WalletHub Finds Tax Burden is Taxing for NY, CT Residents

FT says: It is impossible to avoid an increasingly oppressive per-capita tax burden in a state like CT where there is no population or job growth and yet the cost of government continues to rise faster than the rate of inflation.

A report on the tax burden for residents of the 50 states and District of Columbia released this morning by the financial website WalletHub has some good news and bad news for residents of New York state and Connecticut. First, the good news: Neither state is ranked as the worst in the U.S. when it comes to the amount of state and local taxes residents have to pay. Now the bad news: Connecticut is ranked as next to worst, ranking at number 50 and New York is only slightly better, coming in at 49. Westfair Online 3.9.21

A report on the tax burden for residents of the 50 states and District of Columbia released this morning by the financial website WalletHub has some good news and bad news for residents of New York state and Connecticut. First, the good news: Neither state is ranked as the worst in the U.S. when it comes to the amount of state and local taxes residents have to pay. Now the bad news: Connecticut is ranked as next to worst, ranking at number 50 and New York is only slightly better, coming in at 49. Westfair Online 3.9.21

What Can Connecticut Learn From Its Neighbors About Property Tax Limitations?

Key Findings

• Connecticut’s property tax burdens are rising rapidly, with the state’s effective property tax rates on owner-occupied housing now among the highest in the country at 1.7 percent of housing value.

• Property tax burdens in Connecticut continue to increase even as property values decline, whereas other states—including neighboring Massachusetts and New York—have managed to keep the growth of property tax burdens in check.

• Connecticut possesses no meaningful property tax limitation regime, making it an outlier among states, while Massachusetts and New York both impose effective limitation regimes that are considered models for other states.

• There are three types of property tax limitations—assessment limits, rate limits, and levy limits—with the latter combining the greatest effectiveness with the fewest unintended consequences.

• Property tax limitations typically allow for some rate of growth and usually feature override provisions under which voters can approve growth outside the cap when additional flexibility is needed.

• Massachusetts and New York provide a valuable blueprint for Connecticut policymakers concerned with reversing the outflow of residents and making Connecticut a more attractive place to live and work.

Read Full Report

• Connecticut’s property tax burdens are rising rapidly, with the state’s effective property tax rates on owner-occupied housing now among the highest in the country at 1.7 percent of housing value.

• Property tax burdens in Connecticut continue to increase even as property values decline, whereas other states—including neighboring Massachusetts and New York—have managed to keep the growth of property tax burdens in check.

• Connecticut possesses no meaningful property tax limitation regime, making it an outlier among states, while Massachusetts and New York both impose effective limitation regimes that are considered models for other states.

• There are three types of property tax limitations—assessment limits, rate limits, and levy limits—with the latter combining the greatest effectiveness with the fewest unintended consequences.

• Property tax limitations typically allow for some rate of growth and usually feature override provisions under which voters can approve growth outside the cap when additional flexibility is needed.

• Massachusetts and New York provide a valuable blueprint for Connecticut policymakers concerned with reversing the outflow of residents and making Connecticut a more attractive place to live and work.

Read Full Report

CT Income Tax Town-By-Town: Who Pays The Most

The top 10 for total income tax paid are:

Patch 2.10.20

- Greenwich $692.98 million (26,427 returns)

- Stamford $309.91 million (61,666 returns)

- Fairfield $220.96 million (24,510 returns)

- Westport $219.78 million (11,394 returns)

- Darien $210.65 million (8,283 returns)

- West Hartford $201.17 million (28,817 returns)

- New Canaan $176.52 million (7,964 returns)

- Norwalk $155.28 million (42,460 returns)

- Wilton $131.14 million (7,475 returns)

- Glastonbury $131.12 million (16,240 returns)

Patch 2.10.20

Ever wonder why the cost of living is so high in CT? This article provides part of the answer.

Three Brief Excerpts:

“Project labor agreements essentially require a construction project to be completed using union labor, rather than non-union companies, but the overall effect, the study found, was to increase the cost of the project by 19 percent.”

Our State “Government-mandated project labor agreements unnecessarily and significantly drive up construction costs, forcing taxpayers to pay more.”

“All state and municipal projects over $1 million in Connecticut are subject to prevailing wage standards that dictate the pay and benefits of employees performing the work.”

One Illustrative Fact Not in the Article:

The current hourly rate (including benefits) mandated by the State for work in Fairfield County by “Laborers (common and general)” on public building projects is $51.59, which represents a $103,180 annual rate (8 hours x 250 work days) with no overtime.

Read the article: Project labor agreements cost Connecticut taxpayers an extra $500 million, according to study | Yankee Institute for Public Policy 2.6.20

“Project labor agreements essentially require a construction project to be completed using union labor, rather than non-union companies, but the overall effect, the study found, was to increase the cost of the project by 19 percent.”

Our State “Government-mandated project labor agreements unnecessarily and significantly drive up construction costs, forcing taxpayers to pay more.”

“All state and municipal projects over $1 million in Connecticut are subject to prevailing wage standards that dictate the pay and benefits of employees performing the work.”

One Illustrative Fact Not in the Article:

The current hourly rate (including benefits) mandated by the State for work in Fairfield County by “Laborers (common and general)” on public building projects is $51.59, which represents a $103,180 annual rate (8 hours x 250 work days) with no overtime.

Read the article: Project labor agreements cost Connecticut taxpayers an extra $500 million, according to study | Yankee Institute for Public Policy 2.6.20

Why So Many of America’s Financial Elite have Left Greenwich

It is a small town with a big reputation. Greenwich, Connecticut, with a population of 60,000, has long been home to titans of finance and industry. A century ago Edmund C. Converse, the first president of Bankers Trust, Zalmon Gilbert Simmons, a mattress magnate, and two Rockefellers lived there. Among today’s residents are Ray Dalio of Bridgewater, the world’s most successful hedge fund, and Indra Nooyi, the former boss of Pepsi. It has one of America’s greatest concentrations of wealth. As measured by the income of the top 1% of residents, Connecticut is America’s richest state. The metro area (Bridgeport-Stamford-Norwalk) and county (Fairfield) containing Greenwich come second and fourth on the same measure.

You might think a decade in which rich Americans became richer would have been kind to Greenwich. Not so. The 2007-08 financial crisis and hedge funds’ fading fortunes depleted the state’s coffers. In response it raised taxes, triggering an exodus that has lessons for the rest of America about the risks of relying on low taxes to lure wealthy residents. And as Americans cool on small-town living, Greenwich is a reminder that even the most privileged enclave is not immune to national trends. The Economist 1.9.20

You might think a decade in which rich Americans became richer would have been kind to Greenwich. Not so. The 2007-08 financial crisis and hedge funds’ fading fortunes depleted the state’s coffers. In response it raised taxes, triggering an exodus that has lessons for the rest of America about the risks of relying on low taxes to lure wealthy residents. And as Americans cool on small-town living, Greenwich is a reminder that even the most privileged enclave is not immune to national trends. The Economist 1.9.20

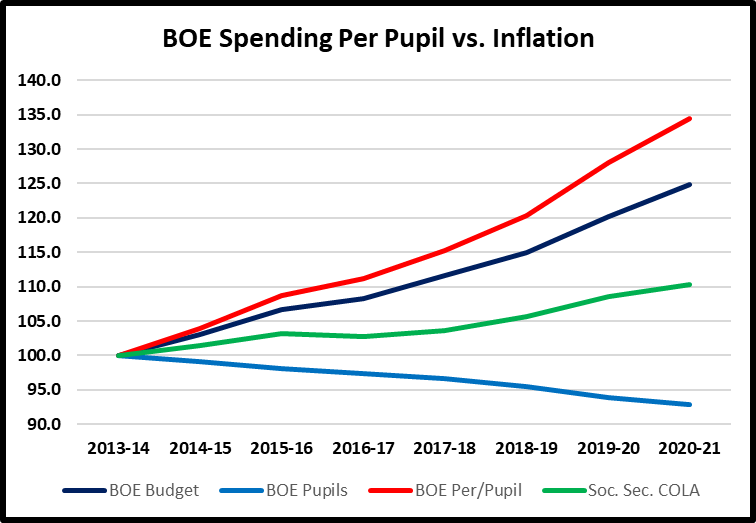

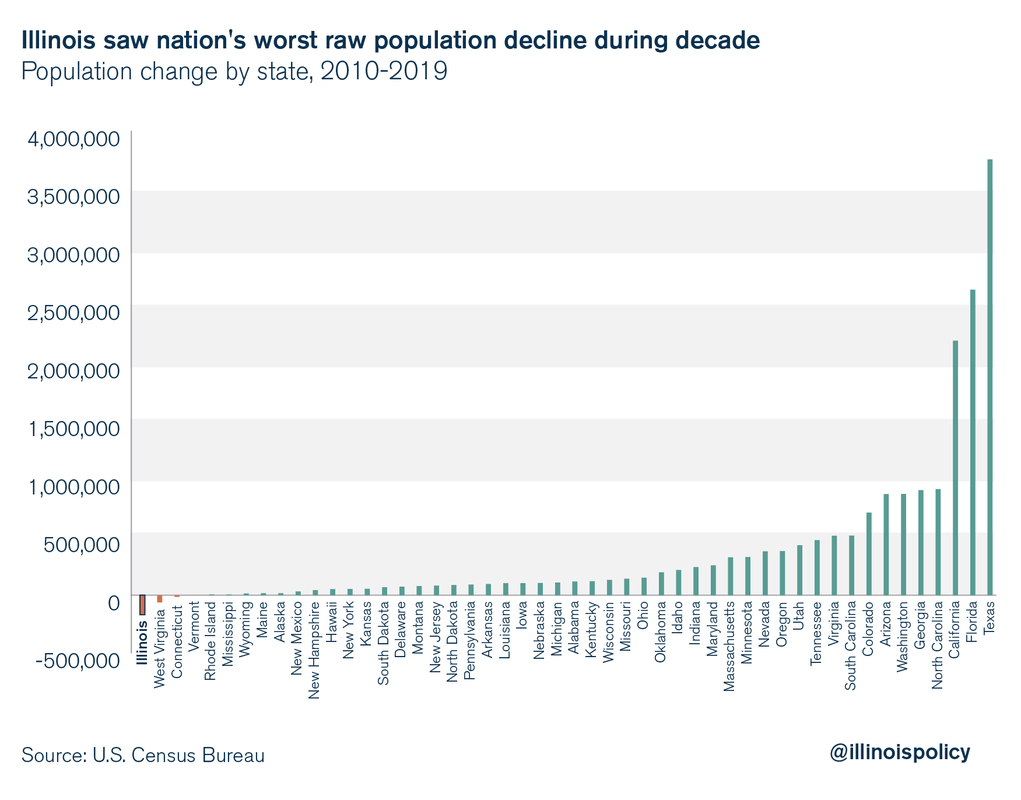

$7 Million Budget Increase Proposed For Fairfield Schools

Fairfield's superintendent is proposing a budget increase of about $7 million — or 3.9 percent — for the 2020-21 school year. The majority of the additional spending would pay for staffing expenses, according to Superintendent Mike Cummings, who presented the budget Tuesday to the Board of Education. "Ultimately, all of this is about improving the learning experiences for students in the Fairfield Public Schools," Cummings said. Patch 1.9.20

Proposed Fairfield Schools Budget Includes Nearly 4% Increase

There is a $7.7 million increase in the Fairfield Public Schools 2020-21 budget, according to a presentation given to the Board of Education on Jan. 7.

The budget has grown from the previous year by 3.9 percent, or $7,769,814, to a total of $188,758,852. The two largest increases in spending came from employee benefits and salaries, making up more than half.

Superintendent Mike Cummings described the spending plan as a maintenance budget, adding “every dollar we spend needs to be traced back to supporting student growth.”

“We are at the last year of a five-year district improvement plan,” said Cummings. “This budget carries forth the work that was in the last district improvement plan ... and starts to set the stage for the next one.”

The superintendent said the goal of the district improvement plan and the budget were to “ensure that a rigorous, comprehensive instructional program is consistently delivered across all schools and grade levels.” Fairfield Citizen 1.8.20

The budget has grown from the previous year by 3.9 percent, or $7,769,814, to a total of $188,758,852. The two largest increases in spending came from employee benefits and salaries, making up more than half.

Superintendent Mike Cummings described the spending plan as a maintenance budget, adding “every dollar we spend needs to be traced back to supporting student growth.”

“We are at the last year of a five-year district improvement plan,” said Cummings. “This budget carries forth the work that was in the last district improvement plan ... and starts to set the stage for the next one.”

The superintendent said the goal of the district improvement plan and the budget were to “ensure that a rigorous, comprehensive instructional program is consistently delivered across all schools and grade levels.” Fairfield Citizen 1.8.20

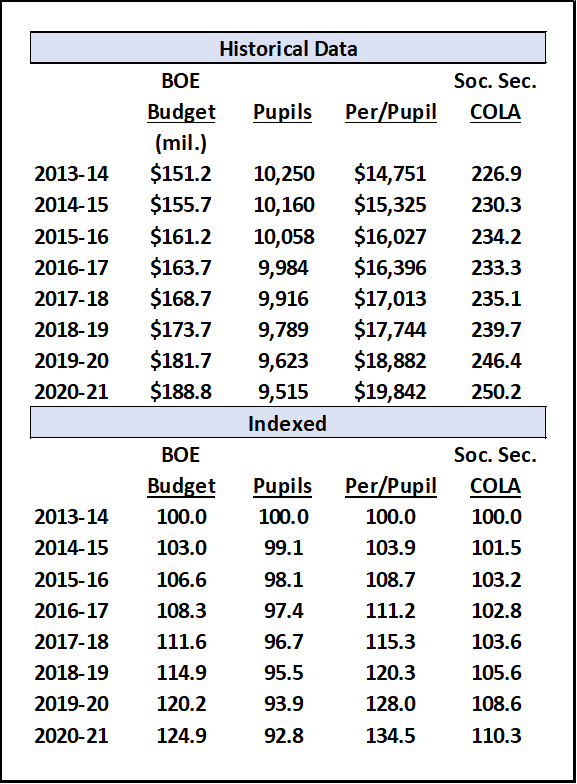

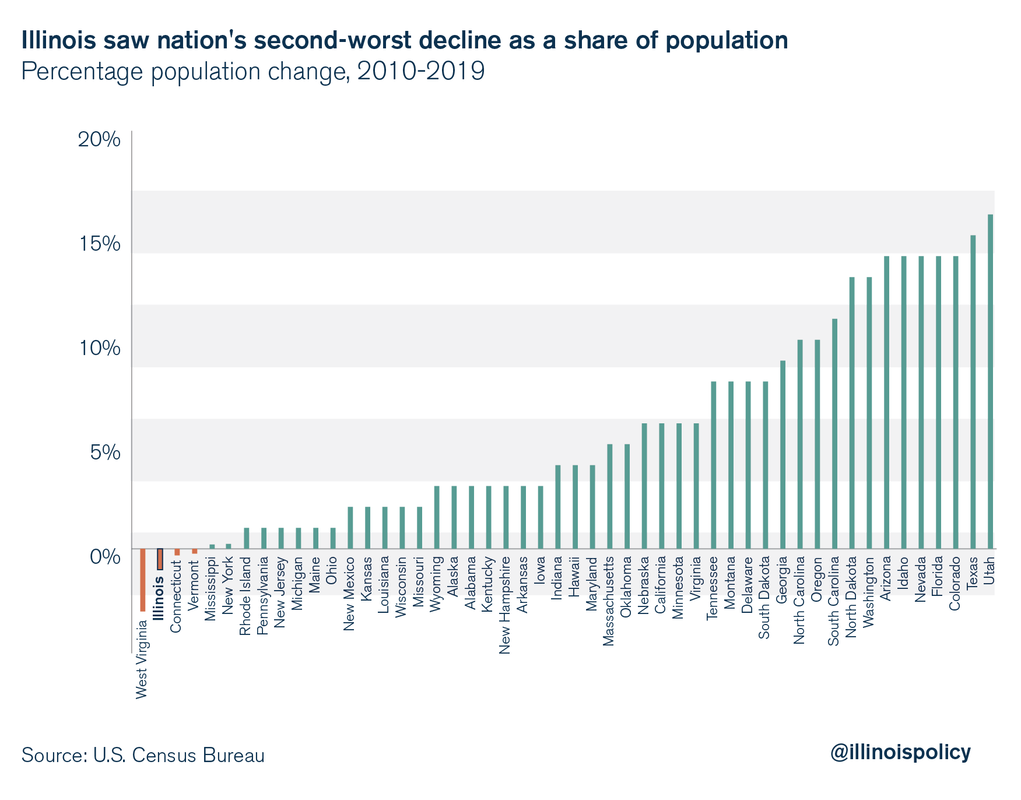

Population Losses & Gains by State

Connecticut’s Lost Decade — And How To Avoid A Repeat

Think back to the first week of 2010.

The reigning champion UConn women’s basketball team was steaming toward five more rings in the next seven years. A former Stamford mayor who lost the Democratic primary for governor four years earlier was about to win the seat and hold it for most of the decade. Obamacare was adopted but not yet in place. The Sandy Hook tragedy was three years away. And the Great Recession had hammered Connecticut along with the rest of the nation.

As the decade opened, Wall Street had started back upward but Main Street still reeled at rock bottom, facing a tough slog. Exactly ten years later, the nation has recovered heartily and then some, under two presidents.

Connecticut? A lost decade by just about every economic measure.

A lost decade — and worst of all, we’re not in the clear yet. One more decade like the one that just ended and we are basically western New York, a place with some great assets that’s on the way to someplace else, looking to recapture its old glory.

The hopeful news is, we can still avoid another 10-year meltdown. We need some demographic breaks, a solid dose of attitude changes and an embrace of the elusive political middle. The Middletown Press 1.4.20

The reigning champion UConn women’s basketball team was steaming toward five more rings in the next seven years. A former Stamford mayor who lost the Democratic primary for governor four years earlier was about to win the seat and hold it for most of the decade. Obamacare was adopted but not yet in place. The Sandy Hook tragedy was three years away. And the Great Recession had hammered Connecticut along with the rest of the nation.

As the decade opened, Wall Street had started back upward but Main Street still reeled at rock bottom, facing a tough slog. Exactly ten years later, the nation has recovered heartily and then some, under two presidents.

Connecticut? A lost decade by just about every economic measure.

A lost decade — and worst of all, we’re not in the clear yet. One more decade like the one that just ended and we are basically western New York, a place with some great assets that’s on the way to someplace else, looking to recapture its old glory.

The hopeful news is, we can still avoid another 10-year meltdown. We need some demographic breaks, a solid dose of attitude changes and an embrace of the elusive political middle. The Middletown Press 1.4.20

Moody’s Praises Connecticut’s Budget Reserves But Knocks Transportation Infrastructure

FT notes this excerpt: “The hobbled economy places the state at a disadvantage when competing with other states for business and residents.”

With no job growth for 30 years, CT still has not figured out how to grow its economy, and the nice $2.8 billion Rainy Day Fund is now, by coincidence, offset by and equal to the official projected budget deficits for fiscal years ‘22, ‘23 and ‘24 — none of which assumes a national recession, which some think is overdue and likely. CT News Junkie 12.17.19

With no job growth for 30 years, CT still has not figured out how to grow its economy, and the nice $2.8 billion Rainy Day Fund is now, by coincidence, offset by and equal to the official projected budget deficits for fiscal years ‘22, ‘23 and ‘24 — none of which assumes a national recession, which some think is overdue and likely. CT News Junkie 12.17.19

Deficit Forecasts, Economic Concerns Spark New Calls for Spending Reforms

Connecticut faces major budget deficits approaching $3 billion through the next five fiscal years, generating renewed calls for state spending reforms. New reports from the legislature's nonpartisan budget office and the governor's Office of Policy and Management forecast a $29.7 million deficit for the current year, a $183.8 million surplus for fiscal 2021, and then three straight years of red ink.

"One thing's for certain—we cannot afford to tax our way out of another budget crisis," says CBIA's Eric Gjede, noting that the 2011 and 2015 tax hikes - two of the biggest in Connecticut's history - failed to stabilize the state's fiscal situation. CBIA 12.12.19

"One thing's for certain—we cannot afford to tax our way out of another budget crisis," says CBIA's Eric Gjede, noting that the 2011 and 2015 tax hikes - two of the biggest in Connecticut's history - failed to stabilize the state's fiscal situation. CBIA 12.12.19

CT's Legacy of Debt Weighed Heavy on Lamont's First Budget

FT Commentary: It seems clear to us that Governor Lamont is focused on the right objective, which is to generate stronger economic growth after, amazingly, 30 years without any net new job creation (same number of jobs, 1.7 million, today as we had in 1989) and a massive per-capita buildup of unfunded liabilities, bonded debt and deferred infrastructure maintenance and improvements. However, our government continues to be controlled by people who believe that CT is still a rich state suffering from extreme income and wealth inequality, and that the rich should simply pay higher taxes, a governing attitude that will continue to encourage resourceful people and companies to generate economic growth and jobs somewhere else. Creating a pro-growth, pro-business environment in CT will require a very different governing attitude.

CT Mirror: The new governor hoped to avert a $3.7 billion shortfall — ending a decade-long cycle of deficits in the process – deliver property tax relief to the middle class, keep income tax rates stable, preserve the rainy day fund and avoid asking unions for their fourth round of major concessions in 10 years. He also wanted an extensive tolling program on cars and trucks – despite a campaign pledge to steer clear of the former – to finance a major transportation rebuild.

“Let’s fix this damn budget once and for all,” Lamont challenged legislators back on Jan. 9, his first day on the job, saying he wanted a budget as sustainable as it is ambitious. What Lamont found was that fixing Connecticut’s budget meant grappling with the state’s enormous debt — an $85 billion problem amassed over more than seven decades. And that debt would ultimately force him to make as many compromises as would the unruly legislature.

When the smoke cleared, Lamont had closed the shortfall, kept income taxes flat, grown the reserve, spared municipalities and social services from reductions, settled a long-running legal feud with Connecticut’s hospitals, and averted a major nursing home strike. But to do it, there were painful trade-offs. CT Mirror 12.11.19

CT Mirror: The new governor hoped to avert a $3.7 billion shortfall — ending a decade-long cycle of deficits in the process – deliver property tax relief to the middle class, keep income tax rates stable, preserve the rainy day fund and avoid asking unions for their fourth round of major concessions in 10 years. He also wanted an extensive tolling program on cars and trucks – despite a campaign pledge to steer clear of the former – to finance a major transportation rebuild.

“Let’s fix this damn budget once and for all,” Lamont challenged legislators back on Jan. 9, his first day on the job, saying he wanted a budget as sustainable as it is ambitious. What Lamont found was that fixing Connecticut’s budget meant grappling with the state’s enormous debt — an $85 billion problem amassed over more than seven decades. And that debt would ultimately force him to make as many compromises as would the unruly legislature.

When the smoke cleared, Lamont had closed the shortfall, kept income taxes flat, grown the reserve, spared municipalities and social services from reductions, settled a long-running legal feud with Connecticut’s hospitals, and averted a major nursing home strike. But to do it, there were painful trade-offs. CT Mirror 12.11.19

High-Wage Jobs Continue To Leave Connecticut

Connecticut continues to bleed high-salary jobs, regaining just 16% of those lost in the recession, the Lamont administration told the General Assembly Thursday. As of September 2019, Connecticut has recovered 88.2% of jobs lost during the recession, which began in December 2007 and ended in June 2009. However, employment growth since the recession “has been skewed toward lower-wage industries,” the state Office of Policy and Management said in its “Fiscal Accountability Report."

Connecticut lost 54,300 jobs in higher-wage industries, but has since gained back 8,900. High-wage industries include management of companies; finance and insurance; professional, science and technical services; and manufacturing. In comparison, Connecticut lost 39,400 jobs in lower-wage industries but regained all and added thousands more for a total of 49,300. Lower wage jobs are classified by economists as administrative and support and waste services; retail; hotel and other accommodations; and food service. Hartford Courant 12.5.19

Connecticut lost 54,300 jobs in higher-wage industries, but has since gained back 8,900. High-wage industries include management of companies; finance and insurance; professional, science and technical services; and manufacturing. In comparison, Connecticut lost 39,400 jobs in lower-wage industries but regained all and added thousands more for a total of 49,300. Lower wage jobs are classified by economists as administrative and support and waste services; retail; hotel and other accommodations; and food service. Hartford Courant 12.5.19

Home Prices in CT Towns Struggling to Recover from 2008 Recession

Connecticut home prices, which tumbled a dozen years ago into the most prolonged recession in generations, still lack a broad-based recovery in towns and cities, and while overall prices saw some gain in 2018, they were still below the 2007 peak.

An analysis by The Courant of single-family house sale price data from 2007 to 2018 shows the painfully slow pace of recovery in Connecticut. Overall sale prices in all of the state’s eight counties remain below the 2007 peak, with Hartford County making the most progress and Fairfield County in the deepest hole.

The home market is even worse than this article makes it sound because the analysis is based in “median sales price” data, which in a falling market can create the illusion of gains when higher-priced homes finally sell at steep discounts to their expected and appraised values. Make no mistake, CT is serious trouble. “The 2018 median price — in which half the sales are above, half below — is still 13 percent below the most recent peak of $295,000 in 2007.” Hartford Courant 10.10.19

An analysis by The Courant of single-family house sale price data from 2007 to 2018 shows the painfully slow pace of recovery in Connecticut. Overall sale prices in all of the state’s eight counties remain below the 2007 peak, with Hartford County making the most progress and Fairfield County in the deepest hole.

The home market is even worse than this article makes it sound because the analysis is based in “median sales price” data, which in a falling market can create the illusion of gains when higher-priced homes finally sell at steep discounts to their expected and appraised values. Make no mistake, CT is serious trouble. “The 2018 median price — in which half the sales are above, half below — is still 13 percent below the most recent peak of $295,000 in 2007.” Hartford Courant 10.10.19

In Lamont’s Plan, it’s Tweed vs. Sikorsky for Expansion

Connecticut has messed around for years with the idea that the state needs a serious commercial airport on Long Island Sound. Tweed New Haven and Sikorsky Memorial both have powerful backers and detractors. We’ve seen no breakthrough progress, though Tweed is much further along. Now the logjam might end with a state-run competition that will be part of Gov. Ned Lamont’s 10-year, $18 billion transportation plan, set to roll out sometime in the next two weeks.

Yes, travel fans, watchers of economic development, there will be a winner. And a loser. One and only one of these two historic locations, 20 miles apart as the jet flies, will secure the state’s blessing to back up Bradley International as Connecticut’s No. 2 airport. Middletown Press 10.7.19

Yes, travel fans, watchers of economic development, there will be a winner. And a loser. One and only one of these two historic locations, 20 miles apart as the jet flies, will secure the state’s blessing to back up Bradley International as Connecticut’s No. 2 airport. Middletown Press 10.7.19

Yale Overwhelms New Haven with Enormous Endowment

Without Yale University, there might not be much left to New Haven beyond the daily shootings, drug overdoses, indignant demands for nullification of federal immigration law, and good pizza. Even so, Yale may be getting too big not just for New Haven but for Connecticut as well. Indeed, the university seems to be slowly taking over the city, which might be an improvement if it wasn't so undemocratic.

The New Haven Register reported the other day that the university this year converted six buildings from commercial to educational or medical use, thereby rendering them exempt from city property taxes and costing the city $3 million a year. Five months ago the university said it will build a neuroscience research center on the part of the Yale New Haven Hospital campus formerly owned by St. Raphael's Hospital, thereby keeping that prime property off the city tax rolls as well.

Meanwhile Yale's endowment has just broken $30 billion even as the finances of city government and state government remain a mess. Journal Inquirer 10.5.19

The New Haven Register reported the other day that the university this year converted six buildings from commercial to educational or medical use, thereby rendering them exempt from city property taxes and costing the city $3 million a year. Five months ago the university said it will build a neuroscience research center on the part of the Yale New Haven Hospital campus formerly owned by St. Raphael's Hospital, thereby keeping that prime property off the city tax rolls as well.

Meanwhile Yale's endowment has just broken $30 billion even as the finances of city government and state government remain a mess. Journal Inquirer 10.5.19

Connecticut Deemed "Sinkhole State" and Receives "F" Grade

In its Financial State of the States report, Truth In Accounting ranks each state based on its Taxpayer Burden or Taxpayer Surplus. Connecticut ranked #48, is deemed a "Sinkhole State" and received an "F" grade. TIA Sept. 2019

Steep Drop in Violent Crime in Connecticut, FBI Says

The rate of violent crime in Connecticut took a steep drop in 2018, according to a report issued Monday by the FBI.

Overall, violent crime dropped 9.5 percent in the state from 2017 to 2018, more than almost all other states in the region. CT Post 9.30.19

Overall, violent crime dropped 9.5 percent in the state from 2017 to 2018, more than almost all other states in the region. CT Post 9.30.19

Connecticut’s Lost Decade and Your Missing Home Value

Connecticut homeowners should be very unhappy. Years of bad government policy have left us poorer. Literally. Property values in the state are 4% lower than they were in 2009 at the end of the Great Recession.

Since 2009, the national average home price (green line below) gained a whopping 28.4%, while CT prices (red) have dropped 4.1%, a 32.5% difference. Greenwich Free Press 9.15.19

Since 2009, the national average home price (green line below) gained a whopping 28.4%, while CT prices (red) have dropped 4.1%, a 32.5% difference. Greenwich Free Press 9.15.19

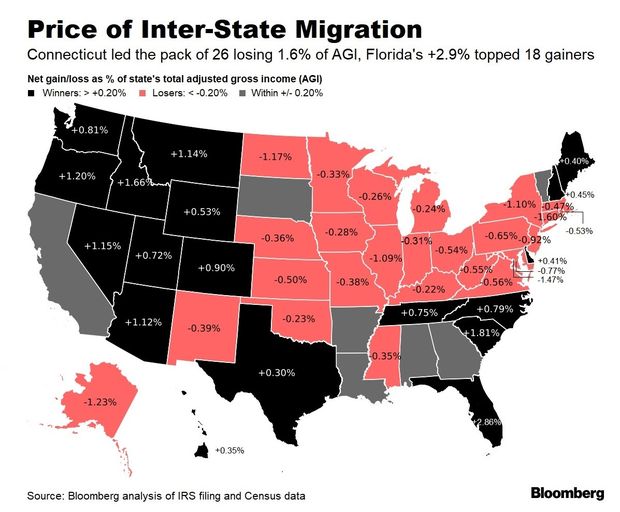

Where Americans Are Moving — And Where They’re Moving Out

Connecticut saw the largest loss in income relative to the overall economy. About $6.1 billion in AGI left the state, while $3.4 billion moved in. That led to a net decrease of about $2.6 billion.

When workers and retirees move to a new locale, local economies often reap a wealth of benefits. New residents not only pad a region’s tax base, they also contribute to the area’s vibrancy by shopping in local stores, purchasing area services or starting businesses of their own. As a result, states may compete to attract new residents and businesses. Using IRS data from 2016, we took a closer at how this competition is playing out nationwide. We found some states are doing better than others at wooing new residents and expanding the number of tax dollars they take in. Lendingtree 8.7.19

When workers and retirees move to a new locale, local economies often reap a wealth of benefits. New residents not only pad a region’s tax base, they also contribute to the area’s vibrancy by shopping in local stores, purchasing area services or starting businesses of their own. As a result, states may compete to attract new residents and businesses. Using IRS data from 2016, we took a closer at how this competition is playing out nationwide. We found some states are doing better than others at wooing new residents and expanding the number of tax dollars they take in. Lendingtree 8.7.19

Solution: Alternative Revenue Sources Could Bolster City Budget, Lower Tax Rate

This article describes some of the likely ways in which CT will increase our taxes in the future by allowing municipalities (in addition to the State) to tax meals, lodging (including AirBNB), and marijuana. Two other possibilities mentioned are: (a) an “employment location” tax, which “would return a share of the income-tax revenue the state collects to municipalities where workers earned those wages . . . [which] would benefit a city like Hartford, which hosts roughly 100,000 Connecticut residents who work in the city but live in the suburbs”; and (b) “a regional tax to pay for quality-of-life and infrastructure improvements.” The article states that “The fear is that future city governments would simply use the extra revenue [from such new ‘local-option taxes’] to increase spending.”

However, the far, far greater fear is that CT will continue to presume that its current citizens are willing to continue to pay more and more taxes. In reality, more and more of CT’s citizens are leaving because State and local taxes are already too high, particularly given the new $10,000 cap on the deductibility of those taxes for federal income-tax purposes. CT’s total population is declining and, shockingly, it has the same number of jobs today (1.7 million) that it had 30 years ago, a period during which NYC added over 1 million jobs and Massachusetts added over 700,000, AND a period during which, despite the lack of job growth, CT’s spending has more than tripled. Raising taxes on a declining tax base (whether measured in incomes, property or transactions) never ends well. Instead, the failing State of CT should be focused on cutting its spending and taxes, and on generating economic growth that will grow its tax base. CT Mirror 7.16.19

However, the far, far greater fear is that CT will continue to presume that its current citizens are willing to continue to pay more and more taxes. In reality, more and more of CT’s citizens are leaving because State and local taxes are already too high, particularly given the new $10,000 cap on the deductibility of those taxes for federal income-tax purposes. CT’s total population is declining and, shockingly, it has the same number of jobs today (1.7 million) that it had 30 years ago, a period during which NYC added over 1 million jobs and Massachusetts added over 700,000, AND a period during which, despite the lack of job growth, CT’s spending has more than tripled. Raising taxes on a declining tax base (whether measured in incomes, property or transactions) never ends well. Instead, the failing State of CT should be focused on cutting its spending and taxes, and on generating economic growth that will grow its tax base. CT Mirror 7.16.19

Connecticut: Largest Declines in Rank over the Last 10 Years

Largest Declines in Rank over the last ten years:

#2 Connecticut, -28 (2019: #46; 2009: #18)

Throughout the decade, Connecticut ranked near the top for wealth levels and near the bottom for debt burden. In 2009, the state had middling scores for employment growth, reserves, home price change, and GDP growth. Most of those indicators have since slipped and today the state ranks among the bottom 10 in nine of 13 indicators. Connecticut does score well for median household income, state GDP per capita, and a low unemployment rate. Conning June 2019

#2 Connecticut, -28 (2019: #46; 2009: #18)

Throughout the decade, Connecticut ranked near the top for wealth levels and near the bottom for debt burden. In 2009, the state had middling scores for employment growth, reserves, home price change, and GDP growth. Most of those indicators have since slipped and today the state ranks among the bottom 10 in nine of 13 indicators. Connecticut does score well for median household income, state GDP per capita, and a low unemployment rate. Conning June 2019

Connecticut Lost 1,500 Jobs in May

Connecticut shed 1,500 jobs in May, particularly in retail and professional and business services, but the state’s jobless held at 3.8 percent, new state labor data shows. Also Thursday, the state Department of Labor (DOL) revised its April estimate of a 300-job gain upward, to 500 jobs.

May’s preliminary Connecticut nonfarm job estimates from the business payroll survey administered by the U.S. Bureau of Labor Statistics pegged the state’s overall employment at a seasonally adjusted 1.6 million. The state’s May unemployed headcount was estimated at 71,700, seasonally adjusted, down 800 from April. Connecticut’s April jobless rate was 3.8 percent. In May 2018, it stood at 4.2 percent.

“With May’s decline of 1,500 jobs, seasonally adjusted employment growth through the first five months of the year is looking rather flat,” said DOL research director Andy Condon. “Most sectors are seeing at least some annual growth, but trade, particularly retail trade, professional & business services and other services are behind last year’s job numbers.” HBJ 6.20.19

May’s preliminary Connecticut nonfarm job estimates from the business payroll survey administered by the U.S. Bureau of Labor Statistics pegged the state’s overall employment at a seasonally adjusted 1.6 million. The state’s May unemployed headcount was estimated at 71,700, seasonally adjusted, down 800 from April. Connecticut’s April jobless rate was 3.8 percent. In May 2018, it stood at 4.2 percent.

“With May’s decline of 1,500 jobs, seasonally adjusted employment growth through the first five months of the year is looking rather flat,” said DOL research director Andy Condon. “Most sectors are seeing at least some annual growth, but trade, particularly retail trade, professional & business services and other services are behind last year’s job numbers.” HBJ 6.20.19

Connecticut is Migration's Biggest Loser as Florida Profits

Roughly 5 million Americans move from one state to another annually and some states are clearly making out better than others. Florida and South Carolina enjoyed the top economic gains, while Connecticut, New York and New Jersey faced some of the biggest financial drains, according to a Bloomberg analysis of state-to-state moves based on data from the Internal Revenue Service and the U.S. Census Bureau. Connecticut lost the equivalent of 1.6% of its annual adjusted gross income, as the people who moved out of the Constitution State had an average income of $122,000, which was 26% higher than those migrating in. Moreover, “leavers” outnumbered “stayers” by a five-to-four margin. Bloomberg 5.24.19

JP Morgan Report Highlights Connecticut Pension Problems

Connecticut would have to pay 35% of its total revenue for the next 30 years to cover all its retirement obligations to state employees and teachers, according to a report released by JP Morgan.

That figure is much higher than the 23% Connecticut is currently paying, as listed in JP Morgan’s 2018 ARC and the Covenants, an annual report that examines state pension and retiree healthcare liabilities. ARC refers to the Annual Required Contribution the state has to make in order to fund pensions and retirement benefits.

The potential solutions raised in the report highlight Connecticut’s catch-22 when it comes to unfunded retirement benefits: increase revenue by 12 percent, increase employee contributions by 408 percent, or see a 10.5 percent investment return every year. Read More: Yankee Institute 5.14.19

That figure is much higher than the 23% Connecticut is currently paying, as listed in JP Morgan’s 2018 ARC and the Covenants, an annual report that examines state pension and retiree healthcare liabilities. ARC refers to the Annual Required Contribution the state has to make in order to fund pensions and retirement benefits.

The potential solutions raised in the report highlight Connecticut’s catch-22 when it comes to unfunded retirement benefits: increase revenue by 12 percent, increase employee contributions by 408 percent, or see a 10.5 percent investment return every year. Read More: Yankee Institute 5.14.19

Connecticut Ranked 21st Best State in U.S.; Top in Corporate Density

Connecticut continues to climb the list of top states in the country, according to a report by the U.S. News & World Report. The 2019 Best States Ranking released Tuesday by the media company said Connecticut moved up three spots to No. 21 in the U.S., ranking fourth among New England states and trailing New Hampshire (No. 2), Vermont (No. 5) and Massachusetts (No. 8). Rhode Island and Maine ranked No. 26 and No. 32, respectively. Nationally, Washington ranked as the nation’s best state with the top five rounded out by Minnesota (No. 3) and Utah (No 4.). Connecticut’s improved aggregate score was helped by its No. 1 ranking in the subcategory of top company headquarters, meaning the state has more Fortune 1000 companies on a per capita basis than any other state. Connecticut also ranked highly in the areas of health care (No. 3), environment (No. 6), criminal justice (No. 7) and education (No. 12). The state’s economy also jumped from No. 43 last year to No. 30 in Tuesday’s report. Read More: Hartford Business Journal 5.14.19

Connecticut’s Great Depression May Be Over

Big news! Going by third-quarter state gross domestic product data that were just released, Connecticut’s economy is on track to grow more than 2 percent in 2018! That’s … not much. But it’s better growth than the state has seen in more than a decade. Read More: Bloomberg 3.5.19

Has Connecticut Found A Solution To Underfunded Public Pensions?

Public pensions are underfunded. One solution Connecticut is considering is truly fresh. The state’s inventory of real assets on its books, such as office buildings, parking lots, raw land or highway right-of-ways, identifies nearly 7,000 properties. An initial estimate is that these assets could have an overall value in the billions. If the state were to include certain state enterprises, such as toll-roads, that number could reach even higher.

A question arose: In lieu of cash, can the state donate any of these real assets as an in-kind contribution to its pension funds? Read more: Forbes 10/16/18

A question arose: In lieu of cash, can the state donate any of these real assets as an in-kind contribution to its pension funds? Read more: Forbes 10/16/18

Connecticut Nearly Last in Fiscal Health

Connecticut is financially in disarray, ranking nearly last in the nation in fiscal health, according to a new report. The free-market-leaning Mercatus Center at George Mason University says Connecticut's financial condition ranks No. 49th in the nation, as state revenues cover just 92 percent of expenses, which is below the U.S. average. Read More: Hartford Business.com 10.10.18

Candidates Fail To Confront Connecticut's Dire Fiscal Straits

The current state gubernatorial campaign debate is missing the point. The hard truth is that all of the candidates are running for the dubious honor of commanding a ship of state that is on fire and about to sail off a fiscal cliff. They should be terrified and sounding the alarm. But spreading bad news is not how you get elected.

The coming cliff is the $4.6 billion deficit projected for the upcoming biennial budget — 11.6 percent of appropriations for fiscal years 2020 and 2021 starting on July 1, 2019. These deficits will continue and will grow by $500 million per year thereafter. The victorious candidates will arrive in the Capitol in January 2019 only to face a budgetary punch in the gut that will deflate any campaign happy talk of tax cuts or increased spending. By law, the governor and the legislature must pass a balanced biennial budget in the 2019 session. What can they do to close the budget gap? There are limited choices, and none of them are attractive. Read More: Hartford Courant 9.12.18

The coming cliff is the $4.6 billion deficit projected for the upcoming biennial budget — 11.6 percent of appropriations for fiscal years 2020 and 2021 starting on July 1, 2019. These deficits will continue and will grow by $500 million per year thereafter. The victorious candidates will arrive in the Capitol in January 2019 only to face a budgetary punch in the gut that will deflate any campaign happy talk of tax cuts or increased spending. By law, the governor and the legislature must pass a balanced biennial budget in the 2019 session. What can they do to close the budget gap? There are limited choices, and none of them are attractive. Read More: Hartford Courant 9.12.18

Connecticut has Second-Highest Bonded Debt per Capita in the Country

Connecticut owes more on the state credit card per resident than nearly every other state in the country, according to a new study. The American Legislative Exchange Council released a study examining the level of bonded debt across the country and found that Connecticut has the second-highest level of bonded debt per person than every other state except Alaska. According to the study based on Connecticut’s comprehensive financial report, the state has a total $36.9 billion in bonded debt, which equals $10,310 for every Connecticut resident. Despite being one of the smallest states, Connecticut total bonded debt was the 8th highest in the country. Read More: Yankee Institute 8/29/18

Connecticut on the Brink - A sad, reasonably comprehensive account of how CT got to where we unfortunately are

The immediate post–Great Recession years were dark times for the Republican Party in Connecticut. Democrats ran up commanding majorities in the state House and Senate in the November 2008 elections, and two years later, Dannel Malloy’s election gave Democrats control of the state’s executive branch for the first time in two decades. In 2010 and 2012, Republican Linda McMahon spent almost $100 million of her personal fortune in campaigns for the U.S. Senate but lost both races by double digits. Read More: City Journal Winter 2018

Connecticut Lawmakers Propose Open Competition to Build Casino

State legislators from Bridgeport on Tuesday proposed a bill that would call for an open competition to build a new casino in Connecticut, creating an opportunity for MGM Resorts International , while possibly straining the state’s relationship with the Indian tribes that manage the other casinos in the state. At least four Democratic lawmakers suggested holding a bidding contest among developers to determine who would get to build a new casino in Connecticut. Two tribes currently have exclusive rights to run casinos in the state. The developers would be required to invest at least $500 million in the casino and employ at least 2,000 people. The winning bidder also would have to give the state 25% of its annual revenue from slot machines and table games, as well as contribute an additional 10% of its annual revenue from video-slot machines to public-education funding. Read More: The Wall Street Journal 2/6/18

Why don’t we (you name it)? Because we don’t have the money.

"Why don’t they build a monorail down the middle of I-95?”

So began the latest in a series of well-intended emails I regularly receive from readers, anxious to offer what seem like smart solutions to our transportation crisis in Connecticut. hy no monorail? Because we don’t have the money.

So let me ask — and answer — a few questions:

Why do we issue 20-year bonds to pay for highway repaving that, at best, will last 15 years?

Why does 40 percent of the state’s Department of Transportation’s annual budget pay for debt service on old bonds instead of buying new trains? Because we don’t have the money.

In China, they spend 10 percent of their GDP on infrastructure. In the U.S., it’s more like 2 percent. Why the under-investment? Because we are paying so much to play catchup on the lack of savings in previous decades for things like pensions for state worker and teachers.

In other words, we don’t have money for new trains — let alone a monorail — because we’re stuck paying the bills passed down to us that our parents didn’t pay. But nobody in Hartford has the guts to tell you that truth. Read More: Viewpoints 11/16/17

So began the latest in a series of well-intended emails I regularly receive from readers, anxious to offer what seem like smart solutions to our transportation crisis in Connecticut. hy no monorail? Because we don’t have the money.

So let me ask — and answer — a few questions:

Why do we issue 20-year bonds to pay for highway repaving that, at best, will last 15 years?

Why does 40 percent of the state’s Department of Transportation’s annual budget pay for debt service on old bonds instead of buying new trains? Because we don’t have the money.

In China, they spend 10 percent of their GDP on infrastructure. In the U.S., it’s more like 2 percent. Why the under-investment? Because we are paying so much to play catchup on the lack of savings in previous decades for things like pensions for state worker and teachers.

In other words, we don’t have money for new trains — let alone a monorail — because we’re stuck paying the bills passed down to us that our parents didn’t pay. But nobody in Hartford has the guts to tell you that truth. Read More: Viewpoints 11/16/17

Connecticut dead last for personal income growth, according to Pew

The personal income growth for Connecticut residents was the slowest in the nation in 2017, according to a report by Pew Charitable Trusts.

Personal income in Connecticut for 2017 actually dipped .6 percent into the negative, and the residents’ personal income growth rate since 2007 has been an anemic .6 percent. The average growth rate for the nation was 1.3 percent over the past year and 1.6 percent since 2007.

Read More

Personal income in Connecticut for 2017 actually dipped .6 percent into the negative, and the residents’ personal income growth rate since 2007 has been an anemic .6 percent. The average growth rate for the nation was 1.3 percent over the past year and 1.6 percent since 2007.

Read More

After 117-day Marathon, Senate Passes Bipartisan Budget

A newly united Senate took a major step early Thursday toward ending Connecticut’s nearly 17-week budget impasse, overwhelmingly adopting a $41.3 billion, two-year plan that closes huge deficits without raising income or sales tax rates, imposes modest cuts on local aid, and provides emergency assistance to keep Hartford out of bankruptcy.

By a veto-proof margin of 33 to 3, the Senate approved the budget after a collegial and self-congratulary three-hour debate that ended with hugs, fist bumps and hand shakes just before 2 a.m. Seventeen of 18 Democrats and 16 of 18 Republicans voted to send the bill to the House, which is scheduled to debate it later Thursday. Read More: CT Mirror 10/26/17

By a veto-proof margin of 33 to 3, the Senate approved the budget after a collegial and self-congratulary three-hour debate that ended with hugs, fist bumps and hand shakes just before 2 a.m. Seventeen of 18 Democrats and 16 of 18 Republicans voted to send the bill to the House, which is scheduled to debate it later Thursday. Read More: CT Mirror 10/26/17

Municipal Aid: See How Your Town Fares in the Bipartisan Budget

State municipal aid is cut by $33.9 million this fiscal year and by an additional $1.8 million in the fiscal year that begins July 1 – a 1.3 percent cut in state support.

With more than three-quarters of overall state municipal aid currently going to the state’s primary education grant — the Education Cost Sharing (ECS) grant — it should be no surprise that it took the brunt of that cut this year. Various non-education grants will be cut next year to make up for restoring ECS funding in 2019.

The way the state funds education has faced increased scrutiny in the year since a Superior Court judge ruled it irrational and unconstitutional. Gov. Dannel P. Malloy later called for a massive redistribution of existing state funding to benefit the most impoverished districts. The budget negotiated by Republican and Democratic legislative leaders – and expected to be adopted this week by the General Assembly – would cut ECS grants by $31.4 million this fiscal year. Read More: CT Mirror 10/25/17

With more than three-quarters of overall state municipal aid currently going to the state’s primary education grant — the Education Cost Sharing (ECS) grant — it should be no surprise that it took the brunt of that cut this year. Various non-education grants will be cut next year to make up for restoring ECS funding in 2019.

The way the state funds education has faced increased scrutiny in the year since a Superior Court judge ruled it irrational and unconstitutional. Gov. Dannel P. Malloy later called for a massive redistribution of existing state funding to benefit the most impoverished districts. The budget negotiated by Republican and Democratic legislative leaders – and expected to be adopted this week by the General Assembly – would cut ECS grants by $31.4 million this fiscal year. Read More: CT Mirror 10/25/17

Wall Street Issues Connecticut Another Warning

Wall Street issued a harsh warning to Connecticut policymakers Monday when it placed the ratings of 26 municipalities and three regional school districts under review for a credit downgrade.

The 26 cities and towns and three regional school districts include a mix of urban, suburban, and rural communities including New Haven, Bridgeport, Hamden, South Windsor, Ashford, and Woodstock, among others. All those communities face state funding cuts under the executive order that are equal to the amount of money they have available in their fund balance or cash.

In addition, Moody’s Investors Service, one of four Wall Street rating agencies, assigned negative outlooks to ratings of another 25 Connecticut municipalities and three regional school districts and maintains the existing negative outlook on the rating of one town.

Of those 25, Moody’s assigned negative outlooks to 14 local governments and two regional school districts and reiterated an existing negative outlook for one local government facing cuts equal to between 75 percent and 100 percent of their fund balance or cash. Read More: CT News Junkie 10/16/17

The 26 cities and towns and three regional school districts include a mix of urban, suburban, and rural communities including New Haven, Bridgeport, Hamden, South Windsor, Ashford, and Woodstock, among others. All those communities face state funding cuts under the executive order that are equal to the amount of money they have available in their fund balance or cash.

In addition, Moody’s Investors Service, one of four Wall Street rating agencies, assigned negative outlooks to ratings of another 25 Connecticut municipalities and three regional school districts and maintains the existing negative outlook on the rating of one town.

Of those 25, Moody’s assigned negative outlooks to 14 local governments and two regional school districts and reiterated an existing negative outlook for one local government facing cuts equal to between 75 percent and 100 percent of their fund balance or cash. Read More: CT News Junkie 10/16/17

For CT, Strides and Stumbles in Quest to Spur Bioscience Industry

When The Jackson Laboratory selected Farmington as the site of its new genomic medicine center nearly six years ago, the biomedical research giant believed it could be a catalyst for something bigger in Connecticut.

Gov. Dannel P. Malloy hoped so, too. After all, it took a lot of convincing to win legislative support for the $291 million package the state offered to lure Jackson to Connecticut after the nonprofit’s plans to build the facility in Florida fell through. Read More: CT Mirror 9/13/17

Gov. Dannel P. Malloy hoped so, too. After all, it took a lot of convincing to win legislative support for the $291 million package the state offered to lure Jackson to Connecticut after the nonprofit’s plans to build the facility in Florida fell through. Read More: CT Mirror 9/13/17

How Did America's Richest State Become Such a Fiscal Mess?

This is not a Dem or Rep caused problem. It has been caused and perpetuated by BOTH parties and a lethargic citizenry. In November, we need to elect candidates from BOTH parties who recognize this and will do everything possible to address it head-on.

Connecticut may be too rich for its own good. Long blessed with a disproportionate number of high-income residents, the state has entertained lavish spending habits for decades. Lawmakers have acted as if they were on a shopping spree at Christmas, confident that the money to pay off the credit cards would somehow be found in the new year. Meanwhile, they have avoided many of their less glamorous responsibilities -- depositing money into pension accounts and other retirement benefits, and paying for adequate infrastructure maintenance. Now, all those bills are coming due, and the money isn’t there to pay them.

Budget problems have become chronic in Connecticut. This year, they got worse. Faced with a projected $5 billion shortfall over the state’s two-year budget period, the legislature blew well past the July 1 budget deadline. (There was still no agreement on a budget as of mid-August.) “People have come to expect a very high level of services, while keeping taxes low,” says state Rep. William Tong. “That math doesn’t work. People are facing two decades of bad decisions and we’re having to reckon with that new reality.” In May, the three major credit rating agencies all downgraded the state, citing weak revenues. Continuing budget fights and tax increases have driven down business confidence. Read More: Governing 9/17

Connecticut may be too rich for its own good. Long blessed with a disproportionate number of high-income residents, the state has entertained lavish spending habits for decades. Lawmakers have acted as if they were on a shopping spree at Christmas, confident that the money to pay off the credit cards would somehow be found in the new year. Meanwhile, they have avoided many of their less glamorous responsibilities -- depositing money into pension accounts and other retirement benefits, and paying for adequate infrastructure maintenance. Now, all those bills are coming due, and the money isn’t there to pay them.

Budget problems have become chronic in Connecticut. This year, they got worse. Faced with a projected $5 billion shortfall over the state’s two-year budget period, the legislature blew well past the July 1 budget deadline. (There was still no agreement on a budget as of mid-August.) “People have come to expect a very high level of services, while keeping taxes low,” says state Rep. William Tong. “That math doesn’t work. People are facing two decades of bad decisions and we’re having to reckon with that new reality.” In May, the three major credit rating agencies all downgraded the state, citing weak revenues. Continuing budget fights and tax increases have driven down business confidence. Read More: Governing 9/17

Moody's Says Revised Executive Order is 'Credit Negative' for Cities and Towns

A Wall Street rating agency says Gov. Dannel P. Malloy’s revised executive order that would reduce municipal aid is “credit negative for Connecticut local governments.”

An analyst for Moody’s Investor Services said the revised order reduces municipal aid by $928 million from 2017 levels. The new revised Aug. 18 executive order, which will go into effect on Oct. 1 if the General Assembly fails to pass a budget, reduces Education Cost Sharing grants by $557 million relative to the fiscal year 2017 disbursement. The largest reduction in Education Cost Sharing grants are to Stratford, Southington, and Enfield. Stratford would lose $21.5 million, Southington $20.3 million, and Enfield $20 million, according to Moody’s.

The revised executive order eliminates ECS funding for 85 Connecticut towns and reduces funding to an additional 54 communities. It restores to 2017 levels funding for Connecticut’s 30 lowest-performing school districts, including Hartford, Bridgeport, Waterbury, and New Haven. The executive order also eliminates $182 million in PILOT funding and reduces smaller municipal revenue-sharing grants by approximately $131 million. Read More: CT News Junkie 8/28/17

An analyst for Moody’s Investor Services said the revised order reduces municipal aid by $928 million from 2017 levels. The new revised Aug. 18 executive order, which will go into effect on Oct. 1 if the General Assembly fails to pass a budget, reduces Education Cost Sharing grants by $557 million relative to the fiscal year 2017 disbursement. The largest reduction in Education Cost Sharing grants are to Stratford, Southington, and Enfield. Stratford would lose $21.5 million, Southington $20.3 million, and Enfield $20 million, according to Moody’s.

The revised executive order eliminates ECS funding for 85 Connecticut towns and reduces funding to an additional 54 communities. It restores to 2017 levels funding for Connecticut’s 30 lowest-performing school districts, including Hartford, Bridgeport, Waterbury, and New Haven. The executive order also eliminates $182 million in PILOT funding and reduces smaller municipal revenue-sharing grants by approximately $131 million. Read More: CT News Junkie 8/28/17

Connecticut Job Growth Remains Flat

Connecticut has a jobs problem.

At a time when New Jersey is celebrating its best private-sector job gains in more than a decade and New York is breaking state employment records, Connecticut’s employment rolls remained flat. Total employment in the state hasn’t returned to pre-recession levels, lagging behind the nation, which crossed that mark in May 2014.

“Connecticut has done very, very poorly since the Great Recession,” said Fred Carstensen, director of the Connecticut Center for Economic Analysis at the University of Connecticut. “We never really got out of it.” More WSJ 3.20.17

At a time when New Jersey is celebrating its best private-sector job gains in more than a decade and New York is breaking state employment records, Connecticut’s employment rolls remained flat. Total employment in the state hasn’t returned to pre-recession levels, lagging behind the nation, which crossed that mark in May 2014.

“Connecticut has done very, very poorly since the Great Recession,” said Fred Carstensen, director of the Connecticut Center for Economic Analysis at the University of Connecticut. “We never really got out of it.” More WSJ 3.20.17

Estate-Planning Attorney Warns of “Deluge” to New York

Attorneys who handle estate planning for wealthy Connecticut residents told lawmakers Friday that Connecticut’s estate and gift taxes are driving out the very people the state needs in these difficult times. Lawmakers on the finance, revenue and bonding committee held a public hearing on proposals to reform Connecticut’s estate tax and possibly eliminate the gift tax. Supporters of estate tax reform believe the ongoing tax revenue from keeping wealthy residents in Connecticut would outweigh the lost revenue from the estate tax. Opponents of the proposal don’t believe people leave Connecticut because of taxes.

Joseph Pankowski Jr., law partner with the Stamford-based firm Wofsey, Rosen, Kweskin & Kuriansky, said that Connecticut’s “trickle” of wealthy people relocating to New York will become a “deluge” if the estate tax exemption is not raised to match both the New York and federal exemption. New York is raising its estate tax exemption to meet the federal standard by 2019. Pankowski warned that Connecticut will start lose more high income residents to New York because they can avoid Connecticut’s estate tax and still see grandchildren who remain in Connecticut. Read More: Yankee Institute 3/6/17

Attorneys who handle estate planning for wealthy Connecticut residents told lawmakers Friday that Connecticut’s estate and gift taxes are driving out the very people the state needs in these difficult times. Lawmakers on the finance, revenue and bonding committee held a public hearing on proposals to reform Connecticut’s estate tax and possibly eliminate the gift tax. Supporters of estate tax reform believe the ongoing tax revenue from keeping wealthy residents in Connecticut would outweigh the lost revenue from the estate tax. Opponents of the proposal don’t believe people leave Connecticut because of taxes.

Joseph Pankowski Jr., law partner with the Stamford-based firm Wofsey, Rosen, Kweskin & Kuriansky, said that Connecticut’s “trickle” of wealthy people relocating to New York will become a “deluge” if the estate tax exemption is not raised to match both the New York and federal exemption. New York is raising its estate tax exemption to meet the federal standard by 2019. Pankowski warned that Connecticut will start lose more high income residents to New York because they can avoid Connecticut’s estate tax and still see grandchildren who remain in Connecticut. Read More: Yankee Institute 3/6/17

As described in this article, Westport continues to move forward with major improvements in its two business centers. As stated in our "Strategic Plan for Fairfield" (www.FairfieldStrategicPlan.com), Fairfield Taxpayer believes that we “should consider bold, transformational changes, like a complete makeover of Fairfield Center, with a major public-private, mixed-use (commercial, residential, educational) development . . .” One strategic option is to create a transit- and senior-oriented Center of Excellence for Senior Living that could offer: a wide range of multi-family housing options (including affordable housing); a new, modern, weather-proof train station that allows commuters to park their cars indoors and get on and off the train without ever going outdoors; ample parking for commuters, shoppers, residents and employees; a major hotel; and pedestrian-friendly plazas and bike paths.

Saugatuck Master Plan Steering Committee formed

Westport First Selectman Jim Marpe announced last week the establishment of the Saugatuck Transit Oriented Development (TOD) Master Plan Steering Committee (the “Saugatuck Steering Committee” or “SSC”). The mission of the Committee shall be to provide input, guidance and direction to professional planning consultants chosen to develop a transit-oriented master plan for the Saugatuck area. The acceptance of the $440,000 State grant, awarded to the Town of Westport in June, 2016 is for the express purpose of developing a Saugatuck TOD Master Plan.

The Saugatuck TOD Master Plan (“Master Plan”) process will be modeled after the successful Downtown Master Plan development and implementation currently in progress. This Master Plan will focus on improving the Saugatuck area in a manner that will benefit residents, commuters and businesses. Among other things, the study will review how to successfully improve streets, sidewalks, lighting, crosswalks and streetscapes. All will be incorporated into a vision of how the Saugatuck area might work better; including a focus on traffic, pedestrian safety, and congestion concerns. Additionally, the Master Plan will incorporate ideas on how future development and infrastructure improvements may be shaped so that community goals such as improved bicycle and pedestrian access to the train station will be addressed. Read More: Fairfield Minuteman 11/11/16

Saugatuck Master Plan Steering Committee formed

Westport First Selectman Jim Marpe announced last week the establishment of the Saugatuck Transit Oriented Development (TOD) Master Plan Steering Committee (the “Saugatuck Steering Committee” or “SSC”). The mission of the Committee shall be to provide input, guidance and direction to professional planning consultants chosen to develop a transit-oriented master plan for the Saugatuck area. The acceptance of the $440,000 State grant, awarded to the Town of Westport in June, 2016 is for the express purpose of developing a Saugatuck TOD Master Plan.

The Saugatuck TOD Master Plan (“Master Plan”) process will be modeled after the successful Downtown Master Plan development and implementation currently in progress. This Master Plan will focus on improving the Saugatuck area in a manner that will benefit residents, commuters and businesses. Among other things, the study will review how to successfully improve streets, sidewalks, lighting, crosswalks and streetscapes. All will be incorporated into a vision of how the Saugatuck area might work better; including a focus on traffic, pedestrian safety, and congestion concerns. Additionally, the Master Plan will incorporate ideas on how future development and infrastructure improvements may be shaped so that community goals such as improved bicycle and pedestrian access to the train station will be addressed. Read More: Fairfield Minuteman 11/11/16

What is Danbury doing right?

The city of Danbury has been experiencing a renaissance in the past few years, which has the city moving in the opposite direction as the rest of the state. Although Connecticut has been experiencing a net loss of population, Danbury has increased its population by 8 percent since 2000; while Connecticut’s credit rating has decreased, Danbury recently earned a AAA rating; Connecticut’s state employee pension system is among the most underfunded in the nation, while Danbury’s is nearly fully funded into the foreseeable future. Read More: Yankee Institute 11/15/16

The city of Danbury has been experiencing a renaissance in the past few years, which has the city moving in the opposite direction as the rest of the state. Although Connecticut has been experiencing a net loss of population, Danbury has increased its population by 8 percent since 2000; while Connecticut’s credit rating has decreased, Danbury recently earned a AAA rating; Connecticut’s state employee pension system is among the most underfunded in the nation, while Danbury’s is nearly fully funded into the foreseeable future. Read More: Yankee Institute 11/15/16

Teacher Pension Costs to Surge, Widen Hole in Next State Budget

State spending on retired teachers’ pensions is set to surge $282.7 million next fiscal year – a 28 percent increase the state is obligated to fund and is likely to push the next state budget further into deficit. The new pension contribution levels, if accepted by the Teachers’ Retirement Board Wednesday, are larger than those anticipated in next fiscal year’s nonpartisan deficit forecast by $47 million and in the 2018-19 projection by $42 million. Read More: CT Mirror 11/1/16

State spending on retired teachers’ pensions is set to surge $282.7 million next fiscal year – a 28 percent increase the state is obligated to fund and is likely to push the next state budget further into deficit. The new pension contribution levels, if accepted by the Teachers’ Retirement Board Wednesday, are larger than those anticipated in next fiscal year’s nonpartisan deficit forecast by $47 million and in the 2018-19 projection by $42 million. Read More: CT Mirror 11/1/16

As a Pinched Hartford tries to Relieve the Pressure, Proposed Fixes Could Ripple Out Across the State

What is the relationship of Connecticut’s cities with the rest of the state? How important is their financial health to the rest of the state? Do suburban communities have a responsibility to the cities at the center of our regions?

These are the questions that are, yet again, coming to the forefront of the Connecticut political landscape. Read More: CT Magazine 10/21/16

What is the relationship of Connecticut’s cities with the rest of the state? How important is their financial health to the rest of the state? Do suburban communities have a responsibility to the cities at the center of our regions?

These are the questions that are, yet again, coming to the forefront of the Connecticut political landscape. Read More: CT Magazine 10/21/16

S&P Global Ratings on Municipal Credit

In our view, local governments that lack forward-looking policies on budgetary planning and reserves will be

the most vulnerable to potential downgrades. Read More: S&P Global Ratings 10/16

In our view, local governments that lack forward-looking policies on budgetary planning and reserves will be

the most vulnerable to potential downgrades. Read More: S&P Global Ratings 10/16

Unaccountable and Unaffordable 2016: Unfunded Public Pension Liabilities Near $5.6 Trillion

Connecticut has the nation’s worst funded ratio at 22.8 percent, meaning no state is failing to keep its promise to taxpayers and pensioners as badly as Connecticut. The state’s failure to address its pension liabilities is a significant contributor to Connecticut’s ongoing budget problems. Read More: Alec.org 10/16

Connecticut has the nation’s worst funded ratio at 22.8 percent, meaning no state is failing to keep its promise to taxpayers and pensioners as badly as Connecticut. The state’s failure to address its pension liabilities is a significant contributor to Connecticut’s ongoing budget problems. Read More: Alec.org 10/16

Financial Irony in Connecticut, the "Sinkhole State"

Today, Truth in Accounting (TIA), a think tank that has analyzed government financial reporting since 2002, released its annual “Financial State of the States” report. Included is the fact that Connecticut ranks 49th for financial health, second to last, and has the second highest taxpayer burden in the country at $49,000 per taxpayer. Taxpayer burden is the amount each Connecticut taxpayer would have to pay the state’s treasury in order for the state to be debt-free. Read More: CT Viewpoints 9/21/16

Today, Truth in Accounting (TIA), a think tank that has analyzed government financial reporting since 2002, released its annual “Financial State of the States” report. Included is the fact that Connecticut ranks 49th for financial health, second to last, and has the second highest taxpayer burden in the country at $49,000 per taxpayer. Taxpayer burden is the amount each Connecticut taxpayer would have to pay the state’s treasury in order for the state to be debt-free. Read More: CT Viewpoints 9/21/16

A Sour Surprise for Public Pensions: Two Sets of Books

When one of the tiniest pension funds imaginable — for Citrus Pest Control District No. 2, serving just six people in California — decided last year to convert itself to a 401(k) plan, it seemed like a no-brainer. After all, the little fund held far more money than it needed, according to its official numbers from California’s renowned public pension system, Calpers. Except it really didn’t. Read More: NY Times 9/17/16

When one of the tiniest pension funds imaginable — for Citrus Pest Control District No. 2, serving just six people in California — decided last year to convert itself to a 401(k) plan, it seemed like a no-brainer. After all, the little fund held far more money than it needed, according to its official numbers from California’s renowned public pension system, Calpers. Except it really didn’t. Read More: NY Times 9/17/16

Webster Bank CEO: State Must 'Control Its Destiny'

Developing enforceable, effective government spending controls should be the top priority for the state’s Spending Cap Commission according to Webster Bank chairman and CEO Jim Smith. Appearing before the commission’s September 7 hearing, Smith said the state must adopt “a control our destiny” approach to resolving Connecticut’s long-term fiscal problems and driving economic growth. Webster Bank CEO Jim Smith“I am deeply concerned for the state’s fiscal condition, which I think we can agree is deteriorating,” Smith told the commission. “I strongly believe that fiscal pressures and related uncertainty regarding taxes and regulatory rules are largely responsible for the low and waning confidence expressed by businesses and consumers. Read More: CBIA 9/16/16

Developing enforceable, effective government spending controls should be the top priority for the state’s Spending Cap Commission according to Webster Bank chairman and CEO Jim Smith. Appearing before the commission’s September 7 hearing, Smith said the state must adopt “a control our destiny” approach to resolving Connecticut’s long-term fiscal problems and driving economic growth. Webster Bank CEO Jim Smith“I am deeply concerned for the state’s fiscal condition, which I think we can agree is deteriorating,” Smith told the commission. “I strongly believe that fiscal pressures and related uncertainty regarding taxes and regulatory rules are largely responsible for the low and waning confidence expressed by businesses and consumers. Read More: CBIA 9/16/16

Give Hartford Something Far Better than Regionalism: Bankruptcy

For the sake of Hartford itself and the whole state, the objective of state government should not be to keep subsidizing the city in its incompetent and corrupt operations, the worst of them required by state law, but rather to shut down the poverty factory by changing the welfare, educational, and labor policies that sustain it. For decades these policies have produced only decline in the city. Unfortunately the Connecticut Conference of Municipalities will be no help. To the contrary, the group seems to have fallen for Mayor Bronin's pitch. The group has appointed a committee to study "property tax and local revenue diversification and regional service delivery" and make proposals to the General Assembly next year. That means tax increases, though Governor Malloy and the legislature concluded this year that state taxpayers were tapped out and that spending had to be cut, especially since next year's financial projections for state government are worse. Read More: Journal Inquirer 9/3/16

For the sake of Hartford itself and the whole state, the objective of state government should not be to keep subsidizing the city in its incompetent and corrupt operations, the worst of them required by state law, but rather to shut down the poverty factory by changing the welfare, educational, and labor policies that sustain it. For decades these policies have produced only decline in the city. Unfortunately the Connecticut Conference of Municipalities will be no help. To the contrary, the group seems to have fallen for Mayor Bronin's pitch. The group has appointed a committee to study "property tax and local revenue diversification and regional service delivery" and make proposals to the General Assembly next year. That means tax increases, though Governor Malloy and the legislature concluded this year that state taxpayers were tapped out and that spending had to be cut, especially since next year's financial projections for state government are worse. Read More: Journal Inquirer 9/3/16

Towns Wary of Local Spending Cap as State Begins Revenue Sharing

Enjoying their first infusion of state sales tax receipts — albeit not as much as promised — Connecticut’s cities and towns remain wary of a revenue-sharing program that comes with a controversial spending cap. The Connecticut Conference of Municipalities continues to press for reform of the cap, which critics say encourages some poor fiscal habits, such as borrowing for ongoing expenses. And the Connecticut Council of Small Towns continues to urge legislators to repeal the cap altogether. Read More: CT Mirror 8/26/16

Enjoying their first infusion of state sales tax receipts — albeit not as much as promised — Connecticut’s cities and towns remain wary of a revenue-sharing program that comes with a controversial spending cap. The Connecticut Conference of Municipalities continues to press for reform of the cap, which critics say encourages some poor fiscal habits, such as borrowing for ongoing expenses. And the Connecticut Council of Small Towns continues to urge legislators to repeal the cap altogether. Read More: CT Mirror 8/26/16

CT to be a Test Case for Education Rights under U.S. Constitution

A group of high-profile attorneys have put Connecticut at the center of a decades-old debate over whether the federal government is responsible for ensuring that children in the U.S. are provided a quality education. In a lawsuit filed in U.S. District Court Tuesday, attorneys for seven minority students from Hartford and Bridgeport asked the court to recognize education as a new right in the U.S. Constitution. The suit attacks Connecticut for its “failing public schools” and long waiting lists for access to charter and magnet schools. Read More: CT Mirror 8/24/16

A group of high-profile attorneys have put Connecticut at the center of a decades-old debate over whether the federal government is responsible for ensuring that children in the U.S. are provided a quality education. In a lawsuit filed in U.S. District Court Tuesday, attorneys for seven minority students from Hartford and Bridgeport asked the court to recognize education as a new right in the U.S. Constitution. The suit attacks Connecticut for its “failing public schools” and long waiting lists for access to charter and magnet schools. Read More: CT Mirror 8/24/16

Budget Deficits Intensify Push for Regional Cooperation in Connecticut

Facing a massive deficit that’s more than 12 percent of his city’s budget, the new mayor of Hartford is appealing to wealthier neighbors to help find regional solutions that benefit Connecticut’s struggling capital city and its suburbs.

Luke Bronin, a Democrat who took office in January, is pitching the idea of greater regionalism. While acknowledging Hartford has made some poor financial decisions, he reminds people that his and other Connecticut communities can only tax local property. And in Hartford, which is nearly 18 square miles, “there’s basically too little property” to pay the bills. “That is a municipal funding structure that’s broken,” Bronin said. “If we want to have strong, vibrant cities that can be engines of growth for our state, we’ve got to fix that and we’ve got to fix it quickly.” Read More: New Haven Register 8/22/16

Facing a massive deficit that’s more than 12 percent of his city’s budget, the new mayor of Hartford is appealing to wealthier neighbors to help find regional solutions that benefit Connecticut’s struggling capital city and its suburbs.