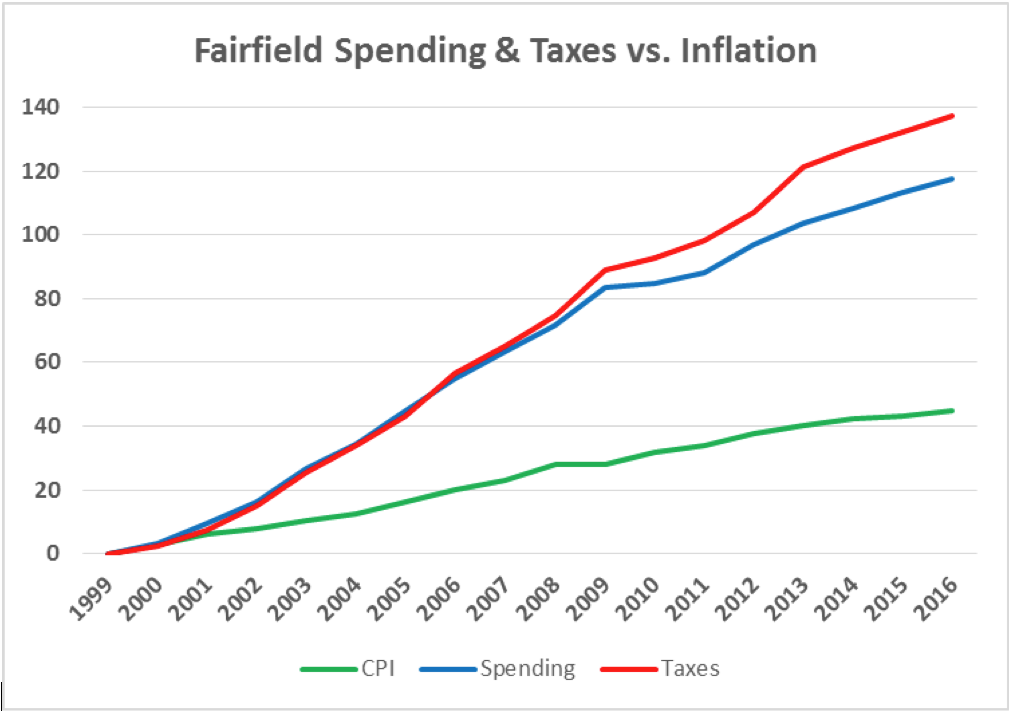

- Based on the BOE’s budget request ($202.5m), spending will rise 5.4% from last year ($192.1m), and compared to where we were nine years ago ($151.2m), when BOE budget growth began to accelerate, spending will be up 34%, even though enrollment is down 9% (9,297 vs. 10,250). So, Spending Per Pupil will be up 48% ($21,781 vs. $14,751), despite only an 18% increase in inflation (CPI-W: 268.2 vs. 226.9) and a Grand List that is still 2% below its peak twelve years ago ($11.87b vs. $12.06b in FY11, before the collapse of the last housing bubble was reflected in our assessments). Each Group of 20 students (an average class size) will cost almost $500,000 per year ($202.5m plus $26.5m [for other school expenses that are not included in the BOE budget] = $229m / 9,297 students = $24,632 per student x 20 = $492,640).

- Education spending is being driven by increases in labor and facility costs and by an expanding scope of educational services that require more resources per student, particularly Special Education (14.9% of total students this year, up from 10.8% seven years ago). These upward pressures continue to more than offset any savings from declining enrollment, which is down 10% from its FY11 peak (10,287), and for years the BOE has resisted making any major structural changes (e.g., consolidating schools, reducing elective course offerings, increasing class sizes) that would provide some relief.

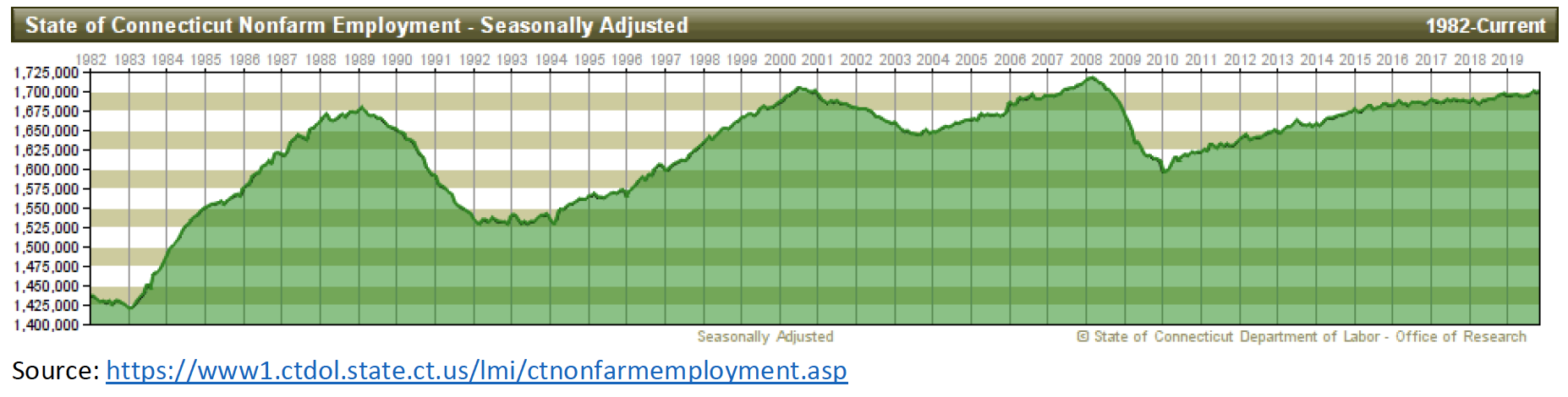

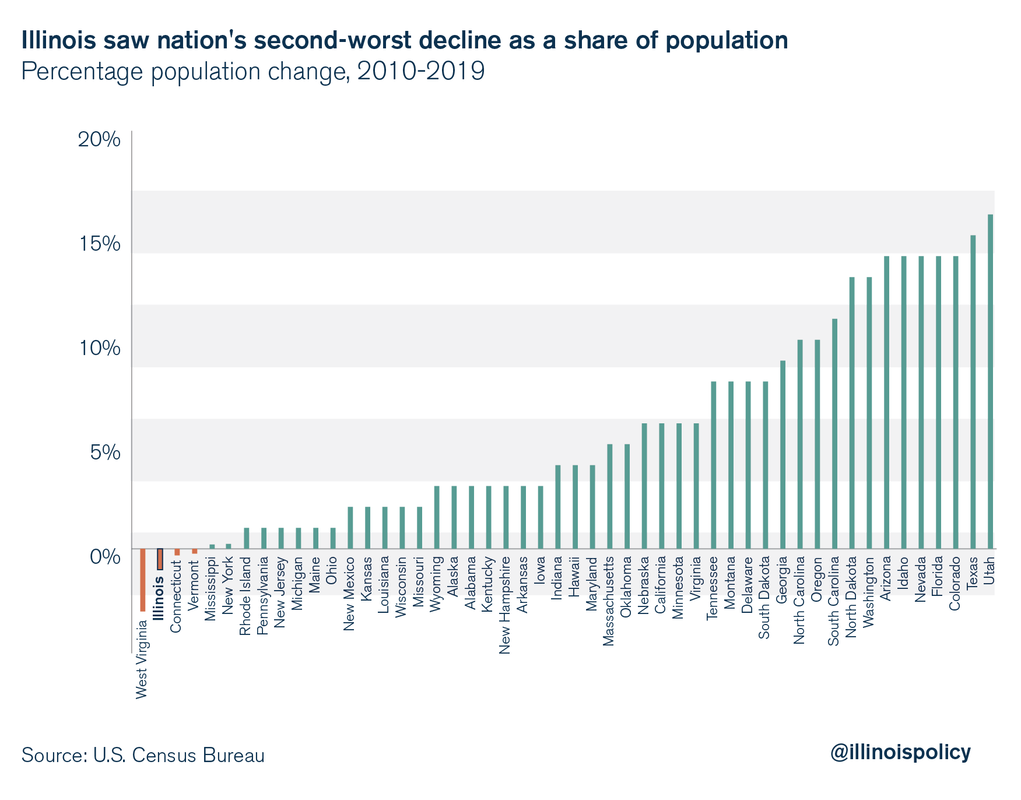

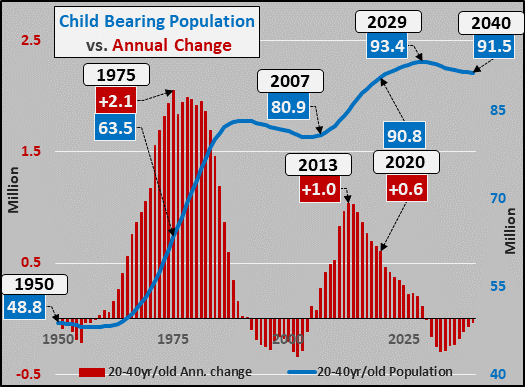

- More rapid growth in our tax base would help, but growing our Grand List will continue to be quite challenging because: (1) we live in the failing State of CT (e.g., stagnant and aging population, high costs of living and of doing business, no job growth in more than 30 years); (2) our regional economic engine, NYC, is facing major pressures[i] (e.g., office buildings that are still more than half empty, rising crime rates, increasing outmigration); (3) our currently strong home values are likely to weaken (e.g., as mortgage rates rise and Covid-related demand subsides); and (4) commercial property values and development are likely to remain weak (e.g., due to continued eCommerce inroads on traditional retailers, and changing work habits that are reducing demand for office space [according to C&W,[ii] the office vacancy rate in Fairfield County is ~33% and there is virtually no new construction]).

- Support for education spending comes from a strong, well-organized, resourceful, and vocal coalition of unions, parents, teachers, administrators, regulators, consultants and contractors.

- Public-education households represent ~35% of total Fairfield households, but they pay a significantly lower percentage of total education costs;[iii] they represent ~40% of registered voters; and they are often a majority of those who vote in municipal elections, for which overall turnout is sometimes below 30%.

- Advocates will argue that some Fairfield County towns spend even more per student,[iv] and they may argue that the proposed $2.5m reduction (in the BOE’s requested $10.4m increase) amounts to only about 30 cents per day for each of Fairfield’s ~21,000 households, all of whom benefit from higher property values because people move to Fairfield for our great schools.[v]

- According to the BOE: (1) every dollar in their budget is necessary to pay for the instructional and social-emotional “needs” of students; (2) structural cost reductions are just too difficult; and (3) there is no need for any performance analysis in their budget presentation.

- The BOE candidly disclaims any responsibility for determining whether the rapid growth in its spending is affordable or might result in serious negative long-term consequences.

- Thus, the Board of Finance must provide the essential long-term perspective and judgment regarding how much we can afford to spend in order to keep Fairfield both desirable and affordable – and this year it must do so in a climate of heightened economic risk in the wake of recent unprecedented and unsustainable monetary and fiscal policies.

- As I do every year, I respectfully urge you to consider carefully the long-term consequences of continued rapid growth in Fairfield’s education spending.

[i] https://www.wsj.com/articles/midtown-manhattan-with-fewer-office-workers-imagining-the-unthinkable-11647941402

[ii] Fairfield-County_Americas_MarketBeat_Office_Q4-2021.pdf

[iii] Most of the cost of our schools is paid by non-public-school households and commercial/industrial taxpayers.

[iv] The BOE never explains that the Fairfield County towns with even higher per-pupil expenditures that it picks to compare to Fairfield every year are all much wealthier than Fairfield and, with the exception of Greenwich, they are all much smaller in terms of enrollment, and thus do not enjoy the same economies of scale as Fairfield, which is one of the largest districts in the State. In FY21 (the data used in the BOE’s latest bar graph), average enrollment for Darien, New Canaan, Weston, Westport and Wilton was less than half (4,021) the size of Fairfield (9,441).

[v] Fairfield Taxpayer agrees emphatically with education advocates that good schools support property values in a town. However, we also know that, as with most things in life (e.g., sun, chocolate, apple pie and ice cream), we can also have too much of a good thing. This means that, at some point, spending too much on education, or on any other government service, also hurts property values by raising taxes to levels that are not affordable or competitive. The corollary to the oft-repeated observation that “people move into Fairfield because of our schools” is that “people will move out of Fairfield if our taxes are too high and/or if our other public services are inferior.” Fairfield Taxpayer believes that we should spend as much on education as we can afford in order to provide the best education we can for our children. Spending more than we can afford is not sustainable because either our tax rates will be too high or we will be forced to cut our spending on other public services too low (e.g., public safety, recreational facilities, roads). Either way, fewer people will choose to live here, and residential property values will suffer. Unless (improbably) there is an offsetting increase in new residential construction and/or in the value of commercial property, our tax base will decline. If our tax base declines, we will eventually have to cut spending on all our public services, including education.

Excerpted from: is_fairfield_spending_enough_on_education_final_11.14.21.pdf (fairfieldtaxpayer.com)

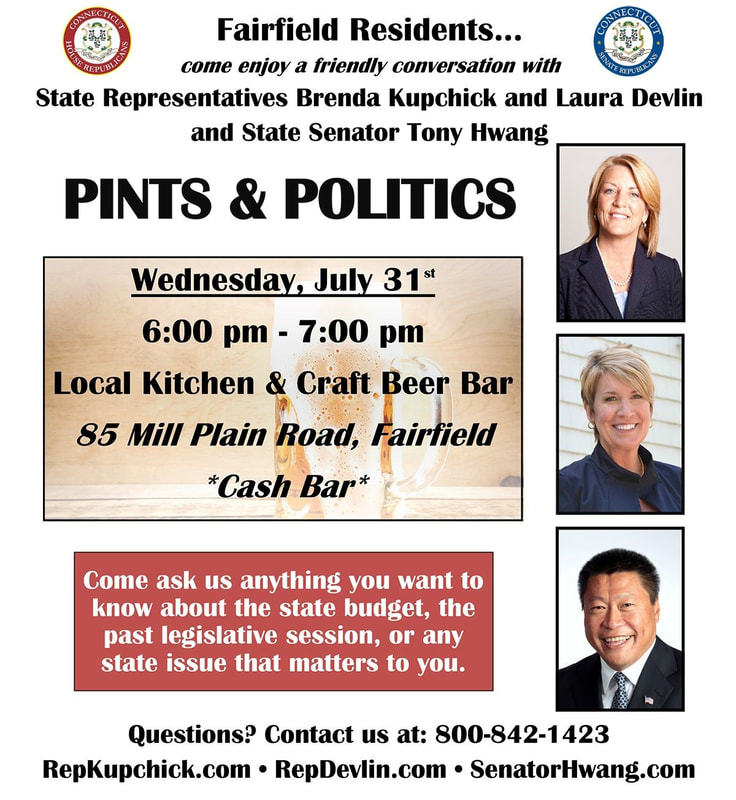

Charter Revision Could Bring Noticeable Changes To Fairfield

With charter revision on the ballot in November, residents might see some noticeable changes — or maybe they won’t.

As promised by First Selectwoman Brenda Kupchick when she took office, a Charter Revision Commission has been working since last fall to examine the town’s guiding document and see what can be freshened up and changed to bring it more into line with the world it exists in. CT Insider 3.20.22

As promised by First Selectwoman Brenda Kupchick when she took office, a Charter Revision Commission has been working since last fall to examine the town’s guiding document and see what can be freshened up and changed to bring it more into line with the world it exists in. CT Insider 3.20.22

Two Fundamental Questions the CRC Has Not Addressed

| two_fundamental_questions_the_crc_has_not_addressed_3.10.22.pdf | |

| File Size: | 251 kb |

| File Type: | |

- How should we evaluate the performance of our existing governance system?

- How should we decide whether any major changes are warranted?

Fairfield Taxpayer believes that our existing governance system has served the Town quite well and that, although it can be updated and tweaked in a number of constructive ways, any major changes in its basic structure should be made only if the expected benefits will significantly outweigh any costs and risks. It is easy to argue, as some have done, that certain major changes would be beneficial by associating them with words like “efficiency,” “transparency,” “accountability,” “competency,” “best practice” and “modernize.” It is easy to assert that one or more recent problems in Town could and would have been avoided under a different structure. It is easy to claim that times have changed and Fairfield should therefore adopt the same structure as other towns of its size, or should do whatever some “subject-matter experts” and/or the “Model City Charter” recommends. However, all these simplistic arguments ignore the overarching facts that: (a) Fairfield has prospered for many years under the existing structure because far more good things than bad things have happened; (b) bad things regularly happen to other towns and cities under every conceivable governance structure; and (c) it is perilously easy to overlook unintended adverse consequences of major governance changes.

The Charter Revision Commission

With the overarching goal of facilitating Fairfield’s ability to continue to prosper, the seven-member Charter Revision Commission (CRC) has been asked to determine if there are any ways in which we can improve our Town Charter — which is the document that sets out the rules by which our community chooses to govern itself — either by fixing any practical and administrative problems or by making more fundamental structural changes that will allow us to better address future challenges and opportunities.

Putting aside the need for any “administrative fixes,” the really important question is whether the CRC should recommend any major changes in a basic governance structure that has served the Town so well for so many years. After meeting for several months, and having listened to several “experts” on municipal government who have opined on various structural alternatives, the CRC is now considering some major structural changes (e.g., adopting a Town Manager/Town Council form of government, eliminating the Board of Selectmen, shrinking the size of the Representative Town Meeting), some of which were included in a “Framework for Deliberations” (see Appendix A) for its February 24th meeting.[1]

Two really important questions are missing from both this framework and from the CRC’s deliberations to date:

- How should we evaluate the performance of our existing Governance System; and

- How should we decide whether any major changes are warranted?

Fairfield’s Existing Governance Structure

- A First Selectperson (FS) who serves a four-year term (with no term limits) and acts as the Town’s full-time senior executive — in effect, the Town’s Chief Executive Officer (CEO) — who is paid ~$150,000/yr. (plus the cost of healthcare and retirement benefits) and who is supported, among other staff, by a Chief Administrative Officer who is selected by and reports to the FS and is paid ~$125,000/yr. All Town-service department heads report to the FS (e.g., Police, Fire, Public Works, Parks & Recreation), as do the Town-administrative department heads (e.g., Chief Fiscal Officer, Town Attorney, Director of Human Resources, Tax Assessor, Conservation Director). In total, there are ~500 municipal employees, including ~16 service and administrative “town officers” who report to the FS.

- A three-person Board of Selectmen (BOS) — including the First Selectperson — all the members of which serve concurrent four-year terms (with no term limits), and no more than two members of which can represent the same political party. The second and third Selectpersons are paid $12,000/yr.

- A nine-person Board of Finance (BOF), which provides comprehensive financial oversight of the Town’s affairs, all the unpaid volunteer members of which serve staggered six-year terms (with no term limits), and no more than six of the nine members of which can represent the same political party.

- A Representative Town Meeting (RTM), the Town’s legislative body, composed of no more than 56 members (currently there are 40), with an equal number elected from each of the Town’s ten political districts (i.e., from each of its ten neighborhoods), all the unpaid volunteer members of which serve concurrent two-year terms (with no term limits), and all of whom can be members of the same party.

- A nine-person Board of Education (BOE), which is responsible for oversight of the Fairfield Public School system (FPS), all the unpaid volunteer members of which serve staggered four-year terms (with no term limits), and no more than five of the nine members of which can represent the same political party. A Superintendent of Schools, who is hired by and reports to the BOE and who is paid $232,000/yr., is responsible for managing FPS. To a much greater extent than any other Town body, the BOE is subject to State oversight, regulations and mandates. Spending on our schools now represents ~66% of the Town’s total spending and an even larger percentage of total capital outlays (primarily for 17 school buildings). Collectively, there are ~1,500 FPS employees.

- A seven-person Town Plan and Zoning Commission (TPZ), which both enacts and administers the Town’s land-use regulations, all of the unpaid volunteer members of which (plus three alternates who serve as needed in the event of absences and recusals) serve either two- or four-year staggered terms (with no term limits).

In addition to these six key governance “entities,“ there are ~44 other boards, commissions and committees (See Appendix B) that provide direction and oversight of specific public affairs (e.g., Parks & Recreation, Golf, Marina). Though some are elected (i.e., the Board of Assessment Appeals and the Zoning Board of Appeals), most of the unpaid volunteer members of these bodies are appointed by the FS or the BOS (in some cases subject to the approval of the RTM), and their decisions are subject in most cases to the oversight and consent of one or more of the FS, the BOS, the BOF and the RTM. In total, at any given time, there are more than 400 people (representing ~1% of the Town’s ~40,000 adult residents) serving in various elected or appointed governance positions.

Beyond this basic description, it is important to consider the intangible effects of our governance system on our community. For example, the fact that Fairfield has many residents who have served on one or more of these many boards, bodies, commissions and committees means that we have many residents who have some familiarity with our governance system and how it works, and who by virtue of their service know personally many past and present elected and appointed officials and public employees. As a guess, there are probably ~1,000 people who have served on one or more public bodies. Though it is impossible to quantify the value of this collective community engagement, the resulting knowledge and experience is arguably quite important to our Civic Culture. Among other benefits, there are many people in Fairfield who are able and willing to defy the old adage, “You can’t fight City Hall.”

With this background, we now return to the two questions posed earlier.

How should the CRC evaluate the performance of our existing Governance System?

Evaluating a governance system is not easy because the performance “outcomes” of any political entity (town, state, nation) are subject to myriad influences over time, and thus whatever measures of success and failure are adopted, they are subject to many, many confounding variables. Thus, it is not usually possible to determine if outcomes are primarily the result of the system or of the leadership at any given time. Accordingly, it is very important when evaluating performance, whether good or bad, and whether broadly or narrowly, to distinguish between structural influences and management influences. In general, there is no perfect governance system that avoids all problems (e.g., negligence, malfeasance, corruption) and always optimizes performance. The three most important determinants of getting good results and avoiding problems are: (a) electing and/or appointing good, honest, diligent, competent people; (b) following good oversight and control processes and procedures; and (c) a Senior Executive who establishes a “Tone at the Top” that fosters a culture of high performance and high integrity.

How should the CRC decide whether any significant changes are warranted?

As Fairfield Taxpayer has stated previously, “any proposal to alter a governance system that has served Fairfield well for so many years should be subject to a very high standard of conviction that the expected benefits will significantly outweigh any costs and risks — direct and indirect, tangible and intangible.”[2]

Any serious analysis of the costs, benefits and risks associated with any major structural changes should begin with agreement on the core values and principles that should apply. Some examples are as follows.

- Flexibility is good.

- Checks and balances are good.

- Ballot-box accountability is good.

- Minority party representation is good.

- Neighborhood legislative representation is good.

- Concentration of power is bad.

- Efficient government is good; efficient governance can be very bad.

- Incremental change is good; radical change can be very bad.

- Having many citizens involved in Town government is good.

- Institutional governance knowledge in a community is good.

Another set of core principles applies to the standards and criteria that should be applied to justify any major structural changes, some examples of which are as follows:

- If it ain’t broke, don’t fix it.

- Beware of unintended consequences.

- Don’t change structure if there is an easier way to accomplish the same objective. For example, if more professional management of municipal services seems desirable (i.e., a Town Manager), instead of permanently altering our governance structure we could simply authorize the FS to retain a highly competent Chief Administrative Officer (or Chief Operating Officer) and then hold the FS responsible at the ballot box for the performance of his/her selection, in the same way that presidents and governors are held responsible on Election Day for their staff and cabinet selections.

- The experience of other towns with different governance structures may or may not be applicable to Fairfield, irrespective of any similarities (e.g., in size or location).

- The recommendations of “subject-matter experts” and of publications like the “Model City Charter,” and the opinions they express with regard to what “works best,” may or may not be applicable to Fairfield, which like every other town, is unique (including 383 years of history).

- It is quite possible that some if not many of the towns being used to benchmark “best practice” would do no worse and might do much better if they adopted Fairfield’s governance structure.

- Not being able to find electoral candidates from both major parties for every open seat on every governance body (or in the case of the RTM, in every district) is not a problem unless there are actually empty seats on those bodies.

- Any major changes that are recommended should be linked directly to one or more specific problems or opportunities that cannot be addressed more easily by simply changing either the people we elect or the management processes and procedures to which their actions are subject.

The CRC should obviously develop its own lists of core values, principles, standards and criteria, but these and others will be used by Fairfield Taxpayer to evaluate any recommendations made by the CRC.

In Conclusion

The CRC should consider carefully how we should evaluate our existing governance structure and how we should decide whether any major changes are warranted. It should offer its recommendations of any major changes with clear explanations of why and how they would, on balance, be in the best interests of our Town based on a rigorous analysis of all the related benefits, costs and risks — direct and indirect, tangible and intangible. Any recommendations that are not unanimous should include dissenting opinions from the CRC members who opposed them.

APPENDIX A

The CRC “FRAMEWORK OF DELIBERATIONS” That Was Included In its Backup Materials

What Are Your goals?

- Vibrant accountability structure: Delineation of responsibilities

- Clear administrative operations: A mix of elected officials supplemented by professional management

- Planning tools: Multi-year capital budgeting, collective bargaining approaches and strategic planning mechanisms

- Public access and participation: Robust comment and appointed service opportunities

- Reduce complexity and byzantine organizational structures

- What is a realistic approach for government reform?

First Selectwoman

- Sole Executive Authority? Role of Board of Selectmen?

- Chief Administrative Officer

- Appointment Authority and Relation to Boards and Commissions

- Annual Report

- Legislative recommendations to RTM

- Absence, vacancy and succession

Legislative Authority of RTM

- Investigative and Audit Powers

- No diminution of legislative authority by Ordinance

- Assumption of legislative/historic special act authority of Board of Selectmen

- Adoption of Legislation – Ordinances and Resolutions.

- Approval Functions/Right of Rejection.

Composition of RTM

- Smaller more accountable legislative body: 15 members?

- At-Large, subject to minority party representation or an odd number?

- District representation (one member per district or odd-number multiple member districts, subject to minority party representation?

- Hybrid comprised of an at-large component and district representation

Organization of the RTM

- RTM President/Chair/Moderator as Presiding Officer?

APPENDIX B

OTHER TOWN BOARDS, COMMISSIONS, BODIES, COMMITTEES

• Affordable Housing Committee

• Bicycle and Pedestrian Committee

• Board of Assessment Appeals

• Board of Condemnation

• Board of Health

• Board of Library Trustees

• Bond Committee

• Burr Gardens Advisory Committee

• Charter Revision Commission

• Community Emergency Response Team

• Conservation Commission

• Earth Day Committee

• Economic Development Commission

• Employees Retirement Board

• Ethics Commission

• Fairfield Arts Advisory Committee

• Fairfield Cares Community Coalition

• Fairfield Citizen Corps Council

• Fairfield Commission on Disabilities

• FairTV Commission

• Fire Commission

• Fitness Council

• Flood and Erosion Control Board

• Forestry Committee

• Golf Commission

• Harbor Management Commission

• Historic District Commission

• Housing Authority

• Human Services Commission

• Inland Wetlands Agency

• Joint Retirement Investment Board

• Land Acquisition Commission

• Parking Authority

• Parks and Recreation Commission

• Police & Fire Retirement Board

• Police Commission

• Racial Equity and Justice Task Force

• Shellfish Commission

• Solid Waste & Recycling Commission

• Strategic Plan Committee

• Sustainable Fairfield Task Force

• Town Facilities Commission

• Water Pollution Control Authority (WPCA)

• Zoning Board of Appeals

[1] See page 5/27: https://www.fairfieldct.org/filestorage/79/110822/114835/02-24-22_Backup_for_CRC_Meeting.pdf This framework listed five main deliberation topics, including: What are your goals; First Selectwoman; Legislative Authority of RTM; Composition of RTM; and Organization of the RTM.

[2] Power - FairfieldTaxpayer.com

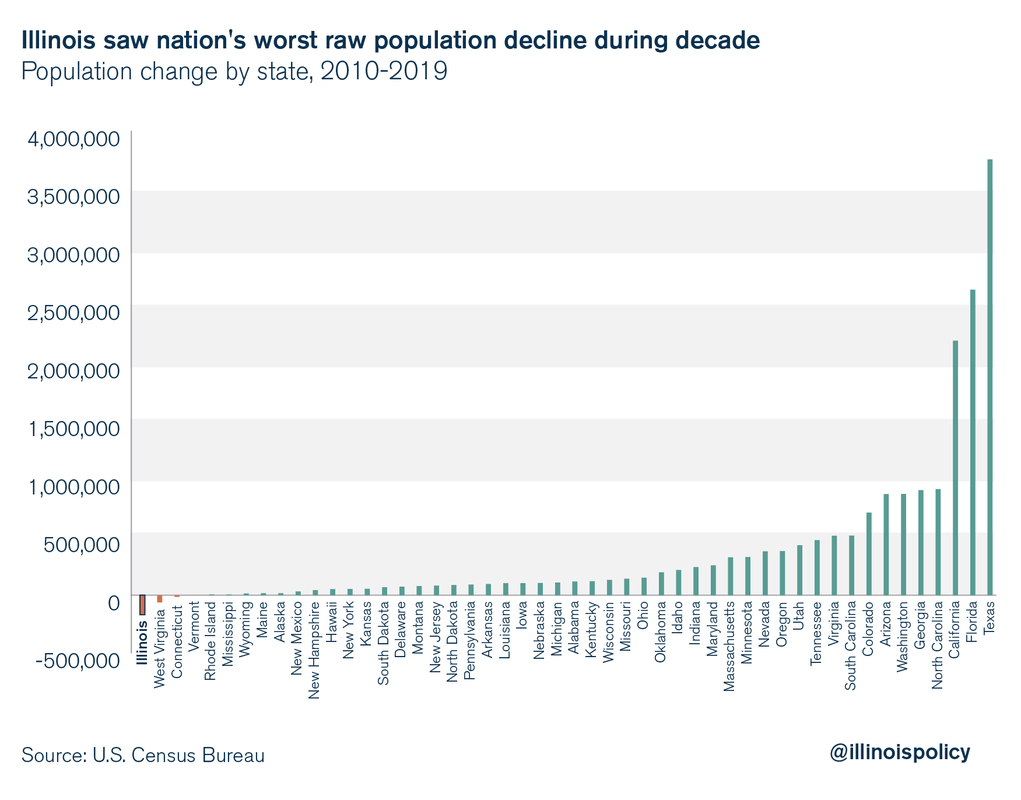

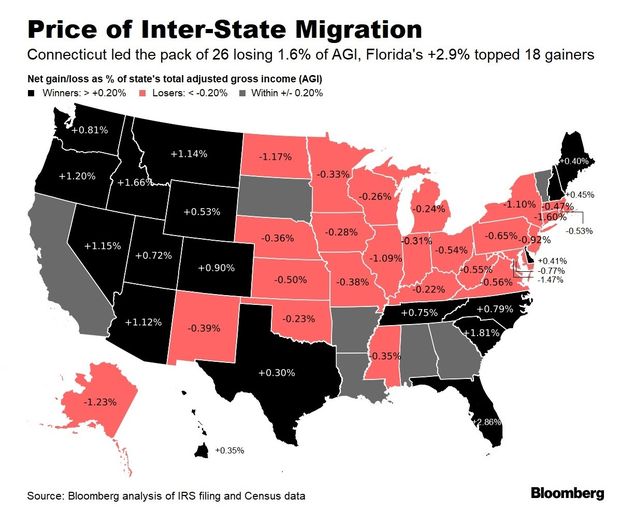

War Of The States

In 2009, facing a revenue drop-off from the previous year’s recession, states raised taxes collectively by $29 billion—at the time, the largest annual hike in history. Many of the biggest increases occurred in Democratic-leaning states, including New York, New Jersey, and Connecticut, which targeted businesses and upper-income residents especially, even as newly inaugurated president Barack Obama touted a similar agenda in Washington. What seemed like a new taxing trend dissipated, however, after the 2010 midterms, when Republicans captured seven governorships and full control of 23 state governments, up from just ten before Obama’s election. The newly elected governments quickly began cutting taxes and reducing business regulations, setting off an intense, often acerbic, state competition to attract wealthier residents and employers. This battle transformed the American economic map, right up to the Covid-19 pandemic. City Journal Winter 2022

Low Tax Burdens & Economic Dynamism Can Help States Attract New Residents

America is experiencing a “great reordering,” in which individuals have increasing flexibility to choose where they live. One of the most salient factors driving domestic migration—and one that policymakers can most easily manage—is a state’s tax burden.

States with lower taxes tend to attract more migrants than they lose, while the opposite is true for states with high taxes. Indeed, of the ten states with the highest tax burdens, as calculated by the Tax Foundation, all but Rhode Island were net losers of migrants in 2019. While taxation alone is a strong indicator of domestic migration, its true power is revealed when analyzed in combination with the dynamism of a state’s economy. States with dynamic economies and relatively low taxes will attract more residents on net. City Journal 2.2.22

States with lower taxes tend to attract more migrants than they lose, while the opposite is true for states with high taxes. Indeed, of the ten states with the highest tax burdens, as calculated by the Tax Foundation, all but Rhode Island were net losers of migrants in 2019. While taxation alone is a strong indicator of domestic migration, its true power is revealed when analyzed in combination with the dynamism of a state’s economy. States with dynamic economies and relatively low taxes will attract more residents on net. City Journal 2.2.22

$12 Million Budget Increase Proposed For Fairfield Schools

Fairfield's school board reduced the district's 2022-23 budget by about $1.5 million before approving it Thursday, but the spending plan is still roughly $10.4 million more than the one passed last year.

Now that the $202.5 million 2022-23 budget — a 5.4 percent year-over-year increase — has cleared the Board of Education, it will head to town hall for further consideration.

When Superintendent Mike Cummings presented the document earlier in the month, he said the spike was due to factors including increased demand for special education, higher heating and maintenance costs related to the supply chain, contract raises, and cybersecurity investments. Patch 1.28.22

Now that the $202.5 million 2022-23 budget — a 5.4 percent year-over-year increase — has cleared the Board of Education, it will head to town hall for further consideration.

When Superintendent Mike Cummings presented the document earlier in the month, he said the spike was due to factors including increased demand for special education, higher heating and maintenance costs related to the supply chain, contract raises, and cybersecurity investments. Patch 1.28.22

N.Y. Can't Teach Kids To Read on $30,000 a Year

One of the perennial defenses of mediocre public K-12 schools is that they just don't have enough money to work with. Liberal groups like The Center for American Progress routinely put out videos like this one denouncing the "underfunding of K-12 schools" that call for more and more money to be spent.

I don't know about you, but when I hear the phrase the underfunding of schools, my head explodes. Not because I dislike kids or public schools; my two sons exclusively attended public schools. What gets my goat is the demonstrably false idea that schools are being starved for resources. Tax revenue per student in public K-12 schools is up 24 percent nationally over the past two decades, and that takes inflation into account.

In New York, where I live, real per-pupil revenue has increased by a mind-boggling 68 percent between 2002 and 2019. Public schools in the Empire State are now shelling out more than $30,000 per kid. That's more than double the national average, and it doesn't even include the $16 billion extra that New York's system got in combined federal and state COVID-19 relief funding. Reason 1.26.22

I don't know about you, but when I hear the phrase the underfunding of schools, my head explodes. Not because I dislike kids or public schools; my two sons exclusively attended public schools. What gets my goat is the demonstrably false idea that schools are being starved for resources. Tax revenue per student in public K-12 schools is up 24 percent nationally over the past two decades, and that takes inflation into account.

In New York, where I live, real per-pupil revenue has increased by a mind-boggling 68 percent between 2002 and 2019. Public schools in the Empire State are now shelling out more than $30,000 per kid. That's more than double the national average, and it doesn't even include the $16 billion extra that New York's system got in combined federal and state COVID-19 relief funding. Reason 1.26.22

$12 Million Budget Increase Proposed For Fairfield Schools

Fairfield school officials have proposed a nearly $12 million budget increase for the 2022-23 school year.

The 6.22 percent year-over-year spending hike was outlined Tuesday when Superintendent Mike Cummings presented his recommended budget to the Board of Education, which is set to consider the plan and vote on it in the coming weeks, before the proposal goes to town hall.

The roughly $204 million budget is a transitional one, according to Cummings, who noted the coronavirus pandemic has interfered with the district's ability to address long-term issues such as the need for structural change and a multi-year plan. Patch 1.13.22

The 6.22 percent year-over-year spending hike was outlined Tuesday when Superintendent Mike Cummings presented his recommended budget to the Board of Education, which is set to consider the plan and vote on it in the coming weeks, before the proposal goes to town hall.

The roughly $204 million budget is a transitional one, according to Cummings, who noted the coronavirus pandemic has interfered with the district's ability to address long-term issues such as the need for structural change and a multi-year plan. Patch 1.13.22

Fairfield Superintendent’s Budget Calls For 6.2% Increase

Calling it a statement of the district’s values, Superintendent of Schools Mike Cummings presented a $204 million operation budget for the 2022-2023 school year on Tuesday night.

You really are putting your money where your mouth is,” he said. The proposed budget is a 6.2 percent, or approximately $12 million, increase over this current school year’s budget, according to the proposal.

Cummings said the growth primarily comes from increases in the demand for special education services, higher maintenance supplies and fuel costs, contractual increases in staff salaries and benefits and investment in core infrastructure. Fairfield Citizen 1.12.22

You really are putting your money where your mouth is,” he said. The proposed budget is a 6.2 percent, or approximately $12 million, increase over this current school year’s budget, according to the proposal.

Cummings said the growth primarily comes from increases in the demand for special education services, higher maintenance supplies and fuel costs, contractual increases in staff salaries and benefits and investment in core infrastructure. Fairfield Citizen 1.12.22

People Fleeing Hi-Tax States With Poor Gov't Financial Management

Yesterday, United Van Lines (UVL) released its annual “National Movers Study.” UVL is one of the largest moving companies in the US, and has done this survey since 1978. The study calculates the share of outbound moves out of total UVL interstate moves for each of the continental 48 states.

In the latest results, New Jersey, Illinois, New York, Connecticut and California were the five states with the highest outmigration. All five of these states rank in the bottom ten states based on Truth in Accounting's "Taxpayer Burden" measure of state government financial condition. Truth in Accounting 1.4.22

In the latest results, New Jersey, Illinois, New York, Connecticut and California were the five states with the highest outmigration. All five of these states rank in the bottom ten states based on Truth in Accounting's "Taxpayer Burden" measure of state government financial condition. Truth in Accounting 1.4.22

The Great Pandemic Migration, II

Data keep piling up on where Americans are moving, and the pattern is clear. In the second year of the pandemic, people continued to ditch the coasts and Great Lakes in favor of less dense, more affordable climes.

That’s the finding of the latest National Movers Study, released Monday by moving company United Van Lines. The survey ranks the states that drew large shares of move-ins in 2021, with a corresponding list of the biggest losers. WSJ 1.3.22

That’s the finding of the latest National Movers Study, released Monday by moving company United Van Lines. The survey ranks the states that drew large shares of move-ins in 2021, with a corresponding list of the biggest losers. WSJ 1.3.22

Sound (barrier) arguments? Not so much.

Jim Cameron makes some interesting arguments against sound barriers. It is a shame that most of his assertions are factually wrong, not backed by science nor economically sound.

I will start with his question, “Do you have sympathy for people who move near airports? He does not, so I assume he is deaf to the situation of middle- and lower- income people. People don’t choose to live by noise, most of the time it is an economic necessity. Further, today many of those who now hear noise from the interstate highways like I-95, did not hear this a decade ago. When I-95 cut through the most populated towns in Connecticut in 1958, the traffic was a fraction of today and today’s 150,000 cars that enter from New York on I-95 daily is two and a half times the number two decades ago. CT Mirror 12.23.21

I will start with his question, “Do you have sympathy for people who move near airports? He does not, so I assume he is deaf to the situation of middle- and lower- income people. People don’t choose to live by noise, most of the time it is an economic necessity. Further, today many of those who now hear noise from the interstate highways like I-95, did not hear this a decade ago. When I-95 cut through the most populated towns in Connecticut in 1958, the traffic was a fraction of today and today’s 150,000 cars that enter from New York on I-95 daily is two and a half times the number two decades ago. CT Mirror 12.23.21

Is Fairfield Spending Enough On Education? UPDATED!

1. AN OFT-REPEATED ARGUMENT BY EDUCATION-SPENDING ADVOCATES GOES LIKE THIS:

3. THEREFORE, THE DECLINE IN FAIRFIELD’S PPE RANK OVER THE LAST 21 YEARS DOES NOT MEAN ITS COMMITMENT TO EDUCATION IS DECLINING, AND IT DOES NOT MEAN THAT WE SHOULD BE SPENDING EVEN MORE ON EDUCATION.

As we have stated previously, Fairfield Taxpayer believes that we should spend as much on education as we can afford in order to provide the best education we can to our children.

Spending more than we can afford is not sustainable because either our tax rates will be too high or we will be forced to cut our spending on other public services too low (e.g., public safety, recreational facilities, roads). Either way, fewer people will choose to live here, and residential property values will suffer. Unless (improbably) there is an offsetting increase in new residential construction and/or in the value of commercial property, our tax base will decline. If our tax base declines, we will eventually have to cut spending on all our public services, including education.

Fairfield Taxpayer agrees emphatically with education advocates that good schools support property values in a town. However, we also know that, as with most things in life (e.g., sun, chocolate, apple pie and ice cream), we can also have too much of a good thing. This means that, at some point, spending too much on education, or on any other public service, also hurts property values by raising taxes to levels that are not affordable or competitive. The corollary to the oft-repeated observation that “people move into Fairfield because of our schools” is that “people will move out of Fairfield if our taxes are too high and/or if our other public services are inferior.”

_____________________________________________________________________________________

POSTSCRIPT – A BRIEF HISTORY OF MISINFORMATION

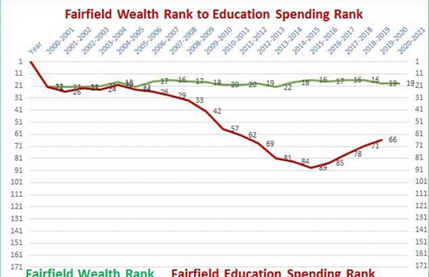

The bogus argument that the decline in our per-pupil expenditure (PPE) rank should be interpreted as a bad sign has its origins in early 2013 when former Supt. of Schools, David Title, and former (but then newly elected) BOE Chairman, Philip Dwyer, included in the BOE budget presentation for the first time a chart showing Fairfield’s decline in PPE rank as a good sign that Fairfield’s schools were becoming more and more efficient (completely ignoring the real reason PPE was rising much faster in all those small towns with declining enrollments than it was in Fairfield with its much larger and rising enrollment).

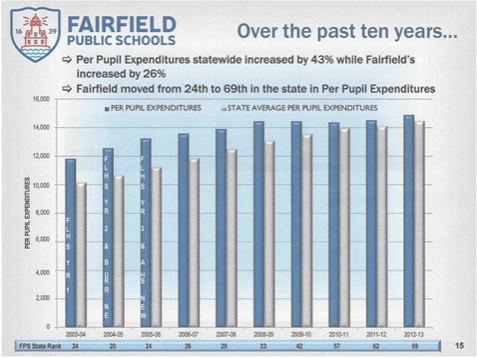

In early 2014, they repeated the claim that our decline in PPE rank was a positive sign of increasing efficiency (“FPS has become more efficient. We have moved from 23rd to 62nd in the state in Per Pupil Expenditures.”).[1] However, at this point they decided that our decline in PPE rank relative to our stable wealth rank could also be used rhetorically as a bad sign that Fairfield was falling behind other CT towns in its commitment to education (“Over the past ten years Fairfield’s state ranking in wealth has remained between 16th and 22nd; per pupil expenditures have declined from 23rd to 62nd.).[2]

In early 2015, they doubled down on the claim that our decline in PPE rank was a bad sign (“Over the past ten years, Per Pupil Expenditures statewide increased by 43% while Fairfield’s increased by 26% [and] Fairfield moved from 24th to 69th in the state in Per Pupil Expenditures.).[3] In their oral remarks, they became quite strident, describing the decline in Fairfield’s PPE rank as a “Race to the Bottom.” Dr. Title’s exact words were: “If we keep this up, we will win the race to the bottom.” Chairman Dwyer’s comments were: “Where are we heading in Dr. Title’s so-called Race to the Bottom, if in five years we are below the average of the state?” With reference to the earlier years, he said that “our ability to pay was [then] equal to our PPE.” He then said that "ability to pay is not the same as willingness to pay," clearly implying that Fairfield could and should be spending substantially more on education, and that Fairfield taxpayers were being too tightfisted.

In early 2016, the budget presentation included a graph showing the decline in Fairfield’s PPE rank and noting that: “Of the state’s 169 cities & towns, Fairfield has moved from 20th to 81st in Per Pupil Expenditures over the past 10 years.”[4]

In early 2017, refreshingly, a new superintendent, Toni Jones, took office who did not ascribe to the “PPE Rank Bad” narrative and therefore did not include any references to it in her budget presentations for the two years she served in that role.

In early 2019, however, under a new superintendent, Michael Cummings, and a new BOE Chair, Christine Vitale, a table providing a side-by-side comparison of Fairfield’s PPE and Wealth ranks showed up in the BOE budget presentation, and it has done so ever since.[5]

Fairfield Taxpayer has repeatedly refuted this “PPE Rank Bad” argument in a series of papers, beginning in early 2014, including: “You Can Fool Some of the People . . .”[6]; “A Race to the Bottom? We Don’t Think So” [7] ; and “Here We Go Again . . . More Simplistic Comparisons of Our Education Spending to Selected Southern Fairfield County Towns.”[8] However, like many superficially plausible arguments, it keeps turning up, particularly during the budget season from members of the public and Town boards and bodies. Among others, Robert Smoler, President of the Teachers’ Union, recently invoked it in his endorsement of three candidates for the Board of Finance.[9] It was also cited by one of those BOF candidates, and the graph on the right was posted on Facebook by one of his supporters.[10]

With Fairfield’s enrollment now falling and its PPE rank rising fairly rapidly, perhaps this bogus argument will finally disappear. Over the last eight years, Fairfield’s education spending is up 27%, its enrollment down 9%, and its per-pupil spending is up 40%.

November 13, 2021

_____________________________

[1] See page 32: 2014-15_Budget_PresentationMAR2014.pdf (fairfieldschools.org)

[2] See page 4: 2014-15_Budget_PresentationMAR2014.pdf (fairfieldschools.org)

[3] See page 15: https://boe.fairfieldschools.org/content/uploads/boe-archive/budget/2015-16/2015-16_Supers_Budget_Presentation.pdf

[4] See page 6: https://boe.fairfieldschools.org/content/uploads/boe-archive/budget/2016-17/2016-17_Board_Budget_Presentation04072016.pdf

[5] See, for example, page 15 of the latest BOE Budget Book: https://boe.fairfieldschools.org/content/uploads/2021/01/BOEBUDGETBOOK2-19-2021FinalForWebsiteMV-1.pdf

[6] https://www.fairfieldtaxpayer.com/uploads/1/1/1/8/11185705/you_can_fool_some_of_the_people_final2.pdf

[7] RACE TO THE BOTTOM FINAL4 (fairfieldtaxpayer.com)

[8] here_we_go_again_1.22.18.pdf (fairfieldtaxpayer.com)

[9] (16) Fairfield Education Association | Facebook “For more than a decade, town bodies have reduced the funding requests of the Board of Education over $20 million . . . Those reductions dropped our per pupil spending from 29th in the state in 2007/2008 to 66th out of 169 towns today. The practical effect of those reductions are felt every day in our schools.”

[10] https://www.facebook.com/kevinstarkeforfairfieldboardoffinance/posts/193767126214330/

- Fairfield’s wealth rank among CT towns has been stable at ~#20/169 (within a 16-22 range).

- But Fairfield’s per-pupil expenditure (“PPE”) rank since 2000 has declined from #20 to #67.

- Therefore, Fairfield’s commitment to education has declined relative to other CT towns, and Fairfield can and should spend more on education.

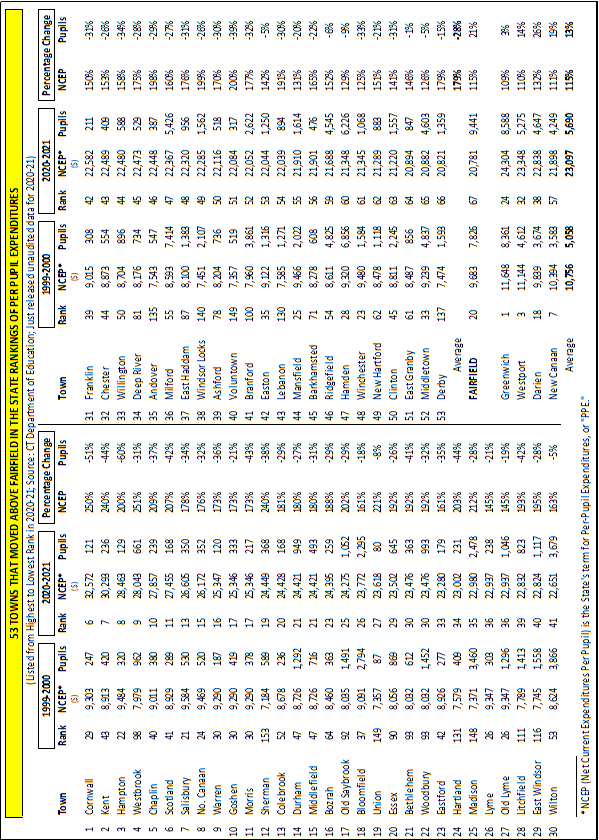

- It is true that Fairfield’s state rank in PPE has dropped from #20 to #67 over the last 21 years (2000 to 2021), as 53 towns moved above Fairfield and six dropped below, resulting in a net change in rank of 47. However, this decline in rank did not happen because those 53 towns increased their education spending more than Fairfield.

- It happened because there are significant economies of scale in education spending when fixed costs (e.g., for facilities, administrators, curriculum) are spread over more students, and when more students allow more optimal class sizes. This means that larger districts can provide comparable services at a lower cost per pupil than smaller districts. This also means that when enrollment is rising, PPE does not rise as much. And the reverse is true – when enrollment is declining, there is strong upward pressure on PPE, particularly in small districts with only limited options to downsize their operations.

- Therefore, the real explanation for the decline in Fairfield’s PPE rank is that enrollments declined 28% on average in 53 mostly very small CT towns at a time when enrollments increased 21% in Fairfield (one of the largest school districts in the State with 9,441 students). Excluding the two towns with the largest 2021 enrollments (Milford at 5,426 and Hamden at 6,226), the other 51 towns on average had only 933 students in 2021 (i.e., one-tenth the size of Fairfield), down 23% from their 2000 average of 1,209.

3. THEREFORE, THE DECLINE IN FAIRFIELD’S PPE RANK OVER THE LAST 21 YEARS DOES NOT MEAN ITS COMMITMENT TO EDUCATION IS DECLINING, AND IT DOES NOT MEAN THAT WE SHOULD BE SPENDING EVEN MORE ON EDUCATION.

- For confirmation, it is instructive to look at how Fairfield did relative to towns that rank even higher in wealth (thus no major affordability problem), and have reasonably large enrollments that (like Fairfield’s) increased rather than declined over this period, namely Greenwich (8,588, up 3%), Westport (5,275, up 14%), Darien (4,647, up 26%) and New Canaan (4,249, up 19%):

- In 2000, Fairfield’s PPE was 83% of Greenwich’s PPE – in 2021, it is 86%.

- In 2000, Fairfield’s PPE was 87% of Westport’s PPE – in 2021, it is 89%.

- In 2000, Fairfield’s PPE was 98% of Darien’s PPE – in 2021, it is 91%.

- In 2000, Fairfield’s PPE was 93% of New Canaan’s PPE – in 2021, it is 95%.

- In 2000, Fairfield’s PPE was 90% of this group’s average – in 2021, it is 90%.

- Considering that Fairfield is not as wealthy as these other Fairfield County towns and that Fairfield has twice as many students (and thus greater scale economies) than three of them, there is no reason to believe based on these comparisons that Fairfield’s commitment to education has declined or that it should be spending even more on education.

As we have stated previously, Fairfield Taxpayer believes that we should spend as much on education as we can afford in order to provide the best education we can to our children.

Spending more than we can afford is not sustainable because either our tax rates will be too high or we will be forced to cut our spending on other public services too low (e.g., public safety, recreational facilities, roads). Either way, fewer people will choose to live here, and residential property values will suffer. Unless (improbably) there is an offsetting increase in new residential construction and/or in the value of commercial property, our tax base will decline. If our tax base declines, we will eventually have to cut spending on all our public services, including education.

Fairfield Taxpayer agrees emphatically with education advocates that good schools support property values in a town. However, we also know that, as with most things in life (e.g., sun, chocolate, apple pie and ice cream), we can also have too much of a good thing. This means that, at some point, spending too much on education, or on any other public service, also hurts property values by raising taxes to levels that are not affordable or competitive. The corollary to the oft-repeated observation that “people move into Fairfield because of our schools” is that “people will move out of Fairfield if our taxes are too high and/or if our other public services are inferior.”

_____________________________________________________________________________________

POSTSCRIPT – A BRIEF HISTORY OF MISINFORMATION

The bogus argument that the decline in our per-pupil expenditure (PPE) rank should be interpreted as a bad sign has its origins in early 2013 when former Supt. of Schools, David Title, and former (but then newly elected) BOE Chairman, Philip Dwyer, included in the BOE budget presentation for the first time a chart showing Fairfield’s decline in PPE rank as a good sign that Fairfield’s schools were becoming more and more efficient (completely ignoring the real reason PPE was rising much faster in all those small towns with declining enrollments than it was in Fairfield with its much larger and rising enrollment).

In early 2014, they repeated the claim that our decline in PPE rank was a positive sign of increasing efficiency (“FPS has become more efficient. We have moved from 23rd to 62nd in the state in Per Pupil Expenditures.”).[1] However, at this point they decided that our decline in PPE rank relative to our stable wealth rank could also be used rhetorically as a bad sign that Fairfield was falling behind other CT towns in its commitment to education (“Over the past ten years Fairfield’s state ranking in wealth has remained between 16th and 22nd; per pupil expenditures have declined from 23rd to 62nd.).[2]

In early 2015, they doubled down on the claim that our decline in PPE rank was a bad sign (“Over the past ten years, Per Pupil Expenditures statewide increased by 43% while Fairfield’s increased by 26% [and] Fairfield moved from 24th to 69th in the state in Per Pupil Expenditures.).[3] In their oral remarks, they became quite strident, describing the decline in Fairfield’s PPE rank as a “Race to the Bottom.” Dr. Title’s exact words were: “If we keep this up, we will win the race to the bottom.” Chairman Dwyer’s comments were: “Where are we heading in Dr. Title’s so-called Race to the Bottom, if in five years we are below the average of the state?” With reference to the earlier years, he said that “our ability to pay was [then] equal to our PPE.” He then said that "ability to pay is not the same as willingness to pay," clearly implying that Fairfield could and should be spending substantially more on education, and that Fairfield taxpayers were being too tightfisted.

In early 2016, the budget presentation included a graph showing the decline in Fairfield’s PPE rank and noting that: “Of the state’s 169 cities & towns, Fairfield has moved from 20th to 81st in Per Pupil Expenditures over the past 10 years.”[4]

In early 2017, refreshingly, a new superintendent, Toni Jones, took office who did not ascribe to the “PPE Rank Bad” narrative and therefore did not include any references to it in her budget presentations for the two years she served in that role.

In early 2019, however, under a new superintendent, Michael Cummings, and a new BOE Chair, Christine Vitale, a table providing a side-by-side comparison of Fairfield’s PPE and Wealth ranks showed up in the BOE budget presentation, and it has done so ever since.[5]

Fairfield Taxpayer has repeatedly refuted this “PPE Rank Bad” argument in a series of papers, beginning in early 2014, including: “You Can Fool Some of the People . . .”[6]; “A Race to the Bottom? We Don’t Think So” [7] ; and “Here We Go Again . . . More Simplistic Comparisons of Our Education Spending to Selected Southern Fairfield County Towns.”[8] However, like many superficially plausible arguments, it keeps turning up, particularly during the budget season from members of the public and Town boards and bodies. Among others, Robert Smoler, President of the Teachers’ Union, recently invoked it in his endorsement of three candidates for the Board of Finance.[9] It was also cited by one of those BOF candidates, and the graph on the right was posted on Facebook by one of his supporters.[10]

With Fairfield’s enrollment now falling and its PPE rank rising fairly rapidly, perhaps this bogus argument will finally disappear. Over the last eight years, Fairfield’s education spending is up 27%, its enrollment down 9%, and its per-pupil spending is up 40%.

November 13, 2021

_____________________________

[1] See page 32: 2014-15_Budget_PresentationMAR2014.pdf (fairfieldschools.org)

[2] See page 4: 2014-15_Budget_PresentationMAR2014.pdf (fairfieldschools.org)

[3] See page 15: https://boe.fairfieldschools.org/content/uploads/boe-archive/budget/2015-16/2015-16_Supers_Budget_Presentation.pdf

[4] See page 6: https://boe.fairfieldschools.org/content/uploads/boe-archive/budget/2016-17/2016-17_Board_Budget_Presentation04072016.pdf

[5] See, for example, page 15 of the latest BOE Budget Book: https://boe.fairfieldschools.org/content/uploads/2021/01/BOEBUDGETBOOK2-19-2021FinalForWebsiteMV-1.pdf

[6] https://www.fairfieldtaxpayer.com/uploads/1/1/1/8/11185705/you_can_fool_some_of_the_people_final2.pdf

[7] RACE TO THE BOTTOM FINAL4 (fairfieldtaxpayer.com)

[8] here_we_go_again_1.22.18.pdf (fairfieldtaxpayer.com)

[9] (16) Fairfield Education Association | Facebook “For more than a decade, town bodies have reduced the funding requests of the Board of Education over $20 million . . . Those reductions dropped our per pupil spending from 29th in the state in 2007/2008 to 66th out of 169 towns today. The practical effect of those reductions are felt every day in our schools.”

[10] https://www.facebook.com/kevinstarkeforfairfieldboardoffinance/posts/193767126214330/

Should the Teachers' Union be Endorsing Local Candidates?

The Teachers’ Union just endorsed three candidates for the Board of Finance.

The Democratic Town Committee calls this “Exciting News,” and says, “Thanks.”

Fairfield Taxpayer agrees that this is “exciting” news, but says, “No Thanks.”

Should the Teachers’ Union be endorsing local candidates?

The Democratic Town Committee calls this “Exciting News,” and says, “Thanks.”