Financiers Set Tax Rate that could Force Local Budget Cuts

The tax rate adopted for the 2016-17 fiscal year by the Board of Finance could mean cuts to the town and school budgets if state aid to the town is cut when the General Assembly finally agrees on a budget.

The 25.45-mill tax rate set by the finance panel Thursday will fully fund the town’s $293.5 million budget only if all of the $8.2 million in expected state revenue is restored, which appeared unlikely. If the money raised by town taxes does not cover the local spending package, First Selectman Michael Tetreau and Superintendent of Schools David Title will have to find areas to make up the shortfall.

The combined total of $8.2 million in state aid that was used to formulate the municipal budget includes $3.5 million in Education Cost Sharing money, more than $1 million sales tax sharing, $2 million in PILOT funding and other allocations. By week’s end, local officials said it appeared the town would receive about $5.9 million, a $2.29 million difference from what was built into the municipal budget, which is set to take effect July 1. Read More: Fairfield Citizen 5/8/16

The tax rate adopted for the 2016-17 fiscal year by the Board of Finance could mean cuts to the town and school budgets if state aid to the town is cut when the General Assembly finally agrees on a budget.

The 25.45-mill tax rate set by the finance panel Thursday will fully fund the town’s $293.5 million budget only if all of the $8.2 million in expected state revenue is restored, which appeared unlikely. If the money raised by town taxes does not cover the local spending package, First Selectman Michael Tetreau and Superintendent of Schools David Title will have to find areas to make up the shortfall.

The combined total of $8.2 million in state aid that was used to formulate the municipal budget includes $3.5 million in Education Cost Sharing money, more than $1 million sales tax sharing, $2 million in PILOT funding and other allocations. By week’s end, local officials said it appeared the town would receive about $5.9 million, a $2.29 million difference from what was built into the municipal budget, which is set to take effect July 1. Read More: Fairfield Citizen 5/8/16

Democrats, Governor Strike Budget Deal, Aim for Wednesday Vote

The Governor and the majority (Democratic) leaders in the Assembly have apparently agreed on a budget for next year, which appears likely to be approved, though it is still subject to debate and change. There will still be cuts in the amount of state grants Fairfield receives in the form of municipal and educational aid, but they will apparently be less than the ~$4.5 million originally proposed by the Governor. Details are not yet available. Read more: CT Mirror 5/3/16

The Governor and the majority (Democratic) leaders in the Assembly have apparently agreed on a budget for next year, which appears likely to be approved, though it is still subject to debate and change. There will still be cuts in the amount of state grants Fairfield receives in the form of municipal and educational aid, but they will apparently be less than the ~$4.5 million originally proposed by the Governor. Details are not yet available. Read more: CT Mirror 5/3/16

RTM Quickly Oks $294M Budget, Despite Looming State Cuts

With no debate on the $293.5 million budget itself, the RTM unanimously approved the 2016-17 town budget as presented, and did it in under a half an hour - despite the state fiscal crisis that could cost the town millions in aid. Read more: Fairfield Citizen 5/3/16

With no debate on the $293.5 million budget itself, the RTM unanimously approved the 2016-17 town budget as presented, and did it in under a half an hour - despite the state fiscal crisis that could cost the town millions in aid. Read more: Fairfield Citizen 5/3/16

RTM May Delay Budget Vote until State Aid Cuts are Settled

Representative Town Meeting members Monday searched for ways the town’s budget could be reduced if Gov. Dannel Malloy’s proposed state spending plan — cutting about $5 million in aid — is adopted. The governor’s proposal, which would cut all of the town’s $3.4 million Educational Cost Sharing grant, as well as an additional $1.6 million expected from sales tax revenue, however, is not winning support from either side of the political aisle at the General Assembly. A budget proposal Monday from Republicans in the state legislative body, would restore all of the town’s ECS funding; a proposal from state Democrats, who hold the legislative majority, was expected later in the week. “We know the governor’s proposal is not moving forward,” First Selectman Michael Tetreau said, but local officials still don’t know how much could eventually be cut in revenue allotted to the town from the state. Read More: Fairfield Citizen 4/26/16

Representative Town Meeting members Monday searched for ways the town’s budget could be reduced if Gov. Dannel Malloy’s proposed state spending plan — cutting about $5 million in aid — is adopted. The governor’s proposal, which would cut all of the town’s $3.4 million Educational Cost Sharing grant, as well as an additional $1.6 million expected from sales tax revenue, however, is not winning support from either side of the political aisle at the General Assembly. A budget proposal Monday from Republicans in the state legislative body, would restore all of the town’s ECS funding; a proposal from state Democrats, who hold the legislative majority, was expected later in the week. “We know the governor’s proposal is not moving forward,” First Selectman Michael Tetreau said, but local officials still don’t know how much could eventually be cut in revenue allotted to the town from the state. Read More: Fairfield Citizen 4/26/16

GOP Budget Plan: Slash Agency Budgets, Cut Bonding Drastically

Whatever plan is ultimately adopted to address Connecticut's growing budget deficits (including the Governor's and the Appropriation Committee's, both of which would transfer a portion of those deficits to towns like Fairfield through cuts in Educational Cost Sharing and other State grants), this should be a "wake-up call" for everyone about what happens when the cumulative efforts of special-interest groups, including the public-employee unions, push government spending beyond sustainable levels. Read More: CT Mirror 4/25/16

Whatever plan is ultimately adopted to address Connecticut's growing budget deficits (including the Governor's and the Appropriation Committee's, both of which would transfer a portion of those deficits to towns like Fairfield through cuts in Educational Cost Sharing and other State grants), this should be a "wake-up call" for everyone about what happens when the cumulative efforts of special-interest groups, including the public-employee unions, push government spending beyond sustainable levels. Read More: CT Mirror 4/25/16

Malloy's School Funding Cuts Draw United Opposition

In an effort to balance the state budget, Malloy has proposed eliminating all education cost-sharing grants for 28 of the state’s wealthiest municipalities, including Fairfield and Westport, for a total of $65 million. “We have to make tough decisions,” a representative for Malloy was quoted as saying, noting it was part of an attempt to eradicate what is projected to be a $922 million state deficit in the next fiscal year. But as far as some area legislators are concerned, the money being pulled out of both Fairfield and Westport is nothing they’re in favor of.

“As a member of the Education Committee and a strong advocate for our public schools, students and educators, I am deeply concerned,” said Fairfield State Rep. Cristin McCarthy Vahey, a Democrat, who added, “My concerns are further exacerbated by the timing of this announcement. Fairfield, like many communities throughout our state, has reached a point in the budget process where there is little recourse to address the proposed cut, let alone plan for it.”

While she acknowledged that the state’s financial issues and concerns warrant some “very difficult decisions,” she said, “This proposal will not serve our community well. A reduction of over $3.5 million to our local educational system is not tenable.” Read More: Fairfield Minuteman 4/21/16

In an effort to balance the state budget, Malloy has proposed eliminating all education cost-sharing grants for 28 of the state’s wealthiest municipalities, including Fairfield and Westport, for a total of $65 million. “We have to make tough decisions,” a representative for Malloy was quoted as saying, noting it was part of an attempt to eradicate what is projected to be a $922 million state deficit in the next fiscal year. But as far as some area legislators are concerned, the money being pulled out of both Fairfield and Westport is nothing they’re in favor of.

“As a member of the Education Committee and a strong advocate for our public schools, students and educators, I am deeply concerned,” said Fairfield State Rep. Cristin McCarthy Vahey, a Democrat, who added, “My concerns are further exacerbated by the timing of this announcement. Fairfield, like many communities throughout our state, has reached a point in the budget process where there is little recourse to address the proposed cut, let alone plan for it.”

While she acknowledged that the state’s financial issues and concerns warrant some “very difficult decisions,” she said, “This proposal will not serve our community well. A reduction of over $3.5 million to our local educational system is not tenable.” Read More: Fairfield Minuteman 4/21/16

As State Aid Cuts Loom, School Board won’t Say how to Handle Loss

With a looming cut in state aid threatening to upend Fairfield’s 2016-17 budget plans with a shortfall as large as $4.5 million, the Board of Education met in special session Wednesday to grapple with the potential loss. But the school board meeting, called in advance of Monday’s Representative Town Meeting session, produced no blueprint on ways the recommended $163.3 million education budget could be reduced to reflect the cuts proposed by Gov. Dannel Malloy. Instead, the board basically affirmed its support for the level of spending already approved by both the Boards of Selectmen and Finance. The brief meeting was scheduled in response to a letter to school board Chairman Philip Dwyer from RTM Moderator Pam Iacono that said, “We respectfully request that your board discuss this item prior to our April 25th meeting, and that as chairman, you be prepared to speak on behalf of your board regarding this issue at our meeting.” Read More: Fairfield Citizen 4/21/16

With a looming cut in state aid threatening to upend Fairfield’s 2016-17 budget plans with a shortfall as large as $4.5 million, the Board of Education met in special session Wednesday to grapple with the potential loss. But the school board meeting, called in advance of Monday’s Representative Town Meeting session, produced no blueprint on ways the recommended $163.3 million education budget could be reduced to reflect the cuts proposed by Gov. Dannel Malloy. Instead, the board basically affirmed its support for the level of spending already approved by both the Boards of Selectmen and Finance. The brief meeting was scheduled in response to a letter to school board Chairman Philip Dwyer from RTM Moderator Pam Iacono that said, “We respectfully request that your board discuss this item prior to our April 25th meeting, and that as chairman, you be prepared to speak on behalf of your board regarding this issue at our meeting.” Read More: Fairfield Citizen 4/21/16

CT Unemployment Rate Rose Slightly to 5.7% in March

Connecticut’s unemployment rate rose two-tenths of a percentage point in March, climbing to 5.7 percent, as job growth essentially remained flat, the state Department of Labor reported Thursday. The state has added 5,600 jobs since the start of 2016, but still has not fully recovered from The Great Recession. Through the most recent report, Connecticut has regained 91,400, or 76.7 percent, of the 119,100 jobs it lost during the last economic downturn.

“Although the rise in the unemployment rate this month was unexpected, there are some positive aspects to the move,” said Andy Condon, director of the Office of Research for the Labor Department. “The rise in unemployment occurred in a growing labor force, meaning it was driven by more people entering the labor market looking for work rather than a decrease in the number of employed. Job growth is occurring, but not fast enough to employ all of those recently entering the market.” Read More: CT Mirror 4/14/16

Connecticut’s unemployment rate rose two-tenths of a percentage point in March, climbing to 5.7 percent, as job growth essentially remained flat, the state Department of Labor reported Thursday. The state has added 5,600 jobs since the start of 2016, but still has not fully recovered from The Great Recession. Through the most recent report, Connecticut has regained 91,400, or 76.7 percent, of the 119,100 jobs it lost during the last economic downturn.

“Although the rise in the unemployment rate this month was unexpected, there are some positive aspects to the move,” said Andy Condon, director of the Office of Research for the Labor Department. “The rise in unemployment occurred in a growing labor force, meaning it was driven by more people entering the labor market looking for work rather than a decrease in the number of employed. Job growth is occurring, but not fast enough to employ all of those recently entering the market.” Read More: CT Mirror 4/14/16

Bye Urges Colleagues, Malloy to Scale Back Town Aid Cuts

The Senate chair of the General Assembly’s budget-writing panel challenged her colleagues and Gov. Dannel P. Malloy on Thursday to ease the municipal aid cuts they are seeking — or watch one budget be rejected after another.

Sen. Beth Bye, D-West Hartford, said she fears many cities and towns already are making plans to increase property tax rates based on the state budgets proposed over the past week by the Appropriations Committee and by the governor. “What we’re hearing from our members and from the House members is that the (local aid) cuts are too large,” Bye told The Mirror. “I’m afraid that just putting out these budgets is impacting local mill rates. Municipal officials simply don’t know what to believe.”

Rep. Toni E. Walker, the other co-chair of appropriations, said she is open to revisiting municipal aid, but noted that other areas of the budget, such as social services, have faced deep cuts over the past several years. “We have to look at municipal aid because (reducing grants) is, in essence, a tax increase,” Walker said. “But I can’t promise anything. … We’ve gotten backlash from everybody about all parts of the budget. Nobody wants to be cut." Read More: CT Mirror 4/14/16

The Senate chair of the General Assembly’s budget-writing panel challenged her colleagues and Gov. Dannel P. Malloy on Thursday to ease the municipal aid cuts they are seeking — or watch one budget be rejected after another.

Sen. Beth Bye, D-West Hartford, said she fears many cities and towns already are making plans to increase property tax rates based on the state budgets proposed over the past week by the Appropriations Committee and by the governor. “What we’re hearing from our members and from the House members is that the (local aid) cuts are too large,” Bye told The Mirror. “I’m afraid that just putting out these budgets is impacting local mill rates. Municipal officials simply don’t know what to believe.”

Rep. Toni E. Walker, the other co-chair of appropriations, said she is open to revisiting municipal aid, but noted that other areas of the budget, such as social services, have faced deep cuts over the past several years. “We have to look at municipal aid because (reducing grants) is, in essence, a tax increase,” Walker said. “But I can’t promise anything. … We’ve gotten backlash from everybody about all parts of the budget. Nobody wants to be cut." Read More: CT Mirror 4/14/16

As Criticism Mounts, Malloy Defends Education Cuts to Affluent Towns

As sharp criticism built Thursday of its proposal to end state education aid to 28 of the state's wealthiest towns, the administration of Gov. Dannel P. Malloy released data to show that most of the towns affected have among the lowest mill rates in the state and rely relatively little on state aid.

Facing a sizable budget deficit, the governor on Tuesday proposed eliminating all of the $25 million that the state currently provides to the wealthiest communities through the Education Cost Sharing grant – a move decried by Republican legislators who largely represent those communities.

"We're in a new economic reality. With fewer resources, it requires difficult choices," said Devon Puglia, spokesman for the Democratic governor. "We need to provide support to schools and districts that need it most. Taking the same percentage of cuts in towns with wildly varying mill rates and tax bases just doesn't make sense. We believe we should protect those schools that rely on us most." Read More: CT Mirror 4/14/16

As sharp criticism built Thursday of its proposal to end state education aid to 28 of the state's wealthiest towns, the administration of Gov. Dannel P. Malloy released data to show that most of the towns affected have among the lowest mill rates in the state and rely relatively little on state aid.

Facing a sizable budget deficit, the governor on Tuesday proposed eliminating all of the $25 million that the state currently provides to the wealthiest communities through the Education Cost Sharing grant – a move decried by Republican legislators who largely represent those communities.

"We're in a new economic reality. With fewer resources, it requires difficult choices," said Devon Puglia, spokesman for the Democratic governor. "We need to provide support to schools and districts that need it most. Taking the same percentage of cuts in towns with wildly varying mill rates and tax bases just doesn't make sense. We believe we should protect those schools that rely on us most." Read More: CT Mirror 4/14/16

Fairfield budget gap up to $4.5M if state cuts stand

The town faces the loss of $4.5 million in revenue under Gov. Dannel Malloy’s proposed budget, a cut that First Selectman Michael Tetreau said would be “devastating” to the community.

The governor’s revised budget proposal to cut more than $900 million in state spending zeroes out all Educational Cost Sharing funds received by Fairfield, as well as many other wealthy municipalities in Fairfield County. It also cuts $1 million in sales tax sharing, Tetreau said.“The only thing we can do is significantly reduce services,” the first selectman said, should the ECS and sales tax funding not be restored prior to final adoption of a 2016-17 budget by the state’s General Assembly.

The town’s $293.5 million spending package for the new fiscal year has already been voted on by the Board of Selectmen and Board of Finance, and awaits a May 2 vote by the Representative Town Meeting. As it stands, that would be a 0.79 percent increase over the current budget.

At Tetreau’s request, the RTM will discuss the budget situation at its meeting Monday. Read more: Fairfield Citizen 4/13/16

The town faces the loss of $4.5 million in revenue under Gov. Dannel Malloy’s proposed budget, a cut that First Selectman Michael Tetreau said would be “devastating” to the community.

The governor’s revised budget proposal to cut more than $900 million in state spending zeroes out all Educational Cost Sharing funds received by Fairfield, as well as many other wealthy municipalities in Fairfield County. It also cuts $1 million in sales tax sharing, Tetreau said.“The only thing we can do is significantly reduce services,” the first selectman said, should the ECS and sales tax funding not be restored prior to final adoption of a 2016-17 budget by the state’s General Assembly.

The town’s $293.5 million spending package for the new fiscal year has already been voted on by the Board of Selectmen and Board of Finance, and awaits a May 2 vote by the Representative Town Meeting. As it stands, that would be a 0.79 percent increase over the current budget.

At Tetreau’s request, the RTM will discuss the budget situation at its meeting Monday. Read more: Fairfield Citizen 4/13/16

Malloy Spending Cuts Could Blow $3.5M Hole in Fairfield Budget

The town faces the loss of $3.5 million in revenue under Gov. Dannel Malloy’s proposed budget, a cut that First Selectman Michael Tetreau said would be “devastating” to the community.

The governor’s revised budget proposal to cut more than $900 million in state spending zeroes out all Educational Cost Sharing funds received by Fairfield, as well as many other wealthy municipalities in Fairfield County.

“The only thing we can do is significantly reduce services,” Tetreau said, should the ECS funding not be restored prior to final adoption by the state’s General Assembly. Read more: Fairfield Citizen 4/13/16

The town faces the loss of $3.5 million in revenue under Gov. Dannel Malloy’s proposed budget, a cut that First Selectman Michael Tetreau said would be “devastating” to the community.

The governor’s revised budget proposal to cut more than $900 million in state spending zeroes out all Educational Cost Sharing funds received by Fairfield, as well as many other wealthy municipalities in Fairfield County.

“The only thing we can do is significantly reduce services,” Tetreau said, should the ECS funding not be restored prior to final adoption by the state’s General Assembly. Read more: Fairfield Citizen 4/13/16

Malloy Cuts All State Aid To Fairfield Schools In New Proposed Budget

Gov. Dannel Malloy released a revised budget proposal for the 2017 fiscal year Tuesday, which includes completely eliminating education cost sharing grants for 11 Fairfield County towns while maintaining full funding for its four large cities. The proposed cuts are aimed at reducing the state's projected $922 million deficit in the budget approved last year. Statewide, the cuts in Education Cost Sharing grants total $43.4 million. Read more: Daily Voice 4/12/16

Gov. Dannel Malloy released a revised budget proposal for the 2017 fiscal year Tuesday, which includes completely eliminating education cost sharing grants for 11 Fairfield County towns while maintaining full funding for its four large cities. The proposed cuts are aimed at reducing the state's projected $922 million deficit in the budget approved last year. Statewide, the cuts in Education Cost Sharing grants total $43.4 million. Read more: Daily Voice 4/12/16

Big Issues Fairfield Taxpayers Should Care About

An important part of Fairfield's annual budgeting process is the Board of Finance-hosted meeting, held specifically for public comment. While this year's proposed budget is not as controversial some in the past, we encourage you and your neighbors to attend and express your opinions:

What: Board of Finance Budget Meeting for Public Comment

When: Saturday, March 19th, 9:30am

Where: Fairfield Ludlowe High School Auditorium

Can't attend Saturday's meeting? Send a "1-Click" Email to the BOF

An important part of Fairfield's annual budgeting process is the Board of Finance-hosted meeting, held specifically for public comment. While this year's proposed budget is not as controversial some in the past, we encourage you and your neighbors to attend and express your opinions:

What: Board of Finance Budget Meeting for Public Comment

When: Saturday, March 19th, 9:30am

Where: Fairfield Ludlowe High School Auditorium

Can't attend Saturday's meeting? Send a "1-Click" Email to the BOF

THE BIG ISSUES FAIRFIELD TAXPAYERS SHOULD CARE ABOUT

SCHOOL SPENDING SHOULD BE FLAT NEXT YEAR

SPENDING AND TAXES SHOULD NOT INCREASE NEXT YEAR

NEW LABOR CONTRACTS SHOULD PROVIDE ZERO SALARY INCREASES

OVERLY GENEROUS PUBLIC EMPLOYEE BENEFITS SHOULD BE CUT

TOWN BUILDING PROJECTS SHOULD BE BETTER MANAGED

FAIRFIELD SHOULD DO MORE FOR ITS SENIOR CITIZENS

FAIRFIELD NEEDS A STRATEGIC PLAN

SCHOOL SPENDING SHOULD BE FLAT NEXT YEAR

- The BOE will have substantial savings from a cheaper healthcare plan, but the Superintendent of Schools, the BOE and the teachers' union all want to spend $5.8 million more on everything else, resulting in a net increase of $3.4 million, or 2%, to $165 million. If all that $5.8 million in additional spending were truly essential, then without the healthcare savings they would be asking for a total increase of $7.8 million, or 5%, to $169 million, at a time when economic conditions remain very challenging, when our property values are declining, and when the State is likely to cut municipal support.

- In the current $161 million budget, with the healthcare savings, and with enrollment continuing to decline (down 3% from its 2012 peak), the BOE should be able to find expenses and programs it can reduce that are less important than the ones it wants to add and thus end up with no increase in school spending next year.

- They claim that Fairfield's per pupil expenditure (PPE) is reasonable because it is below some other towns in Fairfield County or because Fairfield's PPE rank in the State has been declining, BUT they don't tell us: (a) that Fairfield benefits from significant economies of scale as one of the largest school districts in the State; and (b) that the school districts now spending more than Fairfield are all much smaller districts with declining enrollments that are experiencing diseconomies of scale; or (c) that it makes no sense for Fairfield to try to keep pace with spending in some of the richest towns in the country, like Greenwich, Westport, Darien, Weston and New Canaan.

SPENDING AND TAXES SHOULD NOT INCREASE NEXT YEAR

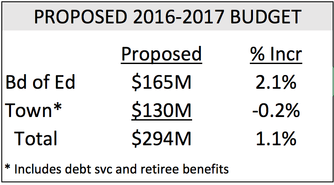

- The First Selectman has proposed flat Town spending (45% of the total) at $130 million, and a 2% increase in Education spending (55%) from $161 million to $165 million, resulting in a 1.1% increase in total spending to $294 million.

- The First Selectman has also proposed a 1.2% increase in taxes for next year, which combined with a 1.8% decline in the Grand List would result in a 3.2% increase in the mill rate from 24.79 to 25.57.

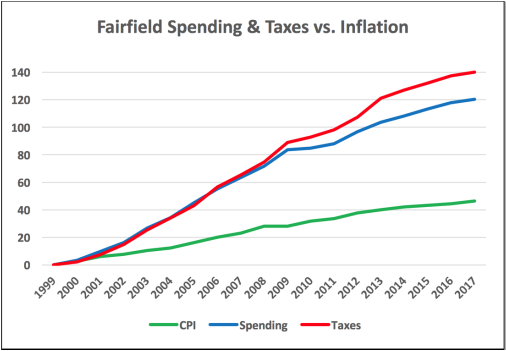

- However, our taxes are simply too high after 18 years when spending and taxes increased at 2.5x-3.0x the rate of inflation without comparable growth in our tax base.

- Taxpayers should be very concerned that our tax base (i.e., the Grand List) has declined 1.8% based on the 2015 revaluation, has been flat over the last five years, and is down 7.5% over the last ten years, while towns like Westport and Greenwich, with much lower tax rates, are increasing their home values and tax bases.

- The decline in our tax base alone will cause the mill rate to rise almost 2% next year even with no increase in spending and taxes.

- To provide some taxpayer relief and to restore Fairfield's competitiveness with homebuyers, spending and taxes should not increase next year.

NEW LABOR CONTRACTS SHOULD PROVIDE ZERO SALARY INCREASES

- According to the Bureau of Labor Statistics and others, public employees are paid substantially more than comparable private-sector workers, due primarily to the high cost of their generous retirement benefits. In addition, union work rules restrict the ability of towns like Fairfield to increase productivity and to replace workers who do not perform well.

- Fairfield's spending and taxes have increased over the last 18 years at 2.5x-3.0x the rate of inflation NOT because residents are getting more services, BUT because the cost of public labor (which is about 75% of total spending), has increased so much.

- Town officials must stop granting 3%-4% annual increases in salary and benefit costs under new contracts, like the ones they approved in recent years for teachers, school administrators, police officers, fire fighters and department heads.

- To bring public employee compensation into line with the private sector, and with healthcare costs continuing to increase 8%-10% annually, any new contracts should provide zero salary increases.

OVERLY GENEROUS PUBLIC EMPLOYEE BENEFITS SHOULD BE CUT

- The Town currently spends $14 million annually for retirement benefits for its employees (BOE employees are covered under State programs), but this number optimistically assumes that the stock market will deliver consistent 7.5% annual returns on our retirement funds and therefore pay much of the cost of their generous benefits.

- Even a relatively small 1.5-percentage-point decline in the rate-of-return assumption (from 7.5% to 6.0%) would more than double the Town's annual cost, and would require a 5% tax increase.

- However, the much greater risk is that the stock market will drop sharply and provide zero returns for an extended period, in which case taxpayers will face HUGE liabilities.

- Therefore, pension plans must be replaced by 401a plans for all new employees, and allexisting plan participants must pay substantially more of the annual cost of their pension and retiree healthcare plans, or the benefits under those plans must be cut.

TOWN BUILDING PROJECTS SHOULD BE BETTER MANAGED

- Penfield Pavilion repairs were supposed to cost $6.2 million, then $7.4 million, and now, because the building is not being raised high enough, we are losing a $500,000 state grant, some of which may or may not be reimbursed by FEMA.

- The costs of school renovation and expansion projects have recently substantially exceeded their budgets.

- The Town should always have a building expert oversee these projects and protect the taxpayers, rather than relying on volunteers serving on temporary Building Committees.

FAIRFIELD SHOULD DO MORE FOR ITS SENIOR CITIZENS

- Programs and facilities designed to serve and retain the Town's senior residents, including the Senior Tax Relief Program, should be evaluated to make sure that the resources being dedicated are sufficient and productive.

FAIRFIELD NEEDS A STRATEGIC PLAN

- Although the Town has prospered for 376 years without a formal strategic plan, times have changed and it appears that only well managed towns will continue to prosper in the future, primarily because of a much more challenging general economic environment in our State and our nation.

GREAT NEWS: $3.5 MILLION IN SCHOOL COST SAVINGS . . . OOPS, NO, SORRY . . . BAD NEWS: TAXPAYERS ASKED TO PAY $4.2 MILLION MORE FOR OUR SCHOOLS DESPITE THOSE SAVINGS AND A 1% DECLINE IN ENROLLMENT

Superintendent of Schools David Title recently released his recommended school budget for next year.

Thanks to a new healthcare plan (the Connecticut Partnership Plan 2.0), next year’s BOE budget will benefit by $3.5 million. Unfortunately, Dr. Title proposes that we spend all those savings and more with a $4.2 million, or 2.6%, increase in next year’s budget to $165.4 million (vs. $161.2 million this year), even though he projects that enrollment will continue to decline – down 1% from 10,058 to 9,960, and down 3% from the FY 2012 peak of 10,287.

It should be quite alarming to taxpayers that without the $3.5 million in savings on healthcare costs, Dr. Title would presumably be asking for a $7.7 million, or 4.8%, increase in spending at a time when enrollment continues to decline. This is particularly alarming at a time when Fairfield taxpayers continue to struggle with a difficult general economic environment in which incomes are growing slowly if at all (e.g., no COLA increase in Social Security benefits for seniors this year), a weak stock market, the impending departure of the Town’s largest taxpayer, and an impending 2% increase in the mill rate simply to offset the recent 2% decline in Fairfield home values (and thus in the Town’s tax base) after the 2015 revaluation. Since the BOE budget represents 55% of our total spending, a 4.8% increase would mean that even if there were no increase in spending on the Town side (police, fire, roads, debt service, etc.), the mill rate would have to rise 2.6% (55% of 4.8%). Combined with the 2% increase required to offset the decline in our tax base, all other things equal, the mill rate would have to rise almost 5% to 25.95 from 24.79. Also, keep in mind that the following year (2017-18), BOE healthcare costs are expected to resume their 5%-10% annual increases. Click here to read full document.

Superintendent of Schools David Title recently released his recommended school budget for next year.

Thanks to a new healthcare plan (the Connecticut Partnership Plan 2.0), next year’s BOE budget will benefit by $3.5 million. Unfortunately, Dr. Title proposes that we spend all those savings and more with a $4.2 million, or 2.6%, increase in next year’s budget to $165.4 million (vs. $161.2 million this year), even though he projects that enrollment will continue to decline – down 1% from 10,058 to 9,960, and down 3% from the FY 2012 peak of 10,287.

It should be quite alarming to taxpayers that without the $3.5 million in savings on healthcare costs, Dr. Title would presumably be asking for a $7.7 million, or 4.8%, increase in spending at a time when enrollment continues to decline. This is particularly alarming at a time when Fairfield taxpayers continue to struggle with a difficult general economic environment in which incomes are growing slowly if at all (e.g., no COLA increase in Social Security benefits for seniors this year), a weak stock market, the impending departure of the Town’s largest taxpayer, and an impending 2% increase in the mill rate simply to offset the recent 2% decline in Fairfield home values (and thus in the Town’s tax base) after the 2015 revaluation. Since the BOE budget represents 55% of our total spending, a 4.8% increase would mean that even if there were no increase in spending on the Town side (police, fire, roads, debt service, etc.), the mill rate would have to rise 2.6% (55% of 4.8%). Combined with the 2% increase required to offset the decline in our tax base, all other things equal, the mill rate would have to rise almost 5% to 25.95 from 24.79. Also, keep in mind that the following year (2017-18), BOE healthcare costs are expected to resume their 5%-10% annual increases. Click here to read full document.

Overheard in a Fairfield Kitchen

Prologue: The context for this very short play is that Fairfield's Board of Education has requested a substantial increase in education spending despite the substantial savings it will realize from a cheaper healthcare plan. Both before and after the First Selectman’s adjustments to its budget request, and at a time when student enrollment is declining, the BOE wants to spend almost $6 million more on everything other than employee benefits. If all this additional spending were truly essential, then without the healthcare savings the BOE would be asking for a total increase of around $8 million, or 5%. Fairfield Taxpayer believes the BOE should find ways, with the benefit of those savings, to hold education spending flat next year, just as the Town is doing for municipal spending.

“Reinvest” Sounds So Much Better than “Spend More” - A One-Act Play

Scene: Two people at their kitchen table in Fairfield discussing their household budget for next year.

Spouse #1: Unfortunately, things are still really tough out there, so we must be very careful with our spending. As you know, our home declined in value based on the latest revaluation, and it may go even lower because all those GE employees are leaving. Meanwhile, the stock market has been weak, which ... Read More

Prologue: The context for this very short play is that Fairfield's Board of Education has requested a substantial increase in education spending despite the substantial savings it will realize from a cheaper healthcare plan. Both before and after the First Selectman’s adjustments to its budget request, and at a time when student enrollment is declining, the BOE wants to spend almost $6 million more on everything other than employee benefits. If all this additional spending were truly essential, then without the healthcare savings the BOE would be asking for a total increase of around $8 million, or 5%. Fairfield Taxpayer believes the BOE should find ways, with the benefit of those savings, to hold education spending flat next year, just as the Town is doing for municipal spending.

“Reinvest” Sounds So Much Better than “Spend More” - A One-Act Play

Scene: Two people at their kitchen table in Fairfield discussing their household budget for next year.

Spouse #1: Unfortunately, things are still really tough out there, so we must be very careful with our spending. As you know, our home declined in value based on the latest revaluation, and it may go even lower because all those GE employees are leaving. Meanwhile, the stock market has been weak, which ... Read More

Public Hearing Schedule on FY17 Budget

The tentative schedule for public hearings on the fiscal year 2017 budget, for the Board of Selectmen, the Board of Finance and the Representative Town Meeting, can be downloaded below. We will update this schedule with any changes as needed.

The tentative schedule for public hearings on the fiscal year 2017 budget, for the Board of Selectmen, the Board of Finance and the Representative Town Meeting, can be downloaded below. We will update this schedule with any changes as needed.

| 2016_budget_meeting_schedule.pdf | |

| File Size: | 1639 kb |

| File Type: | |

1.19% increase for FY 17

At a Chamber of Commerce meeting this morning, First Selectman Tetreau announced a proposed 1.19% increase in spending and taxes for fiscal year 17. His proposed town spending is down 0.22%, and his proposed BOE spending is up 2.1%, which implies a $800,000 cut in the $4.2 million increase proposed by the BOE. 2/25/16

At a Chamber of Commerce meeting this morning, First Selectman Tetreau announced a proposed 1.19% increase in spending and taxes for fiscal year 17. His proposed town spending is down 0.22%, and his proposed BOE spending is up 2.1%, which implies a $800,000 cut in the $4.2 million increase proposed by the BOE. 2/25/16

Westport Grand List up 8% Versus 2% Decline for Fairfield

Westport Assessor Paul Friia announced Friday that on Jan. 31, he signed the Oct. 1, 2015 Grand List as required by state statute. The list is the sum of the net assessed value of all taxable property – real estate, motor vehicles, and personal property.

The net 2015 Grand List of $10,876,602,613 represents a total increase of approximately 7.8 percent compared to the net 2014 Grand List of $10,092,436,351. Residential values increased approximately 7.5 percent, while commercial values increased approximately 10 percent. The combined increase in the real estate categories is 8.3 percent. Read more: Fairfield Minuteman 2/6/16

Westport Assessor Paul Friia announced Friday that on Jan. 31, he signed the Oct. 1, 2015 Grand List as required by state statute. The list is the sum of the net assessed value of all taxable property – real estate, motor vehicles, and personal property.

The net 2015 Grand List of $10,876,602,613 represents a total increase of approximately 7.8 percent compared to the net 2014 Grand List of $10,092,436,351. Residential values increased approximately 7.5 percent, while commercial values increased approximately 10 percent. The combined increase in the real estate categories is 8.3 percent. Read more: Fairfield Minuteman 2/6/16

Connecticut FY2017 Midterm Budget Adjustments

To view Governor Dannel Malloy's FY2017 midterm budget adjustments click here or download the document below.

To view Governor Dannel Malloy's FY2017 midterm budget adjustments click here or download the document below.

| fy17midtermbudgetadjustments.pdf | |

| File Size: | 1563 kb |

| File Type: | |

Fairfield Grand List Decreases 1.77%

The Town of Fairfield’s Net Grand List assessment, based on valuations as of October 1, 2015, and pending Board of Assessment Appeals hearings, is $10,781,433,240, Town Assessor Donald J. Ross, Jr., announced Tuesday. This amount represents a decrease of $194,191,675, or 1.77 percent, from the 2014 net list of $10,975,624,915 as adjusted by the Board of Assessment Appeals effective March 31, 2015.

As a result of the 2015 town wide property revaluation, the net 2014 Real Estate List of $10,199,907,843, as adjusted by the March 2015 Board of Assessment Appeals, decreased 2.2 percent, by $226,287,333, to a net of $9,973,620,510 for the October 1, 2015 list, Ross said. The decrease is mainly due to a decline in many property values since 2010, the year of the last revaluation, he said. As a percentage of the Gross Real Estate List, residential property comprises 89 percent, commercial and public utility properties comprise 10 percent, and industrial properties comprise 1 percent.

The Board of Finance will set the tax rate for the next fiscal year, which begins July 1, based on the town budget and on projected revenues from Grand List assessments. The budget will be set over the next several weeks. Read more: Fairfield Minuteman 2/2/16

The Town of Fairfield’s Net Grand List assessment, based on valuations as of October 1, 2015, and pending Board of Assessment Appeals hearings, is $10,781,433,240, Town Assessor Donald J. Ross, Jr., announced Tuesday. This amount represents a decrease of $194,191,675, or 1.77 percent, from the 2014 net list of $10,975,624,915 as adjusted by the Board of Assessment Appeals effective March 31, 2015.

As a result of the 2015 town wide property revaluation, the net 2014 Real Estate List of $10,199,907,843, as adjusted by the March 2015 Board of Assessment Appeals, decreased 2.2 percent, by $226,287,333, to a net of $9,973,620,510 for the October 1, 2015 list, Ross said. The decrease is mainly due to a decline in many property values since 2010, the year of the last revaluation, he said. As a percentage of the Gross Real Estate List, residential property comprises 89 percent, commercial and public utility properties comprise 10 percent, and industrial properties comprise 1 percent.

The Board of Finance will set the tax rate for the next fiscal year, which begins July 1, based on the town budget and on projected revenues from Grand List assessments. The budget will be set over the next several weeks. Read more: Fairfield Minuteman 2/2/16

Title Proposes $165.4M School Budget with 2.6% Increase

A $165.4 million education budget proposed for 2016-17, with a 2. 6 percent increase, was unveiled Tuesday by Superintendent of Schools David Title.

Title detailed his $165,393,561 spending package — $4,177,921 more than this year’s budget of $160.8 million — to the Board of Education and about 75 members of the public. The proposed budget, which the panel expects to vote on later this month, then faces review by other town boards before final action by the Representative Town Meeting in the spring. The new budget will take effect July 1. Read more: Fairfield Citizen 1/13/16

A $165.4 million education budget proposed for 2016-17, with a 2. 6 percent increase, was unveiled Tuesday by Superintendent of Schools David Title.

Title detailed his $165,393,561 spending package — $4,177,921 more than this year’s budget of $160.8 million — to the Board of Education and about 75 members of the public. The proposed budget, which the panel expects to vote on later this month, then faces review by other town boards before final action by the Representative Town Meeting in the spring. The new budget will take effect July 1. Read more: Fairfield Citizen 1/13/16