Feb 19 Deadline for Appealing Property Revaluations

REMINDER: Any property owner in Fairfield who wishes to contest their 2015 property valuation must file their application for appeal to the Board of Assessment Appeals by February 19th. Please note that you must return a completed and signed original of your appeal application (see link below) along with a copy of your property record card (obtained from the Tax Assessor's office) to the Tax Assessor by Friday, February 19th. This does not mean postmarked by the 19th - it must be in the Tax Assessor's possession by February 19th. It's best to be hand delivered or mailed well in advance to Board of Assessment Appeals, c/o Assessor's Office, 611 Old Post Rd, Fairfield, CT 06824-6646. Keep a copy of your appeal application and bring it with you to the hearing that will be scheduled.

To help taxpayers in Fairfield understand the assessment process and gain insight and perspective to their own assessments, FT has published information and analysis which you may find helpful:

1. FT's Guide to Understanding your 2015 assessment - See entry below

2. Download an Excel File containing property assessments and relevant characteristics for every home in Fairfield. This data (in a simple spreadsheet) may prove valuable in researching your property assessment. This data is from the Asssessor's Office (Click Here)

3. FT's Interactive Map of Property Revaluation Changes - See entry below

4. Download the form required to file an appeal to the Board of Assessment Appeals.

http://www.fairfieldct.org/filestorage/10726/11012/15697/20388/Assessor3.pdf

5. Download instructions for the assessment appeals form.

http://www.fairfieldct.org/filestorage/10726/11012/15697/20388/Assessor2.pdf

To help taxpayers in Fairfield understand the assessment process and gain insight and perspective to their own assessments, FT has published information and analysis which you may find helpful:

1. FT's Guide to Understanding your 2015 assessment - See entry below

2. Download an Excel File containing property assessments and relevant characteristics for every home in Fairfield. This data (in a simple spreadsheet) may prove valuable in researching your property assessment. This data is from the Asssessor's Office (Click Here)

3. FT's Interactive Map of Property Revaluation Changes - See entry below

4. Download the form required to file an appeal to the Board of Assessment Appeals.

http://www.fairfieldct.org/filestorage/10726/11012/15697/20388/Assessor3.pdf

5. Download instructions for the assessment appeals form.

http://www.fairfieldct.org/filestorage/10726/11012/15697/20388/Assessor2.pdf

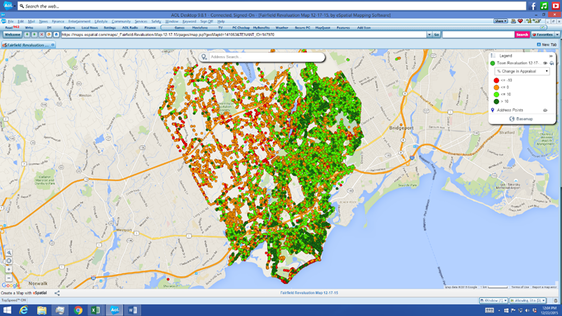

Fairfield Taxpayer's Interactive Map of Property Revaluation Changes

Below is a link to Fairfield Taxpayer’s new web page that allows you to look at how the new revaluation changed property values in Fairfield based on the preliminary data provided by the Tax Assessor.

All property owners should have received a letter from the Tax Assessor dated November 12th informing them of the Assessed value of their property as of October 1, 2015. The Tax Assessor reported that about 10% of all Fairfield residential properties were unchanged in value, about 50% were down and about 40% were up, subject to any adjustments after the informal hearing process with the appraisers. You can also find your new assessment at the following website: http://gis.vgsi.com/fairfieldct/

Fairfield Taxpayer’s new web page will allow you to analyze much more easily whether your new assessment is fair by comparing how it changed relative to other properties in your neighborhood. Although there are always exceptions, if the percentage change in your assessment is roughly similar to those for most of the properties near you, it is likely that your new assessment is fair. The new web page also makes it much easier to analyze how appraised values changed in different neighborhoods. In a large and diverse town like Fairfield, greater or lesser changes in property values are to be expected in different neighborhoods, since each of them is subject to different trends in land values.

Clicking on the button will take you to a web page that looks like the screenshot below. There is a dot on the map for every residential property in Fairfield, and the dots are color-coded to show how the value for each property changed in the latest revaluation. Dark Green – up more than 10%; Light Green – up 0% to 10%; Beige – down 0% to 10%; and Red – down more than 10%. As you can see, in general, property values increased on the east side of town and declined on the west side and along Fairfield Beach Road.

Fairfield Taxpayer’s new web page will allow you to analyze much more easily whether your new assessment is fair by comparing how it changed relative to other properties in your neighborhood. Although there are always exceptions, if the percentage change in your assessment is roughly similar to those for most of the properties near you, it is likely that your new assessment is fair. The new web page also makes it much easier to analyze how appraised values changed in different neighborhoods. In a large and diverse town like Fairfield, greater or lesser changes in property values are to be expected in different neighborhoods, since each of them is subject to different trends in land values.

Clicking on the button will take you to a web page that looks like the screenshot below. There is a dot on the map for every residential property in Fairfield, and the dots are color-coded to show how the value for each property changed in the latest revaluation. Dark Green – up more than 10%; Light Green – up 0% to 10%; Beige – down 0% to 10%; and Red – down more than 10%. As you can see, in general, property values increased on the east side of town and declined on the west side and along Fairfield Beach Road.

Click here to read full document

If you would like to access the data base from which the map is created, which includes more detailed information about each property in an Excel spreadsheet format, please click on the following button:

If you would like to access the data base from which the map is created, which includes more detailed information about each property in an Excel spreadsheet format, please click on the following button:

Some Tips on Analyzing Your New 2015 Property Assessment

All residential and commercial property owners should have received a letter from the Tax Assessor dated November 12th informing them of the Assessed value of their property as of October 1, 2015.

The combined value of all the new assessments for residential, commercial and industrial real estate (which represents ~93% of all the taxable property in Town) reportedly declined about 2% from what those properties were worth on October 1, 2010. If we assume the remaining 7% of taxable property (motor vehicles and personal property) also declined 2%, the so-called "mill rate" will have to rise by 2% in order to collect the same amount of taxes. Under these circumstances:

Click here to read full document

Fairfield Taxpayer will continue to get information to assist residents with their property assessments. If you would like to get alerts from FT regarding any new assessment information, please fill out the form below and we will send updated information as it comes in.

All residential and commercial property owners should have received a letter from the Tax Assessor dated November 12th informing them of the Assessed value of their property as of October 1, 2015.

The combined value of all the new assessments for residential, commercial and industrial real estate (which represents ~93% of all the taxable property in Town) reportedly declined about 2% from what those properties were worth on October 1, 2010. If we assume the remaining 7% of taxable property (motor vehicles and personal property) also declined 2%, the so-called "mill rate" will have to rise by 2% in order to collect the same amount of taxes. Under these circumstances:

- If the value of your property declined exactly 2%, then with the mill rate up 2% due to the revaluation, the amount of taxes you pay would not change, but if spending and taxes in fiscal 2016-17 increase by 1.5%, the mill rate would have to rise even more, and you would pay 1.5% more in taxes.

- If the value of your property declined less than 2% or increased, the amount of taxes you pay would go up due to the revaluation, and you would pay even more if spending and taxes increase 1.5% next year.

- If the value of your property declined more than 2%, the amount of taxes you pay would go down, but your tax bill would go down less if the Town's spending and taxes rise 1.5% next year.

Click here to read full document

Fairfield Taxpayer will continue to get information to assist residents with their property assessments. If you would like to get alerts from FT regarding any new assessment information, please fill out the form below and we will send updated information as it comes in.

Unsure of your voting district? Click here for the street index.