TAX INCREASE NEXT YEAR OF 1.45%

At its meeting on Thursday, May 4th, the Board of Finance (BOF) set the mill rate for next year (FY18) at 25.82, which represents a 1.45% increase from the current mill rate of 25.45. The Board set the new rate after a long discussion about the budget challenges Fairfield faces the following year (FY19) and the increasing risks for Fairfield associated with the deepening fiscal crisis in the State of Connecticut. This concludes a budget process that began with a proposed 4.5% tax increase by the First Selectman, followed by a proposed 1.3% tax increase by the Board of Selectmen, followed by a proposed 1.8% tax increase by the Board of Finance, and ended with a 1.45% tax increase by the Representative Town Meeting earlier this week to cover total spending of $298.5 million (up 1.7%).

According to the BOF, the challenges in FY19 will come from the absence of certain non-recurring benefits to the Town’s revenues and spending in the FY18 budget just adopted, on top of the normal increase in wages and other costs, which together in FY19 could require a 5%-6% increase in taxes, a comparable cut in spending, or some combination of the two. In order to address this looming challenge, all departments, both municipal (35% of total spending) and education (65% of total spending) will be asked to come up with significant cost-reduction recommendations over the next nine months before the formal budget process even begins for FY19.

In addition, there is also a growing risk that the State will make further reductions in the aid it provides to our town (now around $6 million) and/or that it will shift some of its costs onto CT towns (e.g., in his proposed budget, the Governor wanted to shift one-third of teacher pension costs to CT towns, which at this point does not appear likely to happen, but would have cost Fairfield $9.2 million next year). Within the last week, the projected State budget deficit has increased dramatically due to much lower than expected income tax receipts in April. The projected combined deficit for FY18 and FY19 (NB: the State does its budgets in two-year cycles, known as a biennium) is now $5.1 billion, representing approximately 13% of its combined spending of about $40 billion (i.e., about $20 billion per year) in those two years. Some combination of very substantial spending cuts and higher taxes will be required to balance the State budget.

According to the BOF, the challenges in FY19 will come from the absence of certain non-recurring benefits to the Town’s revenues and spending in the FY18 budget just adopted, on top of the normal increase in wages and other costs, which together in FY19 could require a 5%-6% increase in taxes, a comparable cut in spending, or some combination of the two. In order to address this looming challenge, all departments, both municipal (35% of total spending) and education (65% of total spending) will be asked to come up with significant cost-reduction recommendations over the next nine months before the formal budget process even begins for FY19.

In addition, there is also a growing risk that the State will make further reductions in the aid it provides to our town (now around $6 million) and/or that it will shift some of its costs onto CT towns (e.g., in his proposed budget, the Governor wanted to shift one-third of teacher pension costs to CT towns, which at this point does not appear likely to happen, but would have cost Fairfield $9.2 million next year). Within the last week, the projected State budget deficit has increased dramatically due to much lower than expected income tax receipts in April. The projected combined deficit for FY18 and FY19 (NB: the State does its budgets in two-year cycles, known as a biennium) is now $5.1 billion, representing approximately 13% of its combined spending of about $40 billion (i.e., about $20 billion per year) in those two years. Some combination of very substantial spending cuts and higher taxes will be required to balance the State budget.

RTM Adopts Fairfield’s Budget

Ignoring warnings from their Republican colleagues on the finance board, the GOP majority on the Representative Town Meeting Monday adopted a budget that slashed $825,000 from the contingency account. For the most part, votes at the annual budget meeting split cleanly across party lines. The final $298,491,556 spending plan for 2017-18 reflects a 1.45 percent tax increase and translates to a tax rate of 25.82 mills. The final mill rate, however, will be set by the Board of Finance when it meets tonight at 7:30 p.m. in the Board of Education conference room.

Board of Finance Chairman Thomas Flynn cautioned the legislative body against cutting any of the $1.2 million his board put into the contingency account. Flynn said the purpose behind that money was three-fold and provided flexibility given the uncertainty of state revenue. If the town loses more under a final state budget, he said, or if the town’s own revenue projections fall short, this account will give them some room to maneuver. Read More: Fairfield Citizen 5/2/17

Ignoring warnings from their Republican colleagues on the finance board, the GOP majority on the Representative Town Meeting Monday adopted a budget that slashed $825,000 from the contingency account. For the most part, votes at the annual budget meeting split cleanly across party lines. The final $298,491,556 spending plan for 2017-18 reflects a 1.45 percent tax increase and translates to a tax rate of 25.82 mills. The final mill rate, however, will be set by the Board of Finance when it meets tonight at 7:30 p.m. in the Board of Education conference room.

Board of Finance Chairman Thomas Flynn cautioned the legislative body against cutting any of the $1.2 million his board put into the contingency account. Flynn said the purpose behind that money was three-fold and provided flexibility given the uncertainty of state revenue. If the town loses more under a final state budget, he said, or if the town’s own revenue projections fall short, this account will give them some room to maneuver. Read More: Fairfield Citizen 5/2/17

Fairfield Selectmen Adopt Budget with a 1.3% Tax Increase

With a proposed state teacher pension bill of $9 million no longer the full black cloud it once was hanging over the town, the Board of Selectmen Tuesday adopted a 2017-18 budget of $298,047,150 that calls for a 1.3 percent tax increase. After getting word that Gov. Dannel P. Malloy’s pension proposal would not pass the General Assembly, First Selectman Mike Tetreau sought to restore cuts he made to the Board of Education, the Department of Public Works, and the town libraries. Without the $9 million payment to the state, the restoration of those cuts would have meant a tax increase of 2.2 percent, instead of 4.48 percent. Read More: Fairfield Citizen 3/30/17

With a proposed state teacher pension bill of $9 million no longer the full black cloud it once was hanging over the town, the Board of Selectmen Tuesday adopted a 2017-18 budget of $298,047,150 that calls for a 1.3 percent tax increase. After getting word that Gov. Dannel P. Malloy’s pension proposal would not pass the General Assembly, First Selectman Mike Tetreau sought to restore cuts he made to the Board of Education, the Department of Public Works, and the town libraries. Without the $9 million payment to the state, the restoration of those cuts would have meant a tax increase of 2.2 percent, instead of 4.48 percent. Read More: Fairfield Citizen 3/30/17

Fairfield residents: Stand up to Hartford on budget

Parents said families won’t move to town if the school system budget is slashed. Seniors said they won’t be staying if taxes go up 4.48 percent.

But one thing both groups seemed to support at Saturday’s public hearing on the proposed $308 million budget is standing up to lawmakers, and the governor, and just saying “no” to Gov. Dannel P. Malloy’s spending plan that not only cuts revenue, but bills the town $9 million for the underfunded state-managed teacher pension plan. Fairfield Citizen 3.20.17 Read More

But one thing both groups seemed to support at Saturday’s public hearing on the proposed $308 million budget is standing up to lawmakers, and the governor, and just saying “no” to Gov. Dannel P. Malloy’s spending plan that not only cuts revenue, but bills the town $9 million for the underfunded state-managed teacher pension plan. Fairfield Citizen 3.20.17 Read More

Impossible to Assess Racial Imbalance Plan without "Open Choice" Cost Information

As part of the need to respond to the State’s request for revisions to Fairfield’s Racial Imbalance Plan, there will be a public hearing on this topic on Tuesday, March 14, beginning at 6:45 pm at BOE headquarters, 501 Kings Highway, 2nd Floor.

Fairfield Taxpayer fully respects the intent of the State law, but believes it is unfortunate that it is being rigidly applied to Fairfield’s McKinley School, where families are apparently so happy with the school itself, with its culture and with its performance, that none of them wants to leave. Read More

Fairfield Taxpayer fully respects the intent of the State law, but believes it is unfortunate that it is being rigidly applied to Fairfield’s McKinley School, where families are apparently so happy with the school itself, with its culture and with its performance, that none of them wants to leave. Read More

Fairfield Taxpayer Responds to First Selectman Tetreau

A Fairfield resident recently asked First Selectman Tetreau to respond to Fairfield Taxpayer's alternative budget recommendations. We have copied below in its entirety the First Selectman's response.

On the critical issue of how the Town should deal with the possibility that Fairfield might have to pay the State $9.2million next year (representing one-third of our teachers’ pension costs, and 3.3% of our current tax levy), the First Selectman's response makes clear Read More

On the critical issue of how the Town should deal with the possibility that Fairfield might have to pay the State $9.2million next year (representing one-third of our teachers’ pension costs, and 3.3% of our current tax levy), the First Selectman's response makes clear Read More

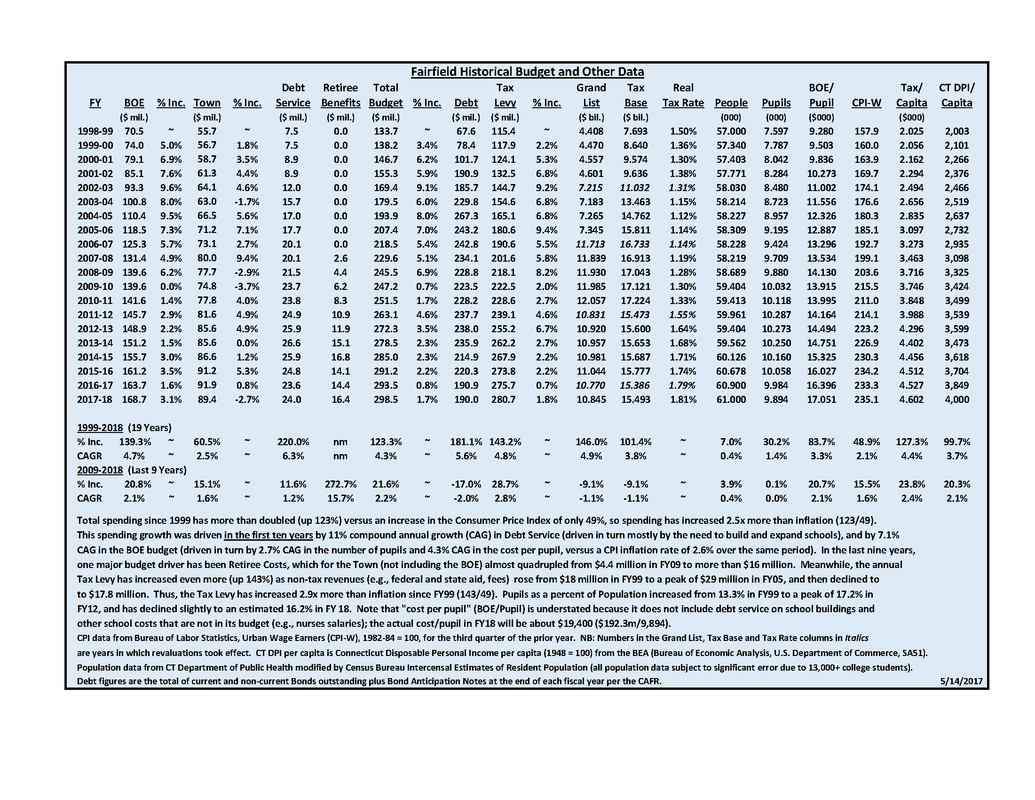

What Goes Up Must Come Down . . . Except Fairfield Taxes

Below is Fairfield Taxpayer's "White Paper" regarding the Fiscal 2018 Budget. Please stay tuned for further messages from Fairfield Taxpayer about what we can do to convince all our elected officials that any tax increase greater than 1.5% is not acceptable.

The State's fiscal crisis is beginning to have a major impact on Fairfield. State municipal aid is being cut, and the Governor also wants towns to pay one-third of the State’s huge overdue bill for teacher pensions. The only options for towns like Fairfield will be to raise taxes or cut spending, (3.5.17) Read More

The State's fiscal crisis is beginning to have a major impact on Fairfield. State municipal aid is being cut, and the Governor also wants towns to pay one-third of the State’s huge overdue bill for teacher pensions. The only options for towns like Fairfield will be to raise taxes or cut spending, (3.5.17) Read More

2018 Budget Process is just Getting Underway

The annual budget season for 2018 begins in early January, when the Superintendent of Schools submits a recommended budget to the BOE. By the end of January, the BOE submits its recommended budget to the First Selectman, who, in turn, a month later presents his recommended budget for the combined Town and BOE spending. This is followed by joint public hearings on the budget in March by the BOS and the BOF. In late March/early April, first the BOS and then the BOF approve a budget that is sent to the RTM. The RTM holds hearings during April, and approves a final budget in early May.

Posted below are the remarks of Chairman Tom Flynn at the Board of Finance meeting on December 6th., in which he addresses the budget challenges facing the Town for fiscal 2018.

I want, first of all, to thank my colleagues for your support to continue as your Chairman. It is not a job or an honor that I take lightly. As I have said many times previously, I am very proud to be a member of this body, proud to count you as friends and colleagues, and work hard to ensure our Board functions well.

In years past, I have stopped my comments there – but this is not a typical year and my comments are meant for a broader audience.

One of the things, that I am proudest of, in my 11 years on this Board, is the proactive and leadership approach that this Board has taken when confronting important financial issues that will or could impact the Town. Pension issues, the global economic meltdown, the underfunding of some long-term liabilities, growing the Town’s fund balance, investigating the Metro Center project, planning capital projects – all of these are examples of issues where our Board pressed for action, provided guidance and raised awareness.

Because of these actions, the Town’s financial position has not only been preserved, but strengthened. Working with our colleagues on the Board of Selectman, the RTM and the Board of Education, as well as numerous department heads, we have done what was in the best financial interests of the Town and its taxpayers.

As we start this next year, however, we face a new and growing threat – the loss of revenue in an unprecedented amount – first, from the loss of revenue coming back from the State and, second, the continued uncertainty from the loss of our single largest taxpayer, GE. If it is just passed on to our tax payers, the result of this revenue loss could mean a tax increase of between 1.25% and 1.75% without accounting for ANY spending increases. These items, while not of our making, are ours to help manage. The State, in years past, has taken the easy road – and have under-funded long-term obligations, bonded significant sums of money – in short, “kicked the can down the road,” as opposed to making the tough decisions that financial hardships require.

We should not and cannot do the same. Through talking with my colleagues on this Board, no one wants to make the same mistakes and damage the Town’s financial position. I know the Board of Selectman and the RTM share our concerns.We must be diligent in this next budget process. We must ask departments heads to review all of their processes/procedures/policies and services. They must review their departments for areas where they can be even more efficient than many of them already are.

We cannot simply ask the taxpayers of the Town to make up the revenue shortfalls with increased taxes – remember, through Income and Sales Taxes, our citizens already contribute over $260 million to the State of Connecticut.The Town gets back under $8 million in direct annual revenue – and that number is decreasing. As the State looks to resolve its financial difficulties, the impact to our Town and its citizens is likely to be even more negative.

I have spoken with the First Selectman and know that he has sent the message to Town-side department heads that their budgets need to be conservative and well thought out. I want to echo those comments and ask that they bring forth only new ideas on how we can be more efficient in the short-term. I would also encourage the Board of Education to adopt that same line of thinking – to review all their policies/procedures and operations – including areas related to unfunded mandates from the State – to identify areas where they can reduce spending while preserving the quality of direct programs to the students of the Town.

No one, on any board, wants to see the quality of Town services or education suffer. This Board has been particularly supportive of educational initiatives and investment in our schools – capital and operating.

In the mid-term, I would encourage the Board of Selectman to act swiftly and move forward with the longer-term strategic plan for the Town that myself – and many members of this Board – have been advocating for – for quite some time. It is more imperative than ever that the operations of the Town, the services provided and the very structure of the Town operations be reviewed – with no sacred cows and every stone overturned.

So, as we face these unprecedented times – and revenue issues – we are asking, I am asking, the other Town bodies, elected officials, department heads and Town employees – to assist us in keeping Fairfield’s financial position strong – while understanding the significant pressures facing the Town and our tax paying citizens who are under enormous pressures of their own and are looking for us to provide the appropriate leadership for all of us.

I have every confidence that this Board will do its part – will be leaders on these issues – but we need a collective effort to make the right decisions.

I know we will do the right thing for the citizens of our Town. I thank you for your time and your attention.

Tom Flynn

Chairman, Board of Finance

Fairfield

December 6, 2016

The annual budget season for 2018 begins in early January, when the Superintendent of Schools submits a recommended budget to the BOE. By the end of January, the BOE submits its recommended budget to the First Selectman, who, in turn, a month later presents his recommended budget for the combined Town and BOE spending. This is followed by joint public hearings on the budget in March by the BOS and the BOF. In late March/early April, first the BOS and then the BOF approve a budget that is sent to the RTM. The RTM holds hearings during April, and approves a final budget in early May.

Posted below are the remarks of Chairman Tom Flynn at the Board of Finance meeting on December 6th., in which he addresses the budget challenges facing the Town for fiscal 2018.

I want, first of all, to thank my colleagues for your support to continue as your Chairman. It is not a job or an honor that I take lightly. As I have said many times previously, I am very proud to be a member of this body, proud to count you as friends and colleagues, and work hard to ensure our Board functions well.

In years past, I have stopped my comments there – but this is not a typical year and my comments are meant for a broader audience.

One of the things, that I am proudest of, in my 11 years on this Board, is the proactive and leadership approach that this Board has taken when confronting important financial issues that will or could impact the Town. Pension issues, the global economic meltdown, the underfunding of some long-term liabilities, growing the Town’s fund balance, investigating the Metro Center project, planning capital projects – all of these are examples of issues where our Board pressed for action, provided guidance and raised awareness.

Because of these actions, the Town’s financial position has not only been preserved, but strengthened. Working with our colleagues on the Board of Selectman, the RTM and the Board of Education, as well as numerous department heads, we have done what was in the best financial interests of the Town and its taxpayers.

As we start this next year, however, we face a new and growing threat – the loss of revenue in an unprecedented amount – first, from the loss of revenue coming back from the State and, second, the continued uncertainty from the loss of our single largest taxpayer, GE. If it is just passed on to our tax payers, the result of this revenue loss could mean a tax increase of between 1.25% and 1.75% without accounting for ANY spending increases. These items, while not of our making, are ours to help manage. The State, in years past, has taken the easy road – and have under-funded long-term obligations, bonded significant sums of money – in short, “kicked the can down the road,” as opposed to making the tough decisions that financial hardships require.

We should not and cannot do the same. Through talking with my colleagues on this Board, no one wants to make the same mistakes and damage the Town’s financial position. I know the Board of Selectman and the RTM share our concerns.We must be diligent in this next budget process. We must ask departments heads to review all of their processes/procedures/policies and services. They must review their departments for areas where they can be even more efficient than many of them already are.

We cannot simply ask the taxpayers of the Town to make up the revenue shortfalls with increased taxes – remember, through Income and Sales Taxes, our citizens already contribute over $260 million to the State of Connecticut.The Town gets back under $8 million in direct annual revenue – and that number is decreasing. As the State looks to resolve its financial difficulties, the impact to our Town and its citizens is likely to be even more negative.

I have spoken with the First Selectman and know that he has sent the message to Town-side department heads that their budgets need to be conservative and well thought out. I want to echo those comments and ask that they bring forth only new ideas on how we can be more efficient in the short-term. I would also encourage the Board of Education to adopt that same line of thinking – to review all their policies/procedures and operations – including areas related to unfunded mandates from the State – to identify areas where they can reduce spending while preserving the quality of direct programs to the students of the Town.

No one, on any board, wants to see the quality of Town services or education suffer. This Board has been particularly supportive of educational initiatives and investment in our schools – capital and operating.

In the mid-term, I would encourage the Board of Selectman to act swiftly and move forward with the longer-term strategic plan for the Town that myself – and many members of this Board – have been advocating for – for quite some time. It is more imperative than ever that the operations of the Town, the services provided and the very structure of the Town operations be reviewed – with no sacred cows and every stone overturned.

So, as we face these unprecedented times – and revenue issues – we are asking, I am asking, the other Town bodies, elected officials, department heads and Town employees – to assist us in keeping Fairfield’s financial position strong – while understanding the significant pressures facing the Town and our tax paying citizens who are under enormous pressures of their own and are looking for us to provide the appropriate leadership for all of us.

I have every confidence that this Board will do its part – will be leaders on these issues – but we need a collective effort to make the right decisions.

I know we will do the right thing for the citizens of our Town. I thank you for your time and your attention.

Tom Flynn

Chairman, Board of Finance

Fairfield

December 6, 2016